What Boat Insurance Will Pay For

You can typically buy liability insurance which pays for damage your boat does to others in amounts from $15,000 to $300,000, according to the Insurance Information Institute. Heres what else you can expect from a policy:

| What boat insurance typically covers | What it doesnt cover |

|---|---|

|

|

|

Check, too, about additional coverage for trailers and accessories, for towing and for damage caused by an uninsured boater.

You can buy two types of damage coverage for a boat:

- Actual cash value. This pays the value of your boat at the time of the damage. If your boat is destroyed, your insurance company determines its market value.

Some important things to know about boating and your policy:

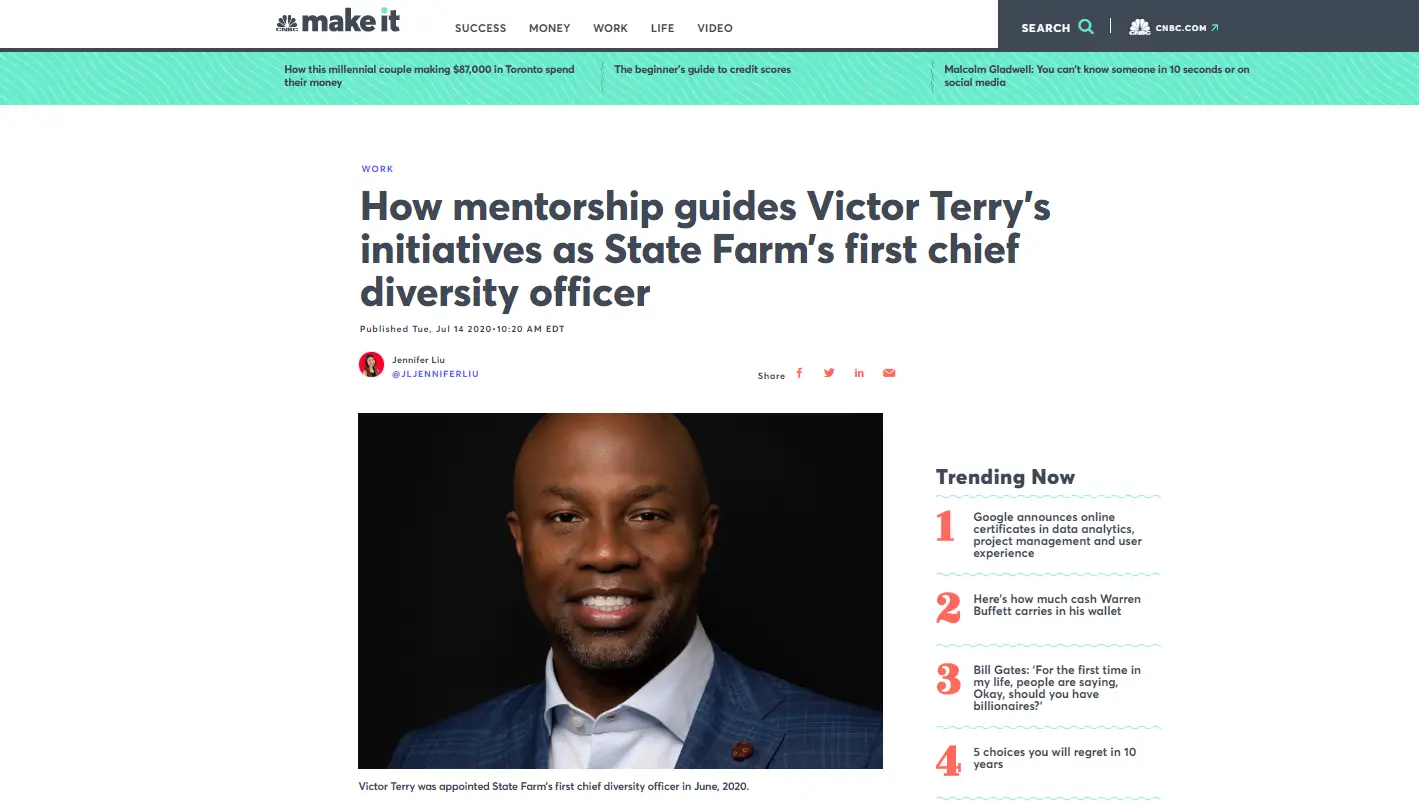

Does State Farm Have A Credit Card

State Farm BankVisa credit cardwill

. Likewise, people ask, what credit cards does State Farm accept?

State Farm®accepts VISA®, MasterCard ®, American Express ®, Discover ®, Diners Club ®, and JCB ® and debit cards.

