Best For Emergency Services Coverage: State Farm

State Farm

- No. of Policy Types: 1

- Coverage Limit: Varies

State Farm is a well-known insurance provider that offers additional coverages including emergency services reimbursement.

-

Coverage for houseboats and jet-skis

-

No online quotes for boat insurance

-

Website needs more detailed information

-

Need to contact agent for policy details

In business since 1922, State Farm is one of the best-known names in insurance in the United States. They offer boat liability and property damage insurance for common risks like storms, collision, theft, and more, with add-on coverage options available . Their property damage coverage extends protection not only to equipment permanently attached to your boat but also to accessories such as detachable canopies, life preservers, and seat cushions. State Farm has resources available for boat owners including articles on boat trailer safety tips, boat safety, and water safety. Boat insurance is available for a multitude of watercraft: runabout/sport boats, cruisers/yachts, sailboats, bass boats, jet skis, houseboats, and kayak/canoes.

They Received National Recognition

USAA was named to a coveted Fortune magazine list. They made it to the 20 bests companies to work for in America list. Its not easy to reach this level of recognition. A few of the reasons for their inclusion as one of the best companies to work for is that they maintain consistently high marks for providing top notch customer service and the members they serve provide this feedback, so its coming from a very reliable source. USAA maintains a family environment and many employees of the company have shared that working there is an enjoyable and rewarding experience.

What Do Consumers Think Of Usaa

USAA is an incredibly popular carrier, one of the most popular for insurance for veterans and military members. It’s considered a great insurance option by the community. Its one of the best military car insurance companies available, according to consumers. The volume of positive reviews speaks for itself.

The overall rating score for the company is a 4.73 out of 5.00 with more than 6,000 USAA reviews as of February, 2020. All reviews are from customers who have had an experience with a USAA insurance product.

More than 80 percent of the reviews were rated as excellent, while only 1.2 percent of the reviews rates USAA as poor.

On average, USAA policyholders consistently rate USAA highly for its great customer service and competitive prices. Below are examples of USAA reviews that people have written on Clearsurance. These USAA members rated their experiences highly and were thrilled with the service they received in addition to the competitive rates.

One user who has trusted USAA car insurance for many years said in a review, I have been with this company for nearly 28 years now and have nothing but great things to say about them. They have great rates and are very responsive to customer needs and claims.

You can read more USAA insurance reviews by visiting USAAs profile page on Clearsurance.

Recommended Reading: Boat Registration In Florida

Selecting A Boat Insurance Provider That Works For You

After youve researched providers, compared them, and found one youre comfortable with, its time to apply for a quote. This can usually be done online or over the phone with an agent. You will need to provide your identification, a vessel license, and the information of your boat including its make, model, year, and the date you purchased it. Be prepared to answer questions about the age and approximate hours on your boat, as well as what you will be using it for.

After you get a quote and sign up for the policy, a payment may be required and this is usually done via credit card. Then you will have access to view and manage your policy online. Some companies also have apps where you can manage your policy on the go.

Does My Boat Policy Cover Damage My Boat Causes To The Dock Or Nearby Boats

In most situations during a named storm or catastrophe, liability coverage would not cover damage to docks, boats and other property caused by your boat colliding into it. Because the damage was caused by a violent storm, the boat owner is not liable or legally responsible. If you own a boat, please review your policy contract and declarations page as well as any attached policy endorsements. These attachments would replace coverages and/or exclusions outlined in your initial policy contract. You may easily locate your policy documents online by logging in to your policy.

You May Like: Boat Fl Numbers

Read Also: Freedom Boat Club Boston Cost

What Types Of Boat Insurance Coverage Does Usaa Boaters Insurance Offer

Although we often talk about boat insurance in the singular, it really includes several types of coverage. USAA Boaters Insurance offers the following types of coverage:

- Bodily Injury Coverage: This insurance pays for your legal defense and for the costs associated with injuries to other people involved in an accident.

- Property Damage Coverage: Usually, this insurance will look after the property damage you cause to another boat or property when at fault in an accident.

- Collision Coverage: Collision coverage is an optional policy that pays for the cost of repairing or replacing your boat after an accident. If you have a lease, the lender may require you to buy collision insurance.

- Comprehensive Coverage: If your boat is damaged in an event other than a collision, comprehensive coverage will pay for the cost of the repair. Covered events include storms, floods, fire, vandalism, and theft.

- Salvage/Wreckage Removal: Some standard insurance policies will subtract salvage costs from the insured value of the boat or only offer a small percentage of the coverage amount for salvage. This endorsement protects from the specific costs and liability that go with a wreckage or salvage.

USAA Boaters Insurance also provides access to the following endorsements:

- Total Loss Replacement: If it’s a total loss, this policy will pay you based on the agreed value, actual cash value or the replacement cost value.

I Cant Tell If The Damage To My Vehicle And/or Boat Has Exceeded My Deductible What Should I Do

You should promptly report all claims to us for which you expect coverage. An inspection by a trained claims representative can determine how much it will cost to repair your vehicle or boat. After you report your claim, a Progressive claims representative will inspect the damage and prepare a repair estimate outlining the extent and cost of damage.

