What Determines My Boat Insurance Rate

The average cost of Boat Insurance is $300-500 per year, according to Trusted Choice. Thats only about $25-42 per month, which is not a lot extra to pay for better peace of mind.

Factors that may determine your Boat Insurance rate include:

- Boat Type

- Boat Year, Make and Model

- Driving Record

- Where You Use Your Boat

- Boat Value

Cutting The Cost Of Boat Insurance

There are a few things you might want to consider to help keep the cost of boat insurance down.

No-claims discount

Just as with cars and other vehicles, insurers will usually take into account a clean boating history.

And just like with driving, taking care at the tiller, being security-conscious and navigating with consideration to others will help you to build your no-claims discount.

Security

Some insurers will offer discounts for fitting security such as alarms or particular types of locks.

Where you keep your boat will also affect your insurance for example, a trailer boat kept in a locked compound might be considered more secure than putting it on your driveway.

Qualifications and experience

Insurers see seasoned boaters who have experience under their belt as lower risk and may offer them cheaper premiums.

If youre new to all things nautical, one way to build your experience is to take insurance-recognised courses and qualifications, such as those run by the Royal Yachting Association.

Courses scoring a discount will vary by insurer and by your type of boat, so contact your provider to find out more.

Does Boat Insurance Cover A Blown Engine

Boat insurance covers a blown engine under some circumstances. Check that with the insurance company issuing the policy. Many policies will cover a blown engine when the cause is a manufacturers defect, but not if is due to normal wear and tear.

Contact an independent agent for assistance with all of your boat coverage.

TrustedChoice.com Article | Reviewed byJeffrey Green

Also Check: Colorado Boat Registration Requirements

Best For Additional Benefits: Boatus

BoatUS

- No. of Policy Types: 3

- Coverage Limit: Varies

BoatUS offers boat insurance as well as towing services and additional discounts on boat charters and services.

-

Coverage for fishing and watersports gear

-

Teamed up with Geico

-

Overload of boating services on site

BoatUS offers boat insurance through the Boat Owners Association of the United States and was acquired by GEICO in 2015. The company has been in business since 1966, resulting in a mix of online customer reviews. But a great majority are positive, especially in the area of claims service. BoatUS offers boat policies in all 50 states for many different types of personal watercraft and yachts.

While membership is not required to get a quote, added benefits for BoatUS members include discounts on popular boating and fishing businesses, fuel, slips, and charter cruises. The basic membership fee is relatively inexpensive at $25/year and goes up to an Unlimited Gold Towing membership for $179 that comes with perks like 100% payment dock-to-dock tows as well as $3,000 for tows outside of TowBoatUS service area. Other membership packages include Unlimited Freshwater Towing for $90/year and Unlimited Saltwater Towing for $165/year.

Does Boat Insurance Cover Theft

Comprehensive boat insurance covers the theft of the boat itself. Personal possessions carried in the boat may or may not be covered, depending on the policy. Therefore, you should carefully review the comprehensive coverage of your policy to determine exactly what is and is not covered.

If you plan to carry expensive fishing equipment or other items of value, you can purchase one or more additional riders, or policy endorsement, to cover those assets.

Don’t Miss: How Much Does Freedom Boat Club Cost Per Month

Why You Need Specialized Boat Insurance Coverage

Boat insurance is not required in all states. However, if you finance your boat or dock it at a marina, you may be required to have a specialty boat policy. Get more information on boat insurance requirements.

Off the water, you may be able to insure your boat on your homeowners policy. But homeowners policies typically cover small low-powered watercraft and offer few optional coverages. Thats why so many boaters choose Progressive specialized policies. With us, youll get all the coverages listed above .

Comparing Boat Insurance Providers

Owning a boat is a major expense and you should choose your boat insurance provider with care. Remember to research the company and check out its ratings and reviews. Some other things to keep in mind when comparing providers include:

- Coverage options: What type of coverage is offered? Make sure you understand the different plans and if things like running aground or hitting the dock are covered.

- Pricing: Know how much youre paying for coverage and what that includes. Also, keep due dates in mind and if a downpayment is required.

