Combine Coverage And Save

Here at Dennis Gutman Insurance, our number one goal is saving you money. We believe that quality boat insurance does not have to break your budget. We know how to maximize your savings on the coverage you need by finding you money-saving discounts, including added savings when you bundle your boat insurance with other types of coverage. Our customers save when they allow us to build a custom insurance package that includes boat, as well as other types of insurance, such as home and auto.

For more information about bundling discounts or to request your free boat insurance quote, contact our office today. We look forward to serving you soon.

How Old Do You Have To Be To Drive A Boat In Wisconsin

A person 1215 years old may operate a motorboat only if: He or she is accompanied by a parent, a guardian, or a person at least 18 years old who is designated by the parent or guardian or He or she has completed a boating safety course that is accepted by the Wisconsin DNR.

Who is required to have a boating license?

A person who was born on or after January 1, 1988, must have completed a boater education course approved by the National Association of State Boating Law Administrators or passed an approved equivalency exam to operate a vessel powered by a motor of 10 horsepower or greater .

Find Out What’s Happening In Brookfieldwith Free Real

Boat insurance offers coverage for a variety of kinds of boats, including yachts, sailboats, and fishing boats. A boat insurance policy offer coverage similar to an auto policy. A standard boat policy can include liability coverage, collision coverage, comprehensive coverage and uninsured/underinsured boater coverage. You may even want to add coverages such as roadside assistance, on-water towing, fuel spill liability or wreckage removal.

When purchasing a boat insurance policy, you may want to shop around for quotes before settling on a provider. Why? Because every insurance carrier offers different coverages and prices. Comparison shopping will ensure that you have a high quality policy at the best possible price. If you already have auto or home insurance, consider purchasing boat insurance from the same provider. You may even be able to receive a multiline discount.

Look beyond your homeowners policy.

Your boat or personal watercraft may be too big or too expensive to be covered through a homeowners policy, which means you may need watercraft insurance to protect it.

Brew City Insurance can write boats up to 50 feet long and up to $250,000 in value,

as well as personal watercraft up to 15 feet long and $27,000 in value.

Even if your boat is eligible for watercraft insurance coverage under your homeowners policy, you still may want specialized coverages that you just can’t get with a standard homeowners policy.

Consider specialized coverages.

Recommended Reading: How To Measure Bimini Top For Pontoon Boat

The Cost Of Boating Accidents

Take a look at some statistics from the Coast Guard for 2019 about boating accidents:

- 4,168 accidents involving recreational boats resulted in $55 million in property damage.

- 556 deaths and more than 2,559 injuries were due to boating accidents.

- 70% of boating deaths were drownings.

- 33% of deaths occurred when the driver had no boater safety instruction.

- Open motorboats were listed in 47% of all boating accidents.

- Alcohol was deemed the leading factor in fatal boating accidents.

Do You Need A License To Drive A Boat In Wisconsin

needsWisconsinlicenseWisconsin BoatingWisconsin boating

What do you need to drive a boat in wisconsin?

Anyone born on or after January 1, 1989 is required to complete a boating safety course to legally operate a motorized boat or personal watercraft on Wisconsin waters. DNR Conservation Wardens recommend all boat operators complete a safety course.

can you drive a boat if you have a driver’s license?drivers licenceoperateYou do

Contents

Don’t Miss: How To Clean Mildew Off Boat Seats

Comparing Boat Insurance Providers

Owning a boat is a major expense and you should choose your boat insurance provider with care. Remember to research the company and check out its ratings and reviews. Some other things to keep in mind when comparing providers include:

- Coverage options: What type of coverage is offered? Make sure you understand the different plans and if things like running aground or hitting the dock are covered.

- Pricing: Know how much youre paying for coverage and what that includes. Also, keep due dates in mind and if a downpayment is required.

- Discounts: What discounts does the provider offer? Some things to ask about are bundling discounts, safe boater discounts, age-based discounts, and discounts for experienced boatmen

- Specializations: Know if the provider specializes in marine coverage and make sure the agents are knowledgeable because it is much different than auto insurance. Some companies specialize in recreational boating and others specialize in commercial boating and yachts.

- Coverage Exclusions: Research ahead of time what is not covered so you know before you choose a policy. Some providers wont insure boats that go above a certain amount of knots and others wont insure boats with aftermarket parts.

Personal Effects And Fishing Equipment Coverage

This boat endorsement protects you against covered losses of those extra items you may use on your boat, such as fishing equipment, diving equipment and clothing. Heres more good news: items claimed under a covered loss are reimbursed on a replacement cost basis meaning there wont be deductions made for depreciation.

The coverage can be purchased with a minimum limit of $1000 up to a maximum of $25,000 and is purchased in $1000 increments.

