Do You Need Boat Insurance To

Here are a few questions to review when getting ready for a summer of fun on the water.

The National Safe Boating Councils National Safe Boating Week is quickly approaching and its a great time to brush up on steps you can take to stay safe out on the water. But, theres lots you can do to prepare for a safe summer season on the water even before then! Not only should you look into life jackets and flotation devices, but you should also be sure to look into your boat insurance.

Boating Safety & Statistics

According to the U.S. Coast Guards 2019 Recreational Boating Statistics, there were over 4,150 boating accidents reported and approximately 55 million dollars in damage to property. Of those accidents, 613 ended in a fatality and over 2,550 resulted in injuries.

Now we know what youre thinking, But that wont happen to me, Im a safe boater. Were sure this is true however, 70% of deaths occurred on boats where the operator had no boating safety instruction. While you may be prepared for the hazards of the open water, unfortunately, lots of other folks are not.

Because of this, we recommend you look into state-approved boater safety instruction and DEFINITELY take the time to look into your boat insurance coverage. Here are a few questions that may be one your mind as you get ready to hit the water.

Do You Need Boat Insurance to Use Your Boat?

What happens if youre involved in an accident with a boater who does not have insurance?

- Video & audio equipment

How Do I Report A Claim On My Boat Insurance Policy

*Boat and PWC coverages are underwritten by GEICO Marine Insurance Company. The TowBoatU.S. Towing Coverage Endorsement is offered by GEICO Marine Insurance Company, with towing services provided by the BoatU.S. Towing Program. Towing coverage only applies to the insured watercraft. This endorsement is not available in all locations and is subject to certain restrictions. Towing coverage is subject to availability and service may be restricted based on the location of the insured watercraft. Please speak to an agent to discuss details of towing services, limits, exclusions and coverage availability.

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages.

When you click “START QUOTE” you’ll be taken to the BoatUS website for a secure boat quote. Any information you provide will be subject to the privacy policy posted on their website.

BoatUSâBoat Owner’s Association of The United Statesâis the nation’s largest association for recreational boaters providing service, savings and representation for over 50 years.

How Much Does Boat Insurance Cost

According to trustedchoice.com, the cost of boat insurance generally ranges from $300 to $500 per year, on average. Depending on the type of boat and your personal profile, your insurance costs may be significantly higher. âThe type of boat, its length, and the expected use of the boat will largely dictate your boat insurance rates. Whether you have a speed boat, a small fishing boat, or a yacht will make a big difference in what you pay.â Another insurance comparison resource tells us that a good approximation for your annual premiums is 1.5% the current market value of your boat.

Don’t Miss: Removing Stains From Boat Seats

How To Obtain A Boating Certificate

Most states allow you to complete the Boating Safety Course either online or in a classroom setting. Depending on your learning style, you should select the most suitable option.

For example, I enjoy the convenience and portability of online courses however, in some instances, I would prefer a classroom setting where I can interact with experienced instructors.

The United States Coast Guard, U.S. Power Squadron, state boating agencies, and several other sponsors and volunteer organizations typically provide boating safety classes.

How Climate Change Is Affecting Boating

According to scientists at theNational Ocean and Atmospheric Administration, the average surface temperature of the Earth has increased about 1.8 Fahrenheit since the early 20th century. This gradual warming of the plant has led to adverse reactions to our bodies of water and climate. Every year, the sea level has risen about four millimeters, due to melting ice caps and water expansion.

The ultimate effectclimate change has had on boaters has to do with natural disasters. The intensity of hurricanes has increased as the plant has warmed, with a projected eleven percent increase in hurricane wind speed that will cause up 60% increase in damage. These stronger hurricanes bring more rain along with them, increasing the frequency of Category 4 and 5 storms and higher storm surges.

With this warming climate, the risk attributed to taking a boat out onto the water has increased, especially in a place like Florida which has experienced a collection of strong hurricanes in recent years. The higher the risk, the more necessary it is to protect your assets with boat insurance. Insurers can provide you with a storm plan to combat volatile weather, which includes storing your watercraft in a hurricane proof facility or towing your watercraft to a harbor outside the eye of the storm.

Also Check: Getmyboat Insurance

If I Live In A State In Which Car Insurance Is Not Required Why Should I Buy It

Although car insurance may seem expensive on a yearly or monthly basis, not having it can be way more costly in the end. Even if your state does not require you to carry insurance, it is a smart thing to purchase it anyway for the benefits it provides.

If you do not have insurance and happen to be in an accident that is your fault, you are responsible for all damage, to the vehicles involved as well as any bodily damage to everyone involved.