- Discounts: What discounts does the provider offer? Some things to ask about are bundling discounts, safe boater discounts, age-based discounts, and discounts for experienced boatmen

- Specializations: Know if the provider specializes in marine coverage and make sure the agents are knowledgeable because it is much different than auto insurance. Some companies specialize in recreational boating and others specialize in commercial boating and yachts.

- Coverage Exclusions: Research ahead of time what is not covered so you know before you choose a policy. Some providers wont insure boats that go above a certain amount of knots and others wont insure boats with aftermarket parts.

Don’t Miss: Boat Upholstery Cleaner Mildew

Best For Safe Boat Drivers: Progressive

Progressive

Progressive offers a variety of comprehensive boat insurance policies and offers discounts for safe boat drivers.

-

Need to contact for pricing

-

New boaters may be overwhelmed with choices

-

Dont insure houseboats

Progressive Insurance is well-known throughout the United States and has an excellent reputation for providing comprehensive coverage at competitive prices. Progressive has been writing boat policies for over 35 years and now insures more than one million watercraft. You can buy a boat policy for several types of personal watercraft vessels up to 50 feet long and up to $500,000 in value.

There are several attractive discounts to reward safe boat owners, including a decreasing deductible, in which your policy deductible will decrease for each policy period you remain accident-free, and a safety course discount for anyone who completes a state-approved safety course. New policyholders will enjoy small accident forgiveness for claims of $500 or less, while customers who have insured their watercraft through Progressive for at least four years and been accident-free for the past three years are awarded large accident forgiveness that ensures no increase in rates for any accident.

How We Chose The Best Boat Insurance Providers

When selecting the best boat insurance providers, we compared policies and discounts for more than 20 nationally recognized insurance companies that offer boat policies. We also looked at each companys financial strength, customer satisfaction ratings, and reviews. We feel confident that our evaluations provide a useful guide to help you select a boat insurance company, but we always encourage you to shop around and compare quotes before signing on the dotted line for any insurance policy.

You May Like: Boat Insurance Cost Mn

How To Get A Comprehensive Boat Insurance Policy

After purchasing a boat, one of the top items on your to-do list should be to get it insured. You want to make sure you get the most out of your policy.

To get a SkiSafe boat insurance policy, there are a few ways to go about it:

1. Get a Boat Insurance Quote Online

The other option would be to do it all online. This is a great option for boaters who have speed on the mind and are looking to receive a quote in minutes.

Youll need to provide us with some basic information about yourself and your boat. And well take it from there.

Plus, anything you need to adjust on your policy quote can always be addressed online or over the phone.

Need to add someone to the policy? Need to change an address? Need to add on extra coverage? No problem. You can take care of everything in minutes on your computer or by contacting one of our underwriters. Whatever the issue is, well work hard to fix it.

How Does Boat Insurance Work

When you buy boat insurance, you must decide on the amount of coverage you need for your boat, the deductible and the types of coverage you need.

If you have an accident, experience a theft, or have another loss that is covered under your policy, you can file a claim and receive a payment covering the loss.

If you were in an accident with another boat that caused serious damage to your vessel, one of the following things would most likely occur, depending upon the insurance coverage you and the other boater have and the laws in your state:

- If you were at fault, your boat liability insurance would cover the damage up to the limits of the policy.

- If the other boater was at fault, their coverage would pay for your damage, up to the limits of their policy.

- If the other boater was at fault, but did not have boat insurance, or did not have enough to cover your expenses, uninsured/underinsured boaters coverage could cover the damage .

Save on Boat Insurance

The cost of boat insurance varies depending on:

- The state you live in

- The type, size, and age of the boat you wish to insure

- The size of the motor and how it is powered

- Whether you are using it on inland waters or the open seas

- Whether you have selected additional coverage options

In general, boat insurance can range anywhere from as little as $200 to as much as $500 per year.

Also Check: How Much To Join Boat Club

Comprehensive Coverage Can Be Purchased

Insurance companies offer the option to purchase comprehensive coverage for your boat, which will protect you against vandalism, theft, and unexpected crisis situations such as floods and fires. It can also include personal property coverage for any fishing gear you have, roadside assistance if you need towing services, and uninsured boater insurance.