You May Like: Can You Boat Down The Mississippi River

Can My Child Operate My Boat In Ohio

In Ohio, children under the age of 12 are prohibited from operating any personal watercraft . Additionally:

- Children 12-15 can operate a PWC only if they have an education certificate and an adult is onboard.

- Children 16 and older can operate without supervision if they have an education certificate.

- Anyone born before 1982 can operate a PWC without an education certificate.

Dont Miss: How Do I Register My Boat In Colorado

Best For Additional Benefits: Boatus

BoatUS

- No. of Policy Types: 3

- Coverage Limit: Varies

BoatUS offers boat insurance as well as towing services and additional discounts on boat charters and services.

-

Coverage for fishing and watersports gear

-

Teamed up with Geico

-

Overload of boating services on site

BoatUS offers boat insurance through the Boat Owners Association of the United States and was acquired by GEICO in 2015. The company has been in business since 1966, resulting in a mix of online customer reviews. But a great majority are positive, especially in the area of claims service. BoatUS offers boat policies in all 50 states for many different types of personal watercraft and yachts.

While membership is not required to get a quote, added benefits for BoatUS members include discounts on popular boating and fishing businesses, fuel, slips, and charter cruises. The basic membership fee is relatively inexpensive at $25/year and goes up to an Unlimited Gold Towing membership for $179 that comes with perks like 100% payment dock-to-dock tows as well as $3,000 for tows outside of TowBoatUS service area. Other membership packages include Unlimited Freshwater Towing for $90/year and Unlimited Saltwater Towing for $165/year.

You May Like: Wv Boat Registration Sticker

Do You Need Boat Insurance In Your State

Generally speaking, you wont be required by your state to purchase boat insurance. In fact, only a handful of states require boaters to purchase insurance, and the requirement is often limited to boats that have engines that are rated to have at least 50 horsepower. The table below lists the insurance requirements for each state.

Is Boat Insurance Required In Minnesota

Acquiring boat insurance in Minnesota can be a prudent move to keep you relaxed when on the water. While boat insurance in Minnesota is not legally required by law, you need it to protect you, your boat, and your passengers when the unexpected occurs.

Are you concerned that you are not conversant about selecting the proper kind of boat insurance in Plymouth, MN? Connect with us today at Anchor Insurance Agency LLP, and our team will assist you in purchasing a proper boat insurance policy.

Boat insurance coverage options in Minnesota

Whether you have a fishing boat, sailing boat, or Jet Ski, boating accidents and other risks can strike cause damage to you or your boat. In light of this, you need to cushion yourself with the below boat insurance coverages:

Knowing that your watercraft is safeguarded with boat insurance while cruising in water gives you peace of mind. If you are looking for boat insurance in Plymouth, MN, dont look beyond Anchor Insurance Agency LLP. Contact us today, and our professional team will safeguard you together with your boat.

Don’t Miss: How Much Is My Pontoon Boat Worth

Renewing Your Wisconsin Boat Registration

A Wisconsin boat registration renewal will need to be completed every three years. Vessel registration renewal can be completed in person at a DNR office, online or by mail. Registering a boat online during the renewal period requires a DNR customer number, mailing address, boat registration number and payment via credit card.

Renewing a registration through mail means payment and the renewal notice will need to be sent to the specified DNR office. If there is no notice, boaters will need to complete a Boat Registration and Titling Application form. In-person renewal requires the renewal notice and payment to be presented at a Department of Natural Resource office.