Also Know, can I pay my State Farm auto loan with a credit card? Make a one-time transfer from a State Farm Bank Home Equity Line of to your vehicle loan account: Call 877-SF4-BANK . Western Union service fees may apply – this is the only payment option where a be used.

Besides, how do I pay my State Farm credit card bill?

What banks own what credit cards?

What To Know About Private Mortgage Insurance

What is PMI?Lenders consider you to carry more risk if you make a down payment of less than 20% of your homes cost. For borrowers with relatively little equity in their home, lenders require private mortgage insurance, or PMI, to protect them if you fail to make payments on your loan. If you cant afford a 20% down payment, youre not alone:

From 2017 to 2019:18.7% of conventional mortgages required PMILoans with PMI averaged $236,100The average value of a home that required a PMI loan was $280,260

How much does PMI cost?If your down payment will be less than 20%, PMI premium payments will likely be part of your monthly loan payment amounts for a while. The amount youll pay depends on the size of your loan, the amount of your down payment and your credit score.

Annual premium range for PMI as of September 2020: 0.58% to 1.86% Example: $235,000 loan 0.75% premium = $1,762.50 per year or an extra $146.88 per month.

Getting rid of PMIOnce the principal outstanding on your loan reaches 80% of your homes value, you can request that your bank cancel PMI under these conditions:You request cancellation in writingYou have made your payments on time and the loan is currentYou havent used the home to secure additional loans, like a second mortgage

Automatic cancellationIf you are current on your payments, your lender may automatically cancel your PMI when the remaining loan principal reaches 78% of your homes original value.

Recommended Reading: Aaa Boat Insurance

What Happens After Im Approved For A Vehicle Loan

After youre approved and have received your funds, its time to start paying down your loan balance. State Farm allows its borrowers to make payments online, over the phone, by mail or through wire transfer services like MoneyGram or Western Union.

Youll be on the hook for late fees if youre more than 10 days late on a payment. The exact amount varies based on your loan terms, so check your promissory note, coupon book or online account for more information.

Keep an eye on your loan balance and your bank account, and if you notice anything off, reach out to State Farm as soon as possible by calling 844-619-8906.

How Can I Get A State Farm Personal Watercraft Insurance Quote

- Visit the State Farm website.

- Fill in the insurance quote application form. You will typically need to provide personal information, such as your name, personal watercraft information and documentation, your driver’s license, and address.

- Check the information is accurate and submit your application.

SuperMoney DisclosureEditorial Disclaimer

Also Check: Hydropeptide Pro Club

What We Love About State Farm Mortgage

The mortgages from State Farm range from fixed-rate mortgages to jumbo mortgages and adjustable-rate mortgages, so consumers have several choices. The company also offers mortgage refinancing services so homeowners can pay off their loans faster, drop their monthly payments, and gain access to equity more quickly. State Farm also offers a Moving Made Simple program for no cost to help with finding and buying the perfect home.

Using Quicken Quickbooks And Other Third Party Tools

Can I access my U.S. Bank account in Quicken or QuickBooks?

Yes. You can help keep track of and manage your money using Quicken or QuickBooks.

How do I enroll in Quicken and import my transactions from U.S. Bank?

U.S. Bank offers three options for importing your transactions into Quicken:

- Download transactions Similar to State Farm Bank, this option allows you to manually import transactions into Quicken from online banking at no extra cost. First, log in to your U.S. Bank account at usbank.com. Once youre logged in, select any of your accounts to view the transactions and in the upper right-hand corner, above your transaction list, select .

- Web connect You can connect to your U.S. Bank account from within the Quicken software at no extra cost. Either add the new account within Quicken and select U.S. Bank Internet Banking as the financial institution or update your existing account changing the financial institution to U.S. Bank Internet Banking.

- Direct Connect Similar to Web Connect, this feature allows you to connect to U.S. Bank from within the Quicken software, but it does not require that you have mobile or online banking credentials to complete the process. This feature also offers you the ability to pay bills through U.S. Bank. If you would like to setup Direct Connect, please call U.S. Bank Technical Support at 800-987-7237 and select option 2. Please note that there is a $3.95 monthly cost.2

What U.S. Bank accounts can I access in Quicken or QuickBooks?

Don’t Miss: Freedom Boat Club Nj Cost

What Documents Do I Need To Apply

To complete your application, you and your cosigner or coapplicant need to provide the information listed below.

- Your name, date of birth, address, Social Security number and phone number.

- Your monthly housing payment and whether you rent or own.

- Your employment status, time at current employer and employers contact information.

- Your monthly or yearly income and its sources.

- The make, model, VIN number and mileage of the vehicle youre looking to buy.

If refinancing, you need to provide State Farm with your remaining loan balance and information about your current lender.