Is My Boat Insurance Policy Also Valid Abroad

Our boat insurance policies are automatically valid

- in the territorial waters and inland waterways of Finland, Sweden and Denmark and in the territorial waters of Norway along the coast

- in the Baltic Sea and its bays, along the Saimaa and Kiel Canals as well as in the Kattegat and Skagerrak straits

- during storage and transport within the territories of these countries.

The geographical scope of our policies can also be extended to cover other areas of Europe and beyond.

Recommended Reading: Is Banana Boat Sunscreen Cruelty Free

Does Boat Insurance Cover Engine Damage

Boat insurance sometimes covers engine damage. This varies from company to company, as well as by policy. Some insurance companies have machinery damage exclusions while others do not it often depends on the age of the motor. Reimbursement may include replacement cost or be subject to depreciation.

Our Boat Insurance Policies Also Cover Outboard Engines And Boating Accessories

Our boat insurance naturally covers the hull of the boat as well as any engines and sails. Our policies also cover any accessories that are intended to be used exclusively on the boat as well as any on-board electronic systems and software.

In other words, you can claim on your boat insurance if an accessory that you store on your boat or that you have temporarily detached from your boat is stolen or damaged. Please remember to tell us whenever you purchase new accessories to ensure that the value of your boat is up to date in your policy documents.

Our boat insurance policies protect your boat in the water and on land, around the year. Launching and laying-up are high-risk operations, which is why it is important that your policy also covers damage sustained on land.

Read Also: How Much Does Freedom Boat Club Cost Per Month

What Isnt Covered Under Boat Insurance

Insurance policies typically exclude certain types of losses. For example, losses related to criminal activity on the policyholders part will typically be excluded. An insurance company usually wont pay for losses related to wear and tear or improper maintenance, either.

For detailed information on exclusions in your policy, read over the policy terms carefully.

What Does Comprehensive Boat Insurance Cover

Comprehensive boat insurance usually covers damage from:

- Vandalism

- Hail

- Fire and lightning

When getting a boat insurance policy, you must choose the amount that you want the insurer to cover your boat for. The common options for boat coverage are agreed-upon value, also known as hull value, and actual cash value.

Hull value insures your vessel for whatever amount you and your insurer agree upon. For instance, you may have paid $50,000 for your boat, so you want to insure it for $50,000. Actual cash value factors in depreciation, which causes the cost of your boat to decrease as it gets older.

If you cover your boat for $50,000, in ten years your carrier may only pay you $30,000, as thats what your insurer determined its fair market price would be at that time. Deprecation formulas vary by provider but know that the older your boat, the less its worth generally.

Theft and Vandalism

If your boat is stolen, the amount youre compensated depends on your coverage. The agreed-upon value will likely provide more than actual cash value. Some companies also offer replacement cost or total replacement cost coverage, which means your provider will buy you a brand-new boat of like make and model as the stolen one after you incur a total loss.

Hurricanes

Most comprehensive boat policies should cover damage from tropical storms and hurricanes, but double-check with your carrier to make sure. As mentioned earlier, some policies will have separate deductibles for hurricane damage, too.

You May Like: Freedom Boat Club Membership Plans

Best For Individualized Customer Service: United Marine Underwriters

United Marine Underwriters

- No. of Policy Types: 4

- Coverage Limit: $1 million

The provider offers personal attention to its customers, doesnt make them feel like a number, and each customer gets assigned a primary customer service agent.

-

Discounts for boat safety courses

-

Knowledgeable agents

-

Cant buy other types of insurance from them

-

Contact for pricing and policy details

As it emphasizes on its website, United Marine Underwriters is a specialty insurance company that writes insurance for just boats. It has been in business since 1990 and provides boat insurance in all U.S. states except New Mexico. Boat insurance navigation is also available to Canada, the Bahamas, and Mexico. Liability limits are available up to $1,000,000, with discounts available for completing one of several boating safety courses approved by the Coast Guard Auxiliary and Power Squadron and the National Association of State Boating Law Administrators, among others, according to its website.

One of the more unique things about United Marine Underwriters is its policy service. When you purchase a boat insurance policy through United Marine Underwriters, you are assigned a primary service person who takes care of all of your servicing needs. This company really cares about its customer service.