Is Boat Insurance Required

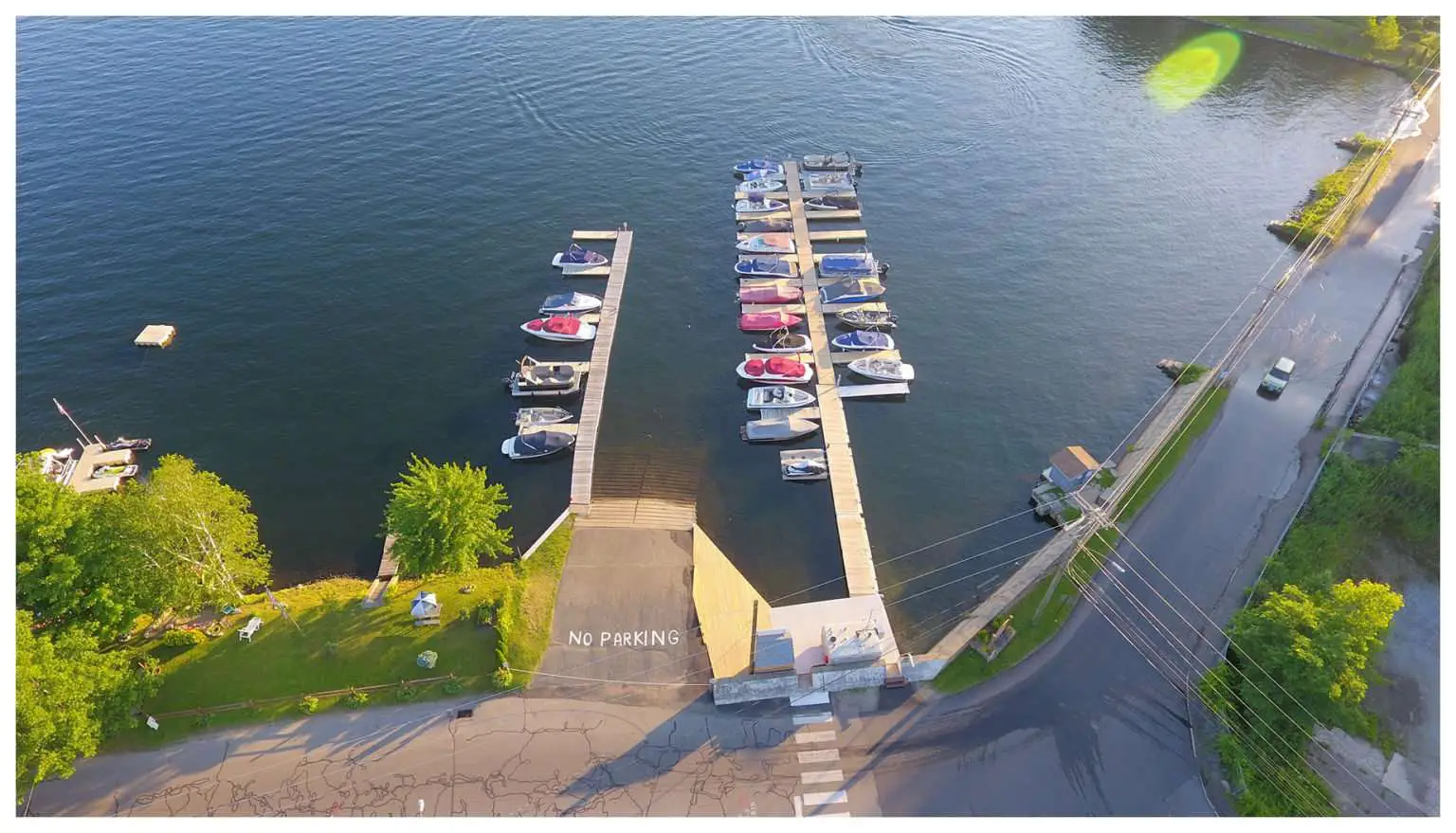

Boat insurance is not required by the state of Wisconsin, however, if you have financed your boat, the lender will require insurance on it to recoup any losses on his asset until it’s paid off. Some marinas and docks also require you to have watercraft insurance for their own protection if you use their facilities.

Also Check: How To Clean Mildew Off Boat Seats

Does My Boat Need To Be Registered

Yes. Boats are just like cars in that they need a paper title and a form of identification physically on the boat. You can register your boat at the DNR website, where you’ll need to fill out an application for a Wisconsin Certificate of Number. After registering, you’ll also need to display the registration number and expiration decal somewhere on the front half of the boat where it’s clearly visible, just like a car’s license plate and expiration decal.

No registration is required for small sailboats without a motor , a sailboard or manually powered watercraft like a kayak or canoe.

Selecting A Boat Insurance Provider That Works For You

After youve researched providers, compared them, and found one youre comfortable with, its time to apply for a quote. This can usually be done online or over the phone with an agent. You will need to provide your identification, a vessel license, and the information of your boat including its make, model, year, and the date you purchased it. Be prepared to answer questions about the age and approximate hours on your boat, as well as what you will be using it for.

After you get a quote and sign up for the policy, a payment may be required and this is usually done via credit card. Then you will have access to view and manage your policy online. Some companies also have apps where you can manage your policy on the go.

Recommended Reading: Freedom Boat Club Charleston Cost

So How Much Does Pontoon Boat Insurance Cost

If youre reading this article with the expectations of getting a definitive answer to this question then Im afraid youre going to be disappointed. Like most other things money-related, insurance is a complex industry. There are a lot of factors that go into determining how much youll pay to insure your pontoon boat. Adjusters consider a number of things before quoting you, like your boats value, state and municipal laws, and your other insurance policies.

In this post, Ill explain more about boating insurance and clear up some common misconceptions.

Which Comes First: The Boat Or The Boat Insurance

If you are in the market for a boat, it’s a good idea to consider shopping for insurance first before signing your boat purchase paperwork. Insurance rates can vary, so you may want to factor in the cost of your coverage as you determine which boat you can reasonably afford.