These expenses add up quickly and will be a lot of money that you are responsible for paying. You may even be sued for compensation, which will cost you even more money.

Also, for most uninsured drivers who are in a car accident, they will be required to purchase car insurance after the accident as well as file for an SR-22 that has to stay in place for three years.

This, plus the cost of damages, is usually much more expensive than driving without insurance for a period of time.

If you are concerned about insurance costs, there are many companies out there that can get you basic insurance for a good price, which is usually worth it.

To find a company right now, just enter your ZIP code in the box below!

What Does Boat Insurance Cover

Common boat insurance coverages include:

- Property damage liabilityâProperty damage liability insurance covers the cost of damages to someone else’s property after an accident you cause. In most cases, your property damage will pay out when you are at fault for an accident that causes damage to someone else’s boat or PWC.

- Collision damageâWhen your boat or PWC is damaged in an accident, collision insurance is an optional coverage that pays the cost of repairing or replacing it, minus the amount of your deductible.

- Bodily injury liabilityâBodily injury liability coverage is the part of your insurance policy that pays for the costs associated with injuries to other people involved, if you are found legally responsible for a boating accident.

- Hull coverageâHull insurance covers any physical damages that occur to your boat and generally includes trailers, equipment, motors, and accessories. Typical claims include fire and windstorm damage.

- Fuel spill liabilityâA separate policy that separates out fuel spill liability and provides coverage for any fines that may occur from an accident involving a fuel spill.

Also Check: Carefree Boat Club Chicago Cost

Boat Insurance Limits In Arkansas

According to the Arkansas Game and Fish Commission’s Boating Laws and Responsibilities Handbook, boating insurance, boat registration and proof of personal property tax payment is required by law at the time of watercraft registration. Liability boating insurance, which protects the policy-holder against damages his watercraft causes to others boaters or vessels on the water, is required for all 50 horsepower-or-higher watercraft.

When Is Proof Of Insurance Required

Even though most states dont legally require you to carry boat insurance, other situations may require proof of insurance for your watercraft.

Docking your boat at a marina

If you plan on docking your boat at a marina, many will require you to show proof of insurance before signing the contract. That being so, make sure to read the fine print and understand the requirements before proceeding with any contractual agreement.

For example, marinas such as the Charleston City Marina in South Carolina and the Kemah Boardwalk Marina in Kemah, Texas require docked boats to have liability insurance of at least $300,000.

Marinas like Brickyard Cove in Pt. Richmond, CA require an endorsement on your policy as additional interest or additional insured to avoid claims of negligence.

Harbors will carry their own liability insurance so they can protect claims where they may be at fault.

Financing your boat purchase

If you have financed your boat, your bank may require you to carry boat insurance. If the bank is using the boat as collateral for the loan, they will require you to list them as payee for loss or damage of the boat.

Unlike home and auto coverage, some policies dont require you to carry year-round coverage. But if you have financed your boat, your lender will most likely ask you to carry coverage even when the boat is stored. Your vessel may still be exposed to risks, such as theft and storm damage, while in storage.

You May Like: Freedom Boat Club Newburyport

Types Of Boat Insurance

There are two basic types of boat insuranceagreed value and actual cash value. How depreciation is handled is what sets them apart.

An “agreed value” policy covers the boat based on its value when the policy was written. While it can cost more up front, there is no depreciation for a total loss of the boat .

“Actual cash value” policies cost less up front, but factor in depreciation. In other word, the policy will only pay up to the actual cash value of the boat at the time it is declared a total or partial loss. Eventually, as your boat ages, your insurer will likely insist on an actual cash value policyand if often gives a substantial savings.

Q: Am I Required To Register My Boat

A: State law requires the registration of any boat that is powered by a motor and operated on public waterways in Massachusetts. Registration is required even if the motor is not the primary means of propulsion for that boat. Some examples of boats that require registration include fishing boats with motors, recreational motorboats, canoes or sailboats that use motors , and personal watercraft such as Jet Skis or wet bikes. Boats exempt from registration requirements include those that do not use motors, and documented vessels . Vessels used solely by a city, county, state, or federal agency will be issued a certificate of registration and number at no charge

