How To Apply For A Boat Loan

Applying for a boat loan is similar to applying for a personal loan or auto loan. Youll need to find a lender first. In some cases, you can apply online. Otherwise you may be able to apply in person at a bank or credit union.

Next, youll typically need to provide information such as the loan amount, purchase price of the boat, type of boat and age of the boat along with employment information and other personal info about your assets and debts. As with personal loans and auto loans, this could result in a hard credit inquiry to check your credit profile .

Then youll wait for approval, which could be available as soon as the next business day, or may take a few business days, depending on the lender youre working with.

Re: Which Scoreing Model For Boat/luxury Item

If it is financially workable, the answer is simple: pay all cards to $0 except one, with the remaining card reporting a small balance. You would get a big score boost from that.

If it is not financially workable, then you should spend some serious effort in figuring out how you got in a situation where you’d be willing to pay 20% in interest to credit card companies and then compound that with buying a new boat. I promise I am not being critical, but just trying to honestly give you the advice that is in your best interest as I see it.

A compromise solution is to pay all cards down to under 68% each and your total utilization to under 28%. That would certainly get you some scoring help, though arguably it is no help at all to expand your ability to incur further debt when you are already paying rapacious interest rates and have little or no savings.

wrote:

If it is not financially workable, then you should spend some serious effort in figuring out how you got in a situation where you’d be willing to pay 20% in interest to credit card companies and then compound that with buying a new boat. I promise I am not being critical, but just trying to honestly give you the advice that is in your best interest as I see it.

My credit situation is not something that needs to be “figured out how I screwed up royally.”

Not that it matters, 3 of those 4 cards are 0% till the end of the year. And they are on the path to be paid.

How To Apply / Next Steps:

A) If you meet the Credit Profile Parameters please apply here. If you have any questions please call 949-515-0055 for more information on our mid-tier and sub-prime marine financing programs. Our service-oriented and friendly staff of experienced boat finance professionals will work with you, one-to-one, every step of the way to get you the boat of your dreams and get your credit rating back on track. * B) If you have not met the Credit Profile Parameters noted above you may not qualify for our sub-prime marine loan financing programs. We strongly suggest that you not apply for a loan unless you are relatively sure that you have met the general Credit Profile Parameters as it will place an unnecessary inquiry on your credit report that may lower your FICO score. Instead we recommend that you start monitoring your credit score and apply for a SeaDream loan once it has reached 550 or above.

To learn more about increasing your chances of securing boat financing SeaDream has put together a series of boat financing tips. After you have taken measures to increase your chances of being financed SeaDream will work with you to get the best possible boat loan.

You may always contact one of our loan representatives to further investigate your current scenario.

* Disclaimer: The credit profile parameters are only a general guideline and do not guarantee a loan approval.

Recommended Reading: What Are The Best Pontoon Boat Brands

What Is A Good Interest Rate On A Used Boat Loan

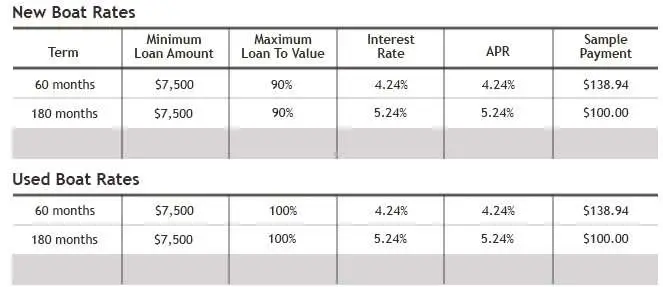

While used boat loans can occasionally have rates higher than those offered for new boats, this isnt always the case. In fact, many lenders offer the same competitive rates whether youre buying used, new, or even refinancing. Because of this, applicants can expect to find used boat loans with rates in the 4% to 5% APR range.

For instance, Bank of the West our overall top pickoffers interest rates starting at 3.74% APR for watercraft over $50,000, whether the boat is new or used.

Boat Financing With A 650 Credit Score

Financing for a boat can occur through traditional banks, credit unions, marine finance companies and boat dealers.

Although a 650 score may generally be approved by various lenders for other items, waiting until your score improved for a boat loan is a good option as previously stated.

This way you increase the chances of loan approval and will likely secure a smaller interest rate.

You can do this by paying down debt, keeping credit utilization low and saving for a larger down payment.

Recommended Reading: How Do I Register My Boat In Colorado

Check Your Credit Score

Checking your credit score is the next essential step, as your credit score can significantly impact what financing options are available to you, including what terms and rates you may qualify for. Many financial institutions and credit card companies offer the ability to check your score for free, so this step may require you to click a button on an online account or app. If this option is not available to you, some online services offer consumers free credit reports.