What Should You Look Out For When Choosing Your Policy

- Is your boat in insurable condition? Most policies will require that you have a “marine survey” done at your expense to show that the boat is seaworthy and in good working order.

- What value do you want insured? You’ve got three choices for insuring the value of your watercraft: agreed value, market value or a random value of your choosing:

- What parts of the boat do you want insured? Some policies allow you to choose which parts of the boat you want insured and for how much. For example, you may wish to reduce your premiums by insuring the hull but not the sail.

- How far can you take your boat from land? A common condition in most policies is a “geographical limit” of 200 nautical miles from Australia’s shores. You’re covered if you stay within that range, but not if you sail beyond it.

- What are the maintenance requirements? Your policy will require that you keep your boat and moorings in good working order. Find out if your insurer has specific requirements. For example, some insurers will require you to have your moorings serviced every year.

- Will you be towing your boat? If your boat is damaged while being transported on a trailer, its usually not covered by boat insurance so you’ll need to add it to your car insurance. Boat insurance may still cover you for damage to others depending on how your policy is structured.

Recommended Reading: Freedom Boat Club Costs 2021

Pontoon Boat Risk Statistics

Finding the right insurance for your pontoon boat can be challenging. Think about some of the risks you might face on the water, both to the structure of your boat and to your passengers or other boaters. Here are some statistics for you to ponder:

- In 2019, there were 40 deaths and 153 casualties on pontoons.

- Pontoons accounted for about 6% of all boating accidents in 2019.

- Alcohol was the number 1 cause of all boating accidents in 2019.

A sunny afternoon on the water with your friends and family is something to cherish. Those peaceful afternoons together can be tarnished when accidents happen, so protecting yourself, your boat, and those who share the water with you is paramount.

An insurance policy that covers your needs and risks will help you relax and enjoy time on your pontoon.

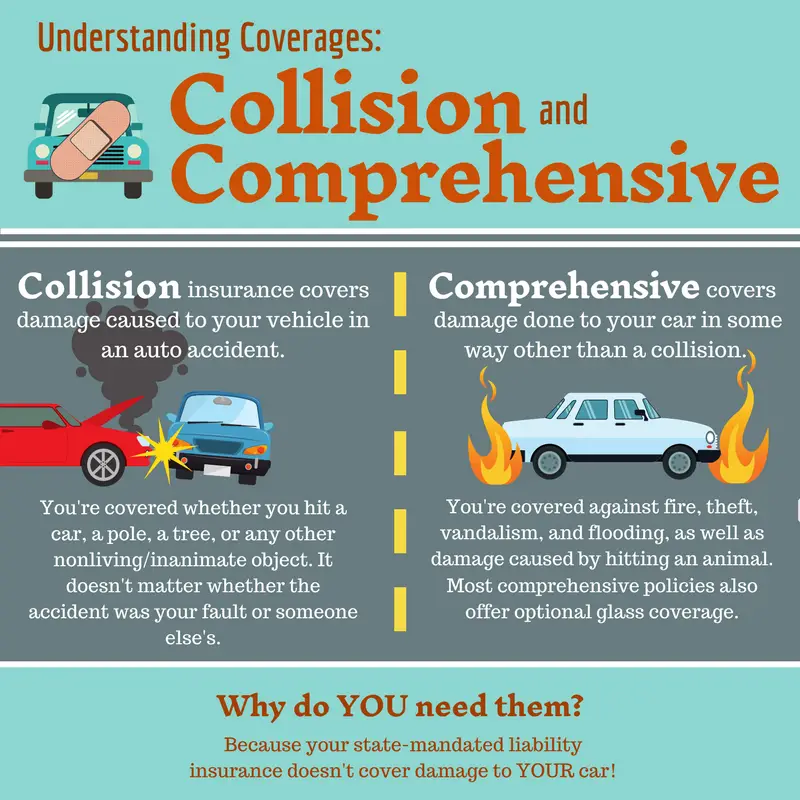

Is Comprehensive Coverage Full Coverage

Comprehensive coverage is a separate type of car insurance that protects your car from things other than an accident or collision, like falling objects and vandalism. Collision and comprehensive insurance are often combined to protect a vehicle against most forms of damage, as part of so-called full coverage.

Read Also: Hydrofin Pontoon