Don’t Miss: Mildew Boat Seats

How Much Coverage Do You Need

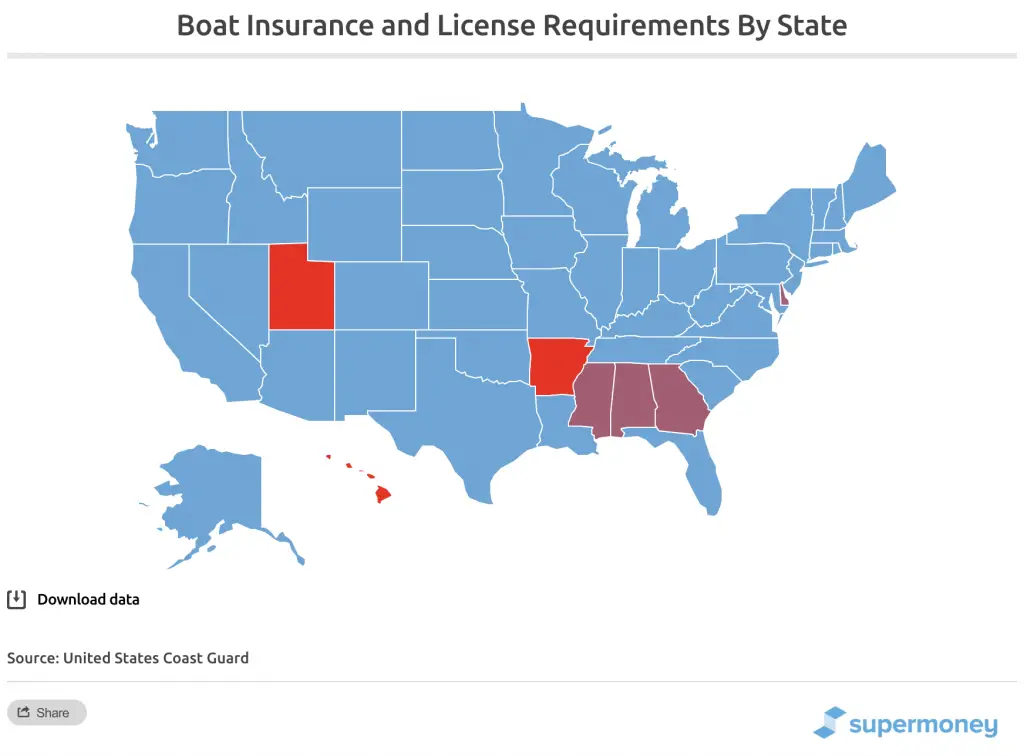

With the exception of Arkansas, Utah, and Hawaii, where some type of liability coverage is required, boat owners dont need a minimum amount of boat insurance in most states. This means that finding the right policy for you will mainly depend on four factors: first, the type of boat you have, second, what you use it forfishing, sports, recreation with family or friends, etc., third, how protected you want your boat to be, and fourth, how much are you willing to pay.

If your intention is purchasing a well-rounded boat insurance policy, it should at least feature some type of liability coverage, collision, and medical payments. These three options will cover damages caused to property, physical damages to your boat, and medical expenses for you or passengers. Adding extra coverage to your policy such as towing and roadside assistance can also come in handy. Keep in mind that sometimes companies include services in their policies that others offer for an additional cost. In order to find the best policy and price, you should at least get three quotes from different companies and compare what coverage and services they feature in their policies.

Will Boat Insurance Cover Me In Another State

Boat insurance policies are typically highly personalized. This is because every boat is different and every owner will use their boat differently.

A basic insurance policy will probably only allow you to use your boat in the state that it has been registered. If you take out a basic boat insurance policy in New Jersey, you will usually only be covered to store and navigate that boat within New Jersey. Be wary that some insurance policies may only allow you to use your boat in rivers, while others may only allow you to use your boat in the sea.

A more bespoke insurance plan may cover you in different states. Youll usually have to outline the specific states that you want to use your boat in. Alternatively, if youre likely to use your boat in lots of different states, you may look into specialist coverage for all states .

If you decide to take out basic insurance that covers you in one state, but you later decide to move to another state, you can usually notify your insurer and have your policy changed to that state. For example, if you decide to move your boat from New Jersey to Florida, your insurer may change your policy, allowing you to store and navigate your boat in Florida .

The risk factors vary from state to state, so you may find that the cost of your policy changes. If you decide to move to another state after this, you will similarly have to notify your insurer again and get this changed.

