What Kinds Of Boat Loans Are Available

Maskery explains that there are three basic steps to follow to get a boat loan. First, identify the price and exact boat you want. Then, figure out the price and the boat insurance you need. Lastly, initiate the purchase.

While the average boat loan is 10 years, you can find loans for 12, 15 or 20 years. Most boat purchases will require that you put down 10-20% upfront. You can put down more if youre able to and if you want to reduce your monthly payments. Check out LendingTrees boat loan calculator to determine how much you can afford.

How To Get A Personal Loan With Bad Credit

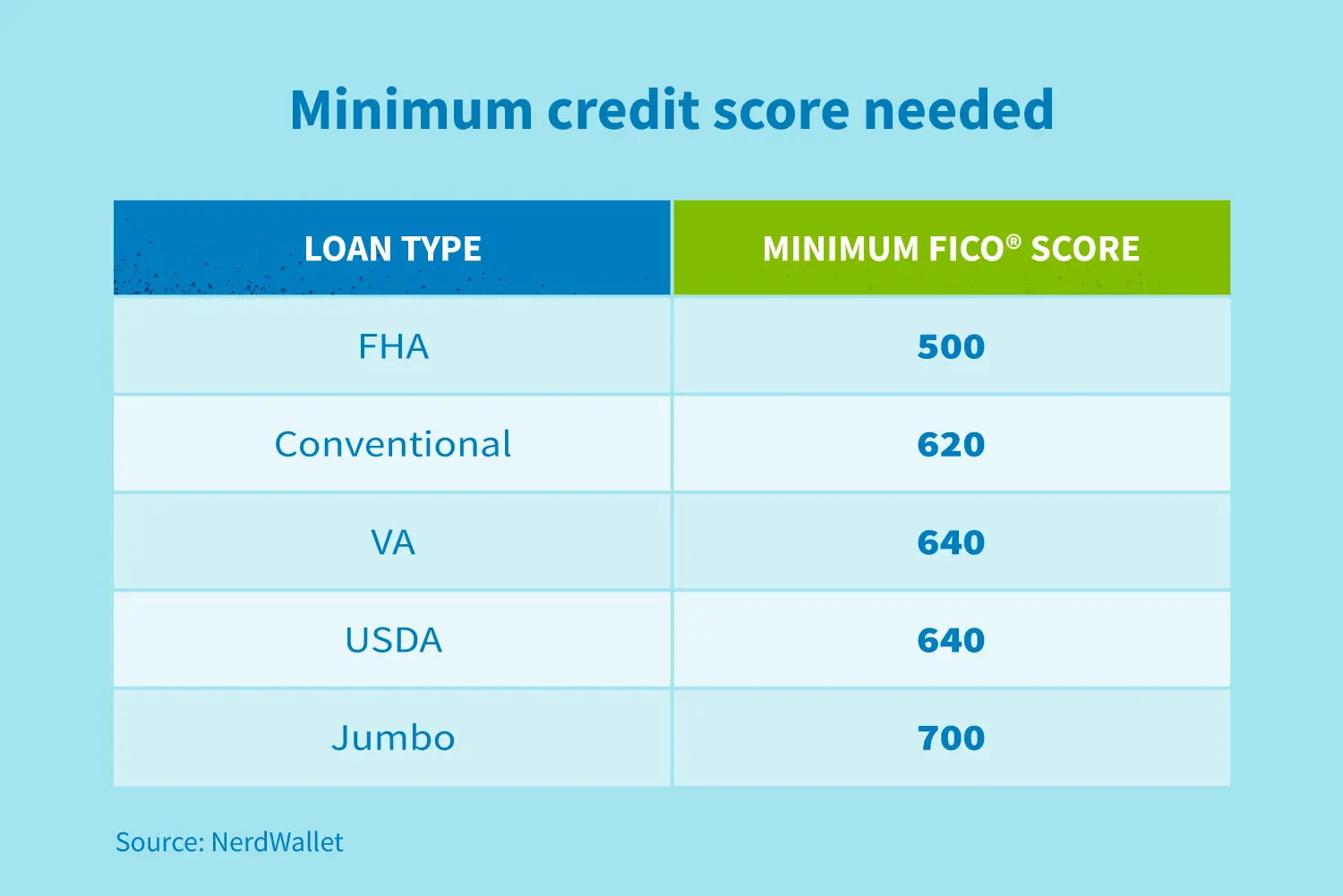

If your FICO® Score is in the poor range, or even the lower end of the fair range, you may have challenges getting approved for a personal loan, but there are borrowing options available to many borrowers with less-than-ideal credit.