You May Like: What Battery Do I Need For My Boat

Don’t Miss: How To Keep Boat Seats From Mildewing

How Do I Report A Claim On My Boat Insurance Policy

*Boat and PWC coverages are underwritten by GEICO Marine Insurance Company. The TowBoatU.S. Towing Coverage Endorsement is offered by GEICO Marine Insurance Company, with towing services provided by the BoatU.S. Towing Program. Towing coverage only applies to the insured watercraft. This endorsement is not available in all locations and is subject to certain restrictions. Towing coverage is subject to availability and service may be restricted based on the location of the insured watercraft. Please speak to an agent to discuss details of towing services, limits, exclusions and coverage availability.

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages.

When you click “START QUOTE” you’ll be taken to the BoatUS website for a secure boat quote. Any information you provide will be subject to the privacy policy posted on their website.

BoatUSâBoat Owner’s Association of The United Statesâis the nation’s largest association for recreational boaters providing service, savings and representation for over 50 years.

Usaa Financial Services Are Based In San Antonio Texas

The headquarters for USAA is based in Texas where the bank is located that offers banking, other financial and insurance services. There are 22,000 employees who serve a total of 8 million USAA members. Enrollment in the companies various plans has grown by leaps and bounds and with the size of the company on the increase, what better place for a big company than the state of Texas, which itself is known for going big on most things that they do.

You May Like: Boat Insurance Oklahoma

Where Can I Get Boat Insurance

There are several ways to buy boat insurance. You can easily get quotes online that will help you find a policy you can afford. You may have questions, special circumstances, or a highly customized or top-dollar boat to insure, and in this case you may opt to speak directly to an independent agent.

To find the best rates available, contact a local independent insurance agent who knows the local insurance regulations in your area. Your independent agent can shop around, compare options and rates from numerous insurance companies and help you to make the most informed decision.

Save on Boat Insurance

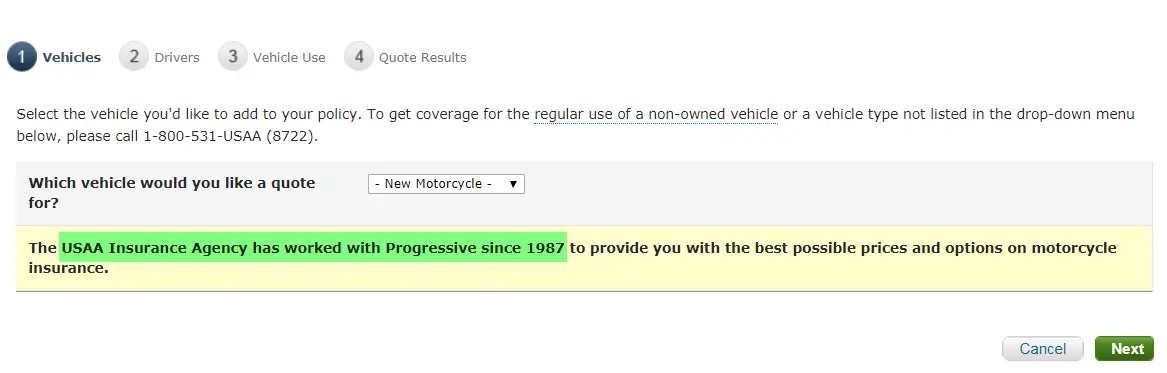

How Can I Get A Usaa Personal Watercraft Insurance Quote

- Visit the USAA website.

- Fill in the insurance quote application form. You will typically need to provide personal information, such as your name, personal watercraft information and documentation, your driver’s license, and address.

- Check the information is accurate and submit your application.

SuperMoney DisclosureEditorial Disclaimer

Recommended Reading: Boat Canvas Patch

Usaa Was Founded By A Group Of Army Officers

At the time that the company was established, it was difficult for men and women in the armed forces to secure auto and home insurance coverage. Their occupations put them in a category that was considered to be high risk. This made many insurers hesitant to insure them because of their high mobility as well as other occupational risk factors. A group of 25 Army officers decided to get together and develop a type of insurance by which they could insure one another through a group effort. What started out small many years ago has not grown into a national phenomenon, offering service men, women and their families excellent options for home and auto insurance that doesnt discriminate against them because of their military affiliations. In fact, it rewards them for it.

Is Travel Trailer Insurance Right For Me

States vary in their insurance requirements for recreational vehicles, so it best to check what your state recommends. Many states insurance laws include travel trailers within your automotive insurance coverage rather than giving them a separate designation.

While some states do not require travel trailers to be insured separately, your auto policy may not cover damages to your trailer, and the road isnt the only place where your trailer should be protected.

Damages caused by fire, inclement weather, theft, or even vandalism can be expensive to repair and can ruin months of planning for your upcoming trip.

One mistake many people make with insurance coverage for recreational vehicles is assuming that an existing automotive policy will cover all the needed expenses.

While your automotive policy may be great for your daily commuting vehicle, your travel trailer serves a different purpose and its coverage should reflect those different needs.