Read Also: Remove Mold From Boat Carpet

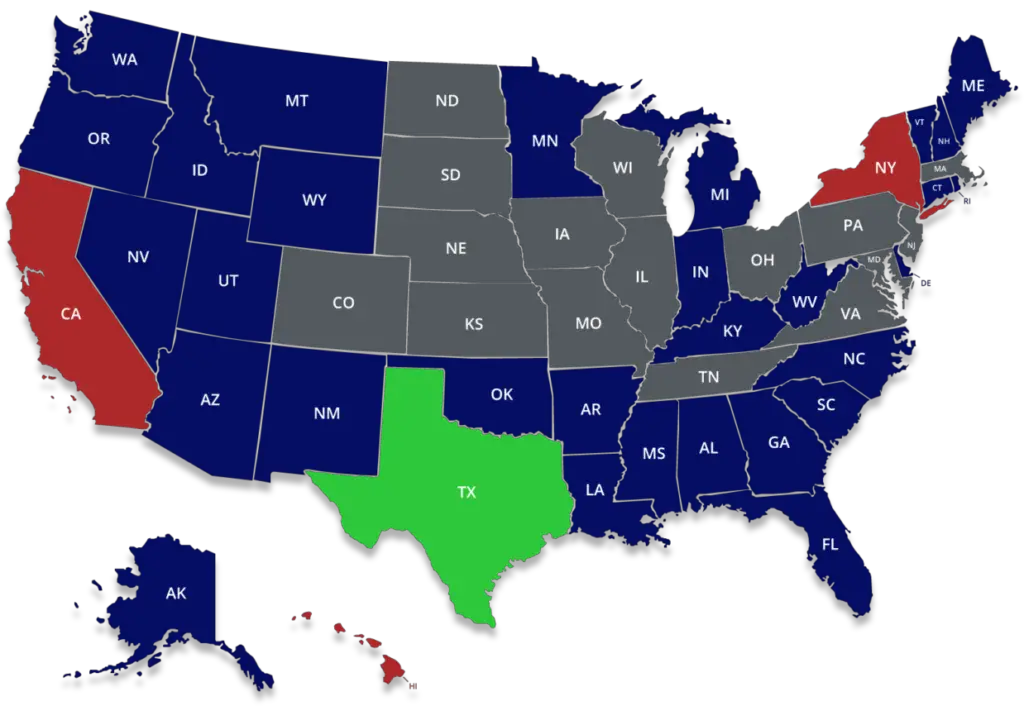

Boating Laws & License Requirements By State

Passing a boating safety course will give you a discount on boat insurance and will increase your water safety skills. Boat safety courses are an excellent investment of time and money, regardless of your state’s boating law. Each state has unique boating education requirements, and the boating rules, laws and regulations vary from state to state for obtaining a boat license or safety certification. Be sure to review the full legal requirements for your particular state.

States with mandatory boating law require safety certification for some or all boaters. Only one state requires an actual boat license. However, many prospective students are not aware of state legal terminology, and search for information about a boat license or licence, or a captain or captains license. This page is an excellent resource for boating law for all fifty states.

Who Else May Require You To Carry Boat Insurance

If you intend to finance the purchase of a boat, your bank will require you to provide proof of insurance for the watercraft. Typically, the policy will need to cover the full value of the boat, and your bank may set minimum requirements for specific types of coverage. In addition, you will need to list the bank as a lienholder on the policy so that it will be included as a co-payee on any compensation in the event of a loss payment.

Most ports and marinas will require you to carry boat insurance in order to use their facilities.

For example, if you want to moor your boat at Port of Bellingham in Washington, you must carry a policy with at least $300,000 in general, legal and pollution liability with a policy term of no less than one year. As another example, the Hawaii Division of Boats and Ocean Recreation requires all vessels moored at its facilities to carry at least $500,000 in liability insurance.

Some marinas, such as the Hawaii Division of Boats and Ocean Recreation, may even require that the marina itself be listed as an “additional insured” or “additional interest” on the policy. You’ll normally need to provide proof of insurance before you can sign a contract for a slip or mooring.

Also Check: Mold On Boat Seats

Q: I Haven’t Registered Or Titled My Boat Before What Should I Do

A: In Massachusetts, initial registration and titling is done by filling out the department’s registration application at any of five Registration offices. The boat owner must submit proof of ownership, a bill of sale, proof of payment of Massachusetts sales tax, and the appropriate registration and/or title fees. For new boats, an original manufacturer’s statement of origin must be provided as proof of ownership. An MSO, title, or previous registration can serve as proof of ownership for used boats.

In order to complete the application, you must provide the vessel’s Hull Identification Number and the boat’s year of manufacture, make, and length. State law requires that the title application must be made and the sales tax paid within 20 days of purchasing a boat. The Division also stores information such as the engine manufacturer, serial number, and horsepower for record keeping purposes.

Average Cost Of Boat Insurance

Average boat insurance costs range from about $200 to $500 annually, but there are many variables. As with auto insurance, the more expensive the make and model of your boat, the higher your boat insurance premium will be. Newer models also will cost you more to insure. For those in hurricane-prone zones, your insurance coverage may cost you more.

Recommended Reading: What Size Anchor For 17 Foot Boat