After you apply for a boat loan, a hard inquiry is necessary. While a soft pull won’t impact your credit score, a hard inquiry might. However, this impact is usually minor and temporary. Reach out to a professional credit consultant with any questions or concerns.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How Much Is Boat Insurance In Louisiana

Fallen In Love With A Boat Compared With Auto Loans Financing A Boat Can Be A Much Heftier Investment

Boats can be more expensive than a car, which means loan amounts can be higher and terms can be much longer.

Just how much you pay to finance a boat depends on a number of factors, including the type of boat loan you choose, the loan terms, your down payment and your credit.

Lets take a look at the different types of boat loans, your financing options and how to apply for a boat loan.

Can I Get A Boat Loan With Bad Credit

Borrowers with bad credit may still qualify for a boat loan. Some online lenders offer unsecured personal loans specifically to borrowers with bad credit.

Secured loans from a bank or credit union may also be a smart option for borrowers with bad credit since approval decisions rely less on their credit.

Also Check: Does Homeowners Insurance Cover Boat Rental

Whether Youll Need A Marine Survey

When you apply for a secured boat loan, the boats value will be a factor in how much you can borrow.

If youre not getting a new boat, you should get a marine survey. During a marine survey, an inspector will examine the vessel, engine and trailer, detail the boats condition, note any repairs needed and determine whether its safe to take on the water.

Applying For A Boat Loan

To apply for a boat loan, you must meet a few basic requirements. Exact rules vary by provider , but generally include:

- Completing an online, phone or written loan application form

- Providing proof of income

- Providing a financial statement that includes details of assets, income and existing debt

- Providing full details of the boat, including price, taxes and registration details

- Agreeing to a credit check many lenders have a minimum credit threshold of 650

Read Also: Who Does 20 Year Boat Loans

How Long To Finance A Boat

At My Financing USA, we offer boat loan terms that range from 60 to 240 months, or 5 to 20 years. The loan terms you are eligible for depend on your credit history, the age of your boat and the amount you wish to finance. We offer the longest available loan term and no prepayment penalties, allowing you to pay off your loan as fast as you want with the lowest payment option.

Use our boat payment calculator to determine how your boat loan term may affect your estimated monthly payment. The longer your loan term, the less you will have to pay each month for your loan. So if your goal is to get the lowest monthly payment possible, you may want to accept an extended loan term. If you wish to finance for a shorter term, ask your loan officer.

Boat Financing & Leasing

If you are looking to enjoy one of the many great lakes in Canada, getting a boat is inevitable. There are many options to choose from, including small family boats, fast speed boats and even a house boat. Whatever type of boat you are looking for, you will likely need financing or leasing to get it. At Smarter Loans, you can browse top financing and leasing providers in Canada. Below you will find a list of reputable companies in Canada that offer boat and yacht financing and leasing with reasonable terms, even if you have poor credit. click Apply Now next to one of them to get started.

Also Check: Do I Need To Register My Boat

Apply To Several Lenders

Because bad credit boat loans have higher interest rates, its important to shop around so you can get the lowest. It doesnt hurt your credit score to apply to multiple lenders any more than it does to apply to one if you do all applications within 14 days. Once you have the loan offers, ask the dealership to beat the lowest rate you got.

What Are Typical Boat Loan Terms

You can often expect boat loan terms to include a repayment period of 15 to 20 years. Down payments may range from 10% to 30%, depending on the amount borrowed, and typically the boat is considered collateral for the loan. Boat loans often start out as low as $5,000, with some lenders offering financing up to $4 million.

Keep in mind that the terms involved with the average boat loan will vary based on a number of factors. These include whether the boat is new, used, or being refinanced how old the boat is how much you plan to borrow and whether the boat is for full- or part-time use.

Don’t Miss: How Much Is Boat Insurance Cost

Is It Hard To Finance A Boat

If you have excellent credit, plenty of income, and a large down payment, financing a boat should not be hard. However, if you do not clear all of a lenders requirements for a boat loan, you may have a hard time securing a boat loan. In addition, if you are trying to finance an older boat or have no down payment, you may need to use an unsecured boat loan. Boat ownership is expensive and lenders know that. They will want to ensure that a borrower is financially stable and responsible before loaning them money to buy a boat.

Alternatives To Bad Credit Boat Loans

A bad credit boat loan isnt the right move for everyone. If your credit score is low but you have a reliable income and a good relationship with your credit union or bank, you may be able to get a secured personal loan with better terms than a subprime boat loan. Unsecured personal loans can also be an option, but you will most likely need good credit to get approved.