Some of those options are best avoided, including:

- Payday loans and other “no credit check loans” that promise cash in a hurry at tremendously high interest rates .

- Car title loans, which often come with high rates as well, and which can lead to the lender seizing your car if you’re unable to make a payment.

Better alternatives for borrowers with subpar credit include:

- Some peer-to-peer lenders offer personal loans to applicants with credit scores as low as 580, and a few ignore credit scores altogether, instead using alternative criteria, such as your work and educational history, to gauge creditworthiness.

- often offer members more lenient borrowing terms than banks and other traditional lenders. You have to have an account at the institution to be a member, and it may have to be open for 30 days before you’re eligible for certain loans. In addition to personal loans, some offer loans known as payday alternative loans that can get you up to $1,000 quickly and without a credit check, on borrowing terms far more favorable than those of payday lenders.

Do Boats Hold Their Value

Similar to cars, some boats may hold their value better than others. Fishing boats and pontoon boats are likely to depreciate faster than other types of boats. Buying a used boat may offer consumers a better value as they should have already depreciated from their original purchase price. Within the first few years of ownership, you can expect a boat to depreciate the most. However, if you buy a used boat you may be able to avoid some depreciation. If you buy a used boat you should have it inspected or purchase it from a credible dealer. After about 7 to 10 years, a boats depreciation should even out.

You May Like: Who Owns Freedom Boat Club

Alternatives To Owning A Boat

If you decide that boat ownership isnt right for you, there are other options you can explore like boat shares and boating clubs.

The Freedom Boat Club and Carefree Boat Club are two examples of clubs you can join if youd like to go boating often but arent interested in buying a boat. Theyre like rental car agencies but you have to be a member. These types of clubs can give you the chance to rent boats for certain periods of time.

Can You Get A Boat Loan On An Old Boat

Getting approved for a boat loan on an older watercraft can be tricky, but it is certainly possible. Some lenders will offer used and refi loans on boats as old as 19 years. If the boat is of high value, you may even find lenders willing to finance a watercraft as old as 25 or 30 years.

Expect that interest rates for old boat loans may be higher than those for newer boats, and you may even encounter higher down payment requirements.

If youre unable to find a lender willing to finance your old boat purchase, consider taking out a personal loan instead.

Recommended Reading: How To Clean Mildew Off Boat Seats

How To Apply For A Boat Loan

Applying for a boat loan is similar to applying for a personal loan or auto loan. Youll need to find a lender first. In some cases, you can apply online. Otherwise you may be able to apply in person at a bank or credit union.

Next, youll typically need to provide information such as the loan amount, purchase price of the boat, type of boat and age of the boat along with employment information and other personal info about your assets and debts. As with personal loans and auto loans, this could result in a hard credit inquiry to check your credit profile .

Then youll wait for approval, which could be available as soon as the next business day, or may take a few business days, depending on the lender youre working with.

Apply To Several Lenders

Because bad credit boat loans have higher interest rates, its important to shop around so you can get the lowest. It doesnt hurt your credit score to apply to multiple lenders any more than it does to apply to one if you do all applications within 14 days. Once you have the loan offers, ask the dealership to beat the lowest rate you got.

Don’t Miss: What Is The Best Deck Boat To Buy

Alternatives To Bad Credit Boat Loans

A bad credit boat loan isnt the right move for everyone. If your credit score is low but you have a reliable income and a good relationship with your credit union or bank, you may be able to get a secured personal loan with better terms than a subprime boat loan. Unsecured personal loans can also be an option, but you will most likely need good credit to get approved.

Lightstream Reviews & Transparency

Category Rating: 82%

- Better Business Bureau: LightStreams parent bank Truist has an A+ rating from the BBB but is not accredited. Truist is the result of themerger of SunTrust Bank and BB& T.

- Consumer Financial Protection Bureau: The CFPBs database has about 250 complaints about SunTrust Banks personal loans. Some reasons for complaints include trouble making payments and required payment amounts being higher than expected. Truist only has 3 personal loan complaints so far. BB& T has over 70.