Try narrowing your purchase choices down to two or three boats, and then take information about their specifications to a local independent agent.

Your agent will get quotes from several insurance companies for you on your potential purchases. You can then determine for yourself which boat will ultimately be better for your needs and budget.

An independent agent in your area can help you evaluate boat insurance rates and options so you can enjoy the water and have peace of mind. If youre thinking about getting a boat, contact a local agent today and get the vital information you need for your best protection.

TrustedChoice.com Article | Reviewed byJeffrey Green

Read Also: Vessel Documentation Search By Hull Number

Replacing Your Wisconsin Boat Registration

The Department of Natural Resources will need to know the reason for a boat registration replacement such as it being lost, stolen or destroyed. There are a few fees to pay when replacing boat documents.

A replacement registration card and expiration decals will cost $2.50 each. A replacement title costs $5. Boaters who need a boat registration replacement will be required to fill out a Boat Registration and Titling Application, present a verifiable ID and pay applicable fees.

Boat Insurance Requirements By State

Generally speaking, you won’t be required by your state to purchase boat insurance. In fact, only a handful of states require boaters to purchase insurance, and the requirement is often limited to boats with engines rated to have at least 50 horsepower. The table below lists the insurance requirements for each state.

| State | |

|---|---|

| No | |

| Arkansas | Liability insurance with at least $50,000 in coverage is required for all boats powered by engines of more than 50 horsepower. |

| California | |

| No | |

| Hawaii | Only for boats parked in Department of Land and Natural Resources Division of Boating and Ocean Recreation facilities. Liability insurance with at least $500,000 in coverage is required for all boats parked in DOBOR facilities, including harbors and offshore moorings. The insurance policy must name the State of Hawaii, DOBOR as the “additional insured” or “additional interest”. The policy should cover salvage costs for grounded or sunken vessels, damage to docks, pollution containment and wreck removals. |

You May Like: How To Get Boat Registration Number

Bundle For Watercraft Insurance Savings

Philleo Agency Insurance offers a range of policies from which to choose and some discounts are available when you bundle your watercraft insurance with other policies, such as your auto insurance or even homeowners insurance policy. Ask your Philleo insurance agent about how much you can save by bundling multiple policies together.

Dont Expect To Be Covered By Your Homeowners Policy

The notion that homeowners insurance covers boats is one of the biggest misconceptions that new pontooners make. Its never a good idea to assume that anything is covered by insurance, so take the time to carefully read your policy. Otherwise, youre setting yourself up for a bad day in the event that your pontoon gets damaged.

Part of the reason that people have this misunderstanding about homeowners insurance is because some policies do cover boats. However, these boats small, usually without an engine, and inexpensive. Your pontoon, which is probably worth anywhere between $15,000 and $45,000, will not be covered by homeowners insurance in any circumstances.

Read Also: Mildew Stains On Boat Seats

Get Watertight Ohio Flood Insurance

Wallace & Turners standard flood policy will insure the following:

-

Structural damage

-

Furnace, water heater, and air conditioner

-

Flood debris cleanup

-

Flooring such as carpeting and tile

Flood insurance can also protect contents in your home, such as furniture, collectibles, clothing, jewelry and artwork.

Our independent insurance agents are ready to help you select the right flood insurance policy for your situation. Call today.

Read Also: How Do I Register My Boat In Colorado

Liens And Security Interests

If a titled boat is financed, the unsatisfied lien will be indicated on the certificate of title. Before the certificate of title can be transferred into a new owner, the seller must satisfy all outstanding liens and provide the buyer with a lien release from the lender. Lien release documents must identify the lien holder listed on the title, the boat owner on account, and the boat by hull ID number or Wisconsin registration number. A lien release can include a signature from the lien holder in the lien release section of the certificate of title, a signed letter from the lien holder or the signed lien notice provided by the Department.

Recommended Reading: Boat Registration Colorado

Uninsured Or Underinsured Watercraft Coverage

This coverage helps protect you against damages suffered in an accident caused by a driver who has no liability coverage or inadequate liability coverage.

Coverage is offered between the increments of $100,000 – $1,000,000, at various fixed levels.

Getting the right balance of boat insurance coverage can make a big difference if the unexpected should happen out on the water. Be sure to reach out to your American Family Insurance agent to learn about how these boat insurance endorsements can be applied to your policy.

Do You Need To Have An Inspection To Buy Boat Insurance

You typically dont need an inspection for the most common types of personal boats. However, insurance companies may require an inspection for older or larger boats.

If youre buying used, an inspection is good for your own safety as damage from a previous accident could compromise your safety. Thats why many insurance companies offer a single-owner discount.

Also Check: How To Get Mold Stains Out Of Boat Seats