You May Like: What Is The Best Aluminum Boat

What Do Lenders Look For In A Borrower

Making yourself a good candidate for lenders will go a long way in getting you low-cost financing for your big purchase.

- Steady source of income. You need to show you have enough regular income to afford monthly repayments after bills and debt obligations.

- Low debt-to-income ratio. Your current debts will also play a role. Lenders want to make sure you wont be overextending yourself and putting yourself at risk of default when you borrow a boat loan.

- Liquid assets. Lenders often want to see that you can still handle payments should your employment or income situation change drastically.

- Good to excellent credit. Lenders look for borrowers with good to excellent credit because it shows a history of paying your bills on time.

- Experienced boat owner. Experience with a boat isnt a must, but it may make a lender more confident. Having had a boat in the past means you likely know the ropes.

Which Lender Is The Most Trustworthy

We’ve compared each institution’s Better Business Bureau score.

The BBB, a non-profit organization focused on consumer protection and trust, measures businesses based on factors like their responsiveness to consumer complaints, truthfulness in advertising, and clarity about business practices. Here is each company’s score:

| Lender | |

| Suntrust | A+ |

All of our three picks are rated A+ by the BBB. Keep in mind that a high BBB score does not guarantee a positive relationship with a lender, and that you should continue to do research and talk to others who have used the company to get the most comprehensive information possible.

Don’t Miss: What Does It Cost To Join Freedom Boat Club

The Best Boat Loans Of July 2022

|

4.49% to 11.89% with AutoPay |

24 to 84 months |

|

| A five pointed star 4.5 /5 |

$10,000 and up for new and used boats, $25,000 and up for live-aboard boats. Loans over $2 million are available. |

Starts at 3.74% |

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, but our reporting and recommendations are always independent and objective.

Stuck At Home So Are Weour Process Is 100% Online

You want to buy a new or used boat. You know you could afford the payments, but you also know you have a low credit score. Do you have to toss your dreams of boat ownership overboard? Absolutely not. At My Financing USA, we help people looking for new or used boat loans, even if they have bad credit.

Your past credit score may not be an accurate indication of whether you can afford boat payments. Circumstances change, and we believe everyone deserves a chance to fulfill their desire to own a boat, regardless of their past. We can help you find a rate you can afford. Even if you have had a past bankruptcy or made a few late payments, a poor credit score may not bar you from low-credit boat loans.

You May Like: What Size Prop Do I Need For My Boat

We Have The Best Boat Loans For People With A Bad Credit History

You can trust My Financing USA to help you find the financing options you want. We have assisted hundreds of thousands of customers, and we have earned a sterling reputation. Our customers’ reviews reflect our dedication to offering stellar support and making the process as easy as possible. By conducting everything online, we make your part simple. You can even sign your closing documents online using DocuSign. Other benefits of working with us include:

- Safe and secure DigiCert Norton VeriSign Secured website, which protects your personal information.

- Fast response times as short as 48 to 72 hours after submitting your application.

- Pre-qualification for loans, which makes it easier to know how much you can afford to spend on your boat.

How Did We Choose The Best Boat Loans

Personal Finance Insider’s goal is to help smart people make the best decisions with their money. We combed through the fine print of many boat loans and lenders so that you don’t have to. We considered the factors that are the most important to boaters, including:

- The type of boats financed: We searched for lenders that offered loans for the most shapes and sizes of boats, from houseboats to sport boats.

- Interest rates: We compared the starting points of interest rates from many banks, and compared ranges where available.

- Few or no fees: We looked for lenders that offered boat loans with the fewest amount of fees on each loan.

- Loan amounts: We chose lenders with the widest variety of loan amounts available to help everyone find a loan for their boat-buying budget.

- Widespread availability: Lenders we considered have loans available in almost all 50 states, if not all.

Also Check: Does Geico Do Boat Insurance

How Long Are Boat Loans

Repayment periods for boat loans vary depending on the type of loan you choose.

Unsecured personal loans typically have shorter repayment periods two to seven years. If you choose a secured boat loan, your term can be as long as 20 years.

Keep in mind the term you choose affects the interest you pay. Shorter terms have higher monthly payments but carry less interest.

For example, a four-year, $30,000 boat loan with an annual percentage rate of 15% will have monthly payments of $835 and cost $10,076 in interest. The same loan with an eight-year repayment term will have monthly payments of $538 and cost $21,683 in interest.

Use NerdWallets boat loan calculator to calculate your boat payments.