- WalletHub: LightStream has a WalletHub user rating of 3.1/5 .

- Transparency: LightStream is transparent about their personal loan terms, which you can see on their website. However, they could be clearer about their minimum credit score and income requirements. The good news is that LightStream offers $100 to anyone who receives a loan from them and is not completely satisfied. Thats a unique benefit and a nice touch.

Don’t Miss: Hydrofin For Pontoon Boat

S In The Process Of Boat Financing

Shopping for a boat loan overlaps with the process of buying a new boat. Here are the basic steps:

Know and understand your financial abilities and your credit rating. Check your credit with the major credit reporting bureaus and correct any inaccuracies.

When you apply, be ready with tax returns and bank statements that show your financial ability to repay. Be prepared to submit those materials to speed up the review process.

Be aware of special use limitations. If you want to live aboard your boat, use it for commercial purposes such as charters or as a fishing guide or to cruise internationally, tell the lender. Not all lenders will loan money on a boat used for those purposes.

Best Marine Lending Specialist: Trident Funding

Trident Funding

Why We Chose It: Our choice for the best marine lending specialist is Trident Funding because they offer competitive rates, specialize in custom marine financing, and have been in business since 1996.

-

Dont finance boats more than 25 years old

-

Dont finance live-aboard vessels

-

You usually need a down payment

Trident Funding was founded by boat enthusiasts for boat enthusiasts with the goal of connecting borrowers to lenders so they can finance their passion. It is the U.S.s largest independently owned boat and yacht loan origination company. Trident also finances RVs and provides marine resources and tips on its website.

The company understands the boating business so can help educate you if this is your first boat. It has worked with over 40 banks and lenders so can rate shop to offer the most competitive rates and terms which vary based on the type of vessel, down payment amount, loan type, and borrower qualifications.

They offer fixed and variable rates starting at 3.99% and both short and long term boat loans up to 25 years. Typically, they approve loans within 48 hours and a down payment of 1020% is standard. They finance new and used boats that are no older than 25 years and only used for recreational purposes.

Trident Funding has positive customer service reviews and a solid industry reputation. Customers raved about the excellent service, timely responses, and marine industry knowledge.

Also Check: Arkansas Boat Registration Search

How Do I Finance A Boat

There are several lenders who specialize in marine financing and employ underwriters who are familiar with the industry. According to Flannery, the major players in the boat financing industry are Bank of America, Wells Fargo and Seacoast National Bank. U.S. Bank , Essex Credit and LightStream also offer boat loans. Check out the National Marine Lenders Association for a list of other lenders.

You can finance a boat for as long as 20 years if need be, much like you would finance a mortgage.

Although you can go through one of these lenders, there are other options that can help you finance a boat as well. For example, you can get a personal loan from your bank or take a home equity line of credit against your house.

Credit Score Boat Loan Options Specialty Marine Financiers

When it comes to specialty marine financiers, a 650 credit score boat loan is somewhat below the minimal requirement.

For instance, Essex Credit requires a minimum score of 690 and BoatUS requires at least 680 to even begin the application.

Also, if a boat is over a certain age, a marine survey may be required in order to inspect the condition of the boat.

Given these facts, improving your 650 rating will give lenders greater confidence the loan will be repaid.

- Related Offer

Recommended Reading: How To Look Up Boat Hull Numbers

Types Of Loans For Marine Financing And Boat Financing

In Canada, there are many financial companies that can offer you loans for the purposes of financing boats and other marine crafts, including but not limited to:

Secured Boat Or Marine Loans

Similar to other vehicle-based financing options, most boat and marine loans will be secured by using the crafts title as collateral. This means that the lender will retain ownership over the vessels title until your repayment plan is complete. If you default on too many payments, they would have the right to seize and resell the asset. In exchange for this collateral, you will often have access to better rates and more credit.

A secured loan is probably the better choice when you feel comfortable using your marine vehicle as collateral and if youre having a hard time qualifying due to lesser financial health. Nonetheless, you must keep in mind that defaulting could have a worse outcome than with unsecured financing .

Unsecured Loans

While some boat and marine financing do involve collateral, you can also apply for a traditional unsecured loan, which is safer if youd prefer not to risk losing your boat in the event of default.