Read Marine Insurance Policy Details

Does your policy cover fuel spills? Will your coverage lapse if you run offshore? What happens if someone else is driving your boat and has an accident does your policy cover you for liability? These are questions you need to ask before anything bad happens. The most important distinction, insurance experts agree, in any marine policy is Agreed Value vs. Actual Cash Value. The agreed-value policy, which commands a higher premium, covers the boat for its replacement value. On a true agreed-value policy, the insurer will pay whatever it costs today to replace a partial or total loss, says Nolan. The actual-cash-value policy, by contrast, factors in depreciation at about 10 percent per year.

For what we spend for our boats, its just plain irresponsible not to have an agreed-value policy, says John Canavan, an independent insurance agent. There are some who will disagree because of the higher costs, but theyll be the ones complaining if they ever have a catastrophe. Canavan knows that firsthand: He recently sheared the drive off his Crownline on a rock. But he was also covered in full with his agreed-value policy. Travelers took care of it, and we were up and running the next weekend, he says.

Also Check: How To Clean Vinyl Boat Seats Of Mildew

Eligible Company List Fca Affiliate Rewards

Pittsburgh, PA. Supplier Employees Only. F00N6D. Miner Ltd. San Antonio, TX. Fleet. Employees Only. S62244. Miniature Precision Components. Janesville, WI. Supplier Employees

get access to a broad catalog of products from Logitechs family of brands, generous commissions on larger-value orders and excellent support every step of the way. Logo of Logitech,

Agriculture. Banking with the Farm Bureau Family Credit Union. The Michigan Farm Bureau Family of Companies does business with the Farm Bureau Family Credit Union. The credit

Where Can I Get A State Farm Rate Quote

Health & Medicare Supplement Quote. We offer online quotes in most states for our hospital income and Medicare Supplement products. Get a health insurance rate quote. Other Rate Quotes. We dont offer online quotes for boats, businesses, or motorcycles yet, but you can always contact your State Farm agent for an off-line quote.

You May Like: Banana Boat Tanning Oil Before And After

Become An Agent State Farm

Facebook page · Visit State Farms Twitter page · Visit State Farms Instagram page · Visit State Farms LinkedIn page · Visit State Farms Flickr page · Visit State Farms YouTube page.

BANKING OVERVIEW. US BANK IMAGE. CHECKING · SAVINGS · CREDIT CARDS · CDs · RETIREMENT CDs. QUICKEN LOANS IMAGE. HOME LOANS.

Where Does State Farm Do Business

State Farm is an insurance carrier based in Bloomington, IL. The company was founded in 1922 and offers watercraft insurance in 47 states .

Highest possible financial rating. State Farm scores the highest available financial rating, which is just what you want from the company responsible for paying for your insurance claims.

If you are looking for a personal watercraft insurance policy and you’re wondering whether State Farm Personal Watercraft Insurance is a good choice, read on.

Recommended Reading: Anchor Weight For 24 Ft Pontoon

A Closer Look At State Farm Bank Auto Loans

Here are some additional details to consider when comparing State Farm Bank with other auto lenders.

- New-car loan terms range from 12 to 84 months. But if you decide to purchase a used car, you can only finance it for up to 72 months.

- Car loan amounts can range from $5,000 to $250,000, though all auto loan amounts depend on the car and your eligibility.

- State Farm Bank doesnt finance vehicles with more than 150,000 miles or vehicles that are driven more than 50,000 miles annually.

- State Farm Bank charges a $100 prepayment penalty for any auto loan paid in full within the first 12 months.

- Payoff Protector is offered with every car loan from State Farm Bank.

- You must be 18 years or older, have proof of identity, reside in the U.S. and be listed as a registered owner on the title and registration of the vehicle to apply.

- State Farm auto loans are not available to residents of Massachusetts or Rhode Island.

Capital One Boat Loan Rates: Used & New

Are you looking to secure a loan so that you can finally get the boat that you have always wanted? Did you know that you can get a maritime financing from Capital One? Capital One is among the top ten banks in the nation. It has expertise and experience in the financing industry. Capital One Maritime Lending Group was established to help you with all your financial needs. The group consists of a team of experts who have knowledge and experience. They have worked in the industry for many years. The headquarters of the lending group is in New Orleans near the Mississippi River. They are close to the Intracoastal Canal, the shipyards at the Gulf Coast, and the natural gas fields that are in the Gulf of Mexico. They are close to the people that they serve meaning that they can understand their needs and serve them better. Their location allows them to stay on top of the trends in the maritime industry and how they affect their prospective clients. They offer rates that are fair since they understand the position of the customer.