An automotive policy may treat your travel trailer like a car, meaning that your insurer may cover only structural damage to the travel trailer, ignoring the internal features and even the personal belongings it contains, and leaving you to cover those costs on your own.

Don’t Miss: Repair Canvas Boat Cover

Do You Need Boat Insurance

Your home insurance policy covers your boat in some cases, but it doesnt go far. Homeowners policies typically cap boat coverage at $1,000 or 10% of your homes insured value. And liability coverage which pays for damage your boat does to others typically isnt included under home insurance. So a home insurance policy might help you only if your boat is small, slow and inexpensive.

At a glance: Do I need boat insurance?

| Yes | |

|---|---|

|

|

|

Auto Insurance Coverage For Damage To Your Own Boat In An Accident

Unfortunately, if you are seeking coverage for damage to your own boat from a car accident, you may not be able to recover from a standard car insurance policy. Instead, you should look into whether it would make sense for you to have a boat insurance policy.

There are special provisions in a boat policy that provide coverage for accidents when you are towing your boat on the road. You may have to pay a deductible, which will depend on how much you think you can afford to pay out of pocket for damages from an accident.

You may be able to get this policy from your same insurance company. If so, you could end up saving more money than if you had to use two separate insurance companies because of discounts for bundling multiple insurance policies.

When you are shopping for boat insurance, the same principles apply as for comparison shopping for car insurance. You will want to get multiple quotes in case you are eligible for better discounts from another insurance company.

You also want to make sure that you get enough coverage to protect both your boat and yourself in the event that you are responsible for an accident with your boat.

Be sure to ask about coverage for the trailer that is used to transport your boat as well.

You May Like: How To Get Mildew Out Of Vinyl Boat Seats

Heres What You Need To Know About Usaa Auto Insurance

Money expert Clark Howard lists USAA as one of his top three favorite picks for car insurance in his guide to the Best and Worst Auto Insurance Companies.

Furthermore, the company scored the highest for auto insurance customer satisfaction in almost every single region of the country, according to the J.D. Power 2019 U.S. Auto Insurance Study.

But heres something to note right off the bat: While USAA can be a great option for affordable coverage, the insurer is only geared to one segment of the population.

In this article, well take a look at who is eligible for USAA auto insurance, what discounts are available to customers and more info youll want to know before you switch your coverage.

We Insure Over 1 Million Watercraft And We Can Help Insure Yours Too

With over 35 years of boat insurance experience, we know how to keep you afloat. So, as long as your boat or personal watercraft is valued at no more than $500,000 and is up to 50 feet long, well most likely insure it. Dont see your watercraft listed here? Call us at and well do what we can to get you covered.

Some of our coverages

Also Check: Florida Boat Registration Costs

Why Is It Called Inland Marine Insurance

Inland marine insurance gets its name from ocean marine insurance, which covers international shipping by boat. When ground transportation, such as trucks and trains, became more common, insurers adapted ocean marine policies to protect cargo on land. They called these new policies inland marine insurance.

Recommended Reading: Boat Canvas Patch

Usaa Vs Liberty Mutual: Which Is Better For You

When deciding whether USAA or Liberty Mutual is the right choice for your auto insurance, there are many factors to consider.

USAA receives widespread praise from customers. However, membership restrictions can prevent you from signing a policy with them and enjoying the companys affordable rates. Liberty Mutual offers many discounts that can lower the cost of its policies, and its 12-month terms benefit many policyholders.

Do your research before deciding on a new auto insurance provider. Choose the company and the coverage levels that best meet your needs. Its best to request quotes from several carriers. Above all, be sure you understand what gets covered before signing a new insurance policy, especially before buying a new or used car.

Read Related Stories:

You May Like: Best Bass Boat Cranking Battery

How To Get An Auto Insurance Quote From Usaa

You can get a quote from USAA online at usaa.com or by calling 800-292-8045. To get a quote online, youll first need to log into your online account or create one.

Once youve filled out the required information, make sure you understand your quote and compare auto insurance rates with several other companies before you make a final decision.

Does Usaa Have Travel Trailer Insurance

Before you hit the road in your shiny new travel trailer, youll want to make sure that you protect that investment by having the proper insurance. USAA is consistently ranked as one of the top insurers in the US because of its competitive rates and comprehensive policies.

USAA covers travel trailers under recreational vehicle or motorhome policies. They also offer a variety of discounts for USAA members, responsible drivers, and for going more than a year without making a claim.

Coverage options include the following:

- Liability protection

- 24-hour claims service

- Roadside assistance

If you are a current USAA auto policyholder thinking about renting an RV or travel trailer before deciding whether or not to buy your own, speak with your USAA insurance agent about whether your current automotive policy covers your rental or if youll need supplemental coverage.

Not all travel trailers are alike, and both insurance companies and recreational vehicle manufacturers make varying distinctions as to what classifies as a travel trailer.

Well discuss what kind of trailer you may have and whether travel trailer insurance is in your best interests.

Also Check: Banana Boat Cruelty-free