The ultimate drawback here is that your interest rate may be higher and the conditions of the loan less favorable due to the lack of security provided. So, if you are going to apply for a large unsecured boat and marine loan, its best to do it when you have a good income, a decent credit score, and otherwise healthy finances.

Loans Canada Lookout

How Do Boat Loans Work

Boat loans at Southeast Financial are efficient, fast, and flexible. We offer boat financing for all types of circumstances and provide quick credit decisions. To get started, simply fill out our online application and we can get you a credit decision in 24 hours or less. Once you are approved, you can get your check within about 3-5 business days. Southeast Financial finances boats from $15,000 to $4 million.

Also Check: What Is The Membership Fee For Freedom Boat Club

Navy Federal Credit Union

Navy Federal Credit Union offers loans for new and used boats and personal watercraft, with terms of up to 180 months. Military members with direct deposit may qualify for a rate discount. Service members in all branches of the armed forces, along with their families and household members, are eligible for credit union membership.

What Qualifies As A Good Credit Score

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

Don’t Miss: Boat Vinyl Mildew Remover

Understand The Costs Of Owning A Boat

Boat loan down payments typically range from 10% to 30%, so make sure you have enough money saved up to cover the cost of the down payment before you apply for a loan. Once you own a boat, youll also have to cover maintenance and related costs. Some of the expenses youll need to cover as a boat owner include:

- Trailer to transport and store your boat: If you dont plan on storing your boat near the water, youll need a trailer to transport it from your home.

- Boat insurance: Boat insurance can protect you in the case of an accident or if anything happens to your boat.

- If you dock your boat at a marina, youll typically have to pay monthly fees for the privilege.

- Registration: Just like a car, many states require boat owners to register their boat. Costs vary widely from state to state.

- Winter storage: If you live in an area where weather conditions arent suitable for boating year-round, youll need to store your boat in the winter.

- Maintenance: Routine maintenance costs include painting, cleaning, and replacing small parts.

- Gas: If your boat is powered by gas, youll need to fill it up regularly.

Offer A Larger Down Payment

The other step you can take to secure a boat loan with a poor credit score is to offer a larger down payment. For instance, if you provide an upfront payment of about 20 % or more of the total loan amount, you are likely to qualify for a boat loan for poor credit. Another important thing that you should consider is to get a good deal on the market. Your boat will secure the loan you get, so you must look for lenders with better terms and conditions. Even when you have a poor financial history, you still have to repay your boat loan. Therefore, you must get the best deal.

Don’t Miss: What Pitch Prop For My Boat

Fallen In Love With A Boat Compared With Auto Loans Financing A Boat Can Be A Much Heftier Investment

Boats can be more expensive than a car, which means loan amounts can be higher and terms can be much longer.

Just how much you pay to finance a boat depends on a number of factors, including the type of boat loan you choose, the loan terms, your down payment and your credit.

Lets take a look at the different types of boat loans, your financing options and how to apply for a boat loan.

What Is The Average Cost Of A Boat

Boat pricing can vary drastically. However, the average cost of a boat is in the $60,000 to $75,000 range, said Paul Flannery, executive director of the International Yacht Brokers Association in Fort Lauderdale, Fla. The type of boat you buy as well as its size, shape, type, capacity and features will all determine its cost.

Also Check: How To Patch Canvas Boat Cover

Can I Get A Boat Loan With Bad Credit

Yes, you can get a bad credit boat loan. While other lenders have a minimum credit score requirement of 720, Southeast Financial does not have minimum credit score requirements. Instead, we consider qualifications on a wide range of factors, including how much you want to borrow and what you are buying.

Getting An Accurate Boat Value For Loan Purposes

Forewarned is forearmed, right? You bet it is, so if youre looking at used boats, its also a good idea to understand what theyre worth. Boat lenders pay attention to boat values when lending, and you can access the same information they have.

Like credit reporting agencies, there are a few sources for researching boat values and prices. These resources can also help you determine the value of your own boat, which is great for getting a fair trade-in or resale price.

The key bit of guidance for securing a boat loan is to do your research and to be as prepared as possible.

The lenders that BoatUS works with take into consideration the age of the boat and the value of the boat, Mann said. There is not a significant difference in available rates or terms between a brand-new boat or a 3-year-old boat, for instance. Since these lenders are looking at the value of the boat, they will typically require a down payment of around 10 to 15 percent.

You May Like: How To Get Boat Registration Number