A line of credit is a certain amount of credit that the bank extends to the borrower. The line of credit is maintained by the borrower and is at the borrowers discretion. The borrower can only access as much as the limit allows. This offering is perfect for businesses that are just starting out and there might be unforeseen expenses in the future. It is also useful for companies that are growing and have not set everything up.

Read Also: Freedom Boat Club Boston Cost

What Other Factors Affect Your Boat Insurance Cost

Besides where you live, several factors play into boat insurance rates, including:

- Type of watercraft: Fishing boats, pontoon boats, sailboats, and other personal watercraft all have unique features that may affect the cost of your policy.

- Safety measures:Completing a boating safety course may lower your rate.

- Boats horsepower: Boats with stronger engines, like powerboats, often have higher rates.

- Boat’s age: Newer boats are often more expensive to insure than older boats.

- Boating history: More experienced boaters may receive lower insurance rates than newer boaters with less experience on the water.

You may be able to lower the cost of boat insurance by qualifying for discounts, including multi-policy, multi-boat, and responsible driver. Learn more about boat insurance discounts at Progressive.

How State Farm Bank Car Loans Work

State Farm insures more cars and homes than any other U.S. company. If youre a policyholder, it may be convenient to have your auto insurance and auto loan in the same place, but anyone can apply for State Farm financing. Cars arent the only vehicles you can buy with State Farm Bank financing it provides loans for boats, motorcycles and recreational vehicles. For purposes of this review, well focus on car loans.

Don’t Miss: How To Stop Birds From Pooping On My Boat

State Farm Auto Loan Review

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Even if youre one of the millions of State Farm insurance policy holders in the U.S. you might not be aware the company has a banking arm, too. State Farm Bank not to be confused with State Farm Federal Credit Union offers competitive rates on new and used car auto loans in all states but Massachusetts and Rhode Island. All loans come with free loan payoff protection, similar to GAP insurance, which is a nice perk. One downside is a prepayment penalty youll be charged if you pay off your loan in fewer than 18 months. Keep reading to see if a State Farm car loan is right for you.

Pros Of State Farm Car Loans

- High loan amounts If you are in the market for an expensive car, State Farm finances up to $250,000 for qualified applicants,

- Wide variety of vehicle eligibility State Farm finances cars, boats, motorcycles and recreational vehicles.

- Payoff protection State Farms free Payoff Protector cancels any remaining amount due on your loan in case your car is totalled or stolen and insurance fails to cover the entire cost.

- No application fee

Read Also: What My Boat Worth

How To Pay Off Student Loans Quickly

Learn ways to make repaying student loans more manageable.

If youre carrying student loan debt, youre not alone. Among the college students graduating in the class of 2019, 69% took out student loans with an average debt of $29,000. While this figure can be daunting, a well-thought-out game plan can make paying off student loans more manageable.

How To Get Cheaper Boat Insurance

Insurance experts say that if you can save 10 to 15 percent or more on an annual premium, it may be worth opting for a higher deductible. The standard deductible is 2 percent for most boats, and insurance experts suggest raising it to 3 or 4 percent. Realize, however, that a higher deductible could cost thousands of dollars more if an accident occurs.

A higher deductible is one way to save on premiums, but there are a number of other things you can do to reduce the cost of boat insurance.

Lets take a look at some of them:

Don’t Miss: Capital One Boat Loan Rates

State Farm Auto Insurance

NAIC complaintsRatings are based on complaints to state regulators relative to a company’s size, according to three years’ worth of data from the National Association of Insurance Commissioners.

Fewer than expected

Ease of useRatings are determined by our editorial team. Our “ease of use” category looks at factors such as website transparency and how easy it is to file a claim.

Above average

DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers.

Great set of discounts

Supplemental State Farm Car Insurance Coverage Options:

- Emergency Road Service: Pays for certain emergency roadside services, including towing, mechanical repair, fuel delivery, jump-starts, tire repairs, and locksmith services.

- Rental Reimbursement: Covers rental costs while your car is in the repair shop due to an accident. Policyholders must have comprehensive or collision coverage to add this coverage option.

- Rental Car Deductible: Covers your deductible expense if you have an accident in your rental car.

- Travel Expense: Covers hotel reservations, meals and transportation if you are involved in an accident more than 50 miles from home and your vehicle becomes inoperable. Policyholders must have comprehensive or collision coverage to add this benefit.

- Rideshare Driver Coverage: Extends your personal auto policy to protect you while youre working. Rideshare coverage may add 15% – 20% to your auto policy premium, and you can only get a personalized quote for it by calling a State Farm agent.

State Farm also insures a variety of recreational vehicles, including motorcycles, scooters, golf carts and ATVs, as well as boats and other watercraft. However, the availability and details of these policies vary by state.

Also Check: Best Deck Boat For Family