What Is A Good Interest Rate On A Used Boat Loan

While used boat loans can occasionally have rates higher than those offered for new boats, this isnt always the case. In fact, many lenders offer the same competitive rates whether youre buying used, new, or even refinancing. Because of this, applicants can expect to find used boat loans with rates in the 4% to 5% APR range.

For instance, Bank of the West our overall top pickoffers interest rates starting at 3.59% APR for watercraft over $50,000, whether the boat is new or used.

How Much Can I Borrow

How much you can borrow generally depends on the price of your boat. Typically, you can fund 90% to 100% of the value of your boat. Minimum loan amounts can start anywhere from $2,000 to $15,000, depending on the lender.

Dont forget the down payment

Like car loans and mortgages, boat loans often require a down payment. Generally, youre required to cover at least 10% of the cost. But lenders tend to favor applicants that can front at least 20% of the boats cost. To avoid over-borrowing, we recommend saving up as much as you can for a down payment so you dont need to borrow as much. The less you borrow, the less interest youll pay.

Remember: Boats are more like cars than houses. Once you make a purchase, your vessel will begin to depreciate. If you borrow a large amount with a lengthy term, you may end up paying more in the long run than its really worth.

Traditional Boat Loans: What To Expect

- Amounts may range from $10,000 to more than $10 million

- Terms may span 48 months to 240 months

Your boat loans interest rate and terms will depend on a wide range of factors, including the type of boat youre trying to buy, the amount youd like to borrow, your credit score, the type of loan youre setting up, whether you make a down payment and the lender.

Robin Cottmeyer, association manager of the National Marine Lenders Association, said boat loans can range from $10,000 to more than $10 million and the parameters vary accordingly. According to Mann, the typical boat loan lasts between 10 to 20 years and the lender will ask for a down payment of at least 10-15% of the value of the boat.

Essex Credit, one of our top picks for boat loans, offers loan terms as short as 48 months all the way up to 240 months. Its interest rates range from 4.59% up to 7.69% at time of publication. Your actual terms will depend on many different factors, so the only way to know for sure is by shopping around.

Read Also: Oklahoma Boat Regulations

How To Find The Best Boat Loan Rates

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

When youre shopping for a boat, your focus might be on the size, year and model of your new watercraft. But before you start seeing whats out there, consider figuring out your boat loan first. While financing is available, qualifying for decent terms can take some research and preparation.

Whether youre buying your very first boat or are an experienced sailor, this guide will help you find your best rates for your upcoming loan. Weve analyzed the different options available and asked for tips from experts at the National Marine Lending Association and the Boat Owners Association of the United States , a national advocacy group for recreational boaters that also offers services such as boat loans, insurance and towing for boats stuck on the water.

How A Boat Loan Works

Generally speaking, lenders will want a down payment between 10% and 20% of the boat purchase. However, for loans under $50,000, zero down loans are possible depending on the borrowers credit score and income. For larger loans on yacht purchases where more than $1 million is being borrowed, a 20% down payment is typically the minimum and some lenders may require even more.

If youre trading in a boat as part of the purchase, your equity in the trade-in boat can be used toward the down payment amount . Also, by putting more money down, you can sometimes improve the interest rate on the loan.

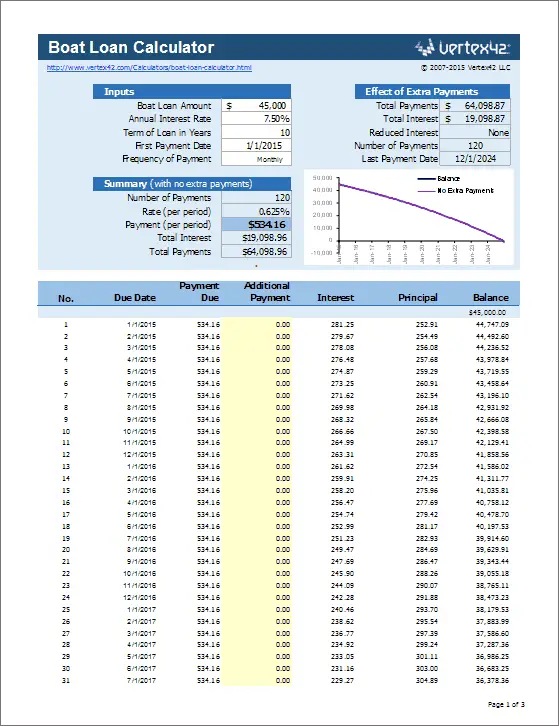

The term of a secured boat loan is typically somewhere between 10 and 20 years. Smaller loan amounts of, say, under $25,000 will usually be on the shorter end of the term range, and larger boat loans will often be around the 20 year term length. Of course, the longer the term of the loan, the more total interest the borrower will pay over time. However, since most loans are simple interest loans, the borrower only pays interest on the outstanding balance of the loan. The borrower can make additional payments to reduce the overall expense, but the payment amount will remain fixed for the duration of the loan.

As previously mentioned, the interest rate will mostly be dictated by your credit score, the size of the down payment, and the term and size of the loan.

Read Also: Registering Boat In Florida

How To Choose The Right Boat

First-time buyers can be intimidated by the selection process, especially without clearly defined expectations. In order to make an appropriate choice, it pays to answer a few questions before locking-in a particular craft. What is your primary use for the boat? Will the boat be docked in the water during the season, or trailered to destinations for each outing? How many people typically embark on your boating ventures? And, more fundamentally, is the boat to be used primarily on inland lakes, rivers, or oceans?

There are dozens of available boat styles, each aimed at particular functions. By dialing-in your requirements, it becomes easier to wade through various options, a few of which include the following boat classes.

Sailboats

Wind-powered vessels conjure romanticized visions, pairing Mother Natures forces with deft maritime manipulation. But while the sentimental pastime is indeed boatings purest form, it requires a high level of skill to carry-off without incident. Unless you are an experienced sailor, or plan to secure the needed knowledge, a sailboat is probably not your best investment. Small, learning sail crafts, on the other hand, may help instill the basics, without putting you at risk.

Fishing Boats

How Did We Choose The Best Boat Loans

Personal Finance Insider’s goal is to help smart people make the best decisions with their money. We combed through the fine print of many boat loans and lenders so that you don’t have to. We considered the factors that are the most important to boaters, including:

- The type of boats financed: We searched for lenders that offered loans for the most shapes and sizes of boats, from houseboats to sport boats.

- Interest rates: We compared the starting points of interest rates from many banks, and compared ranges where available.

- Few or no fees: We looked for lenders that offered boat loans with the fewest amount of fees on each loan.

- Loan amounts: We chose lenders with the widest variety of loan amounts available to help everyone find a loan for their boat-buying budget.

- Widespread availability: Lenders we considered have loans available in almost all 50 states, if not all.

Don’t Miss: Best Paint For Aluminum Jon Boat

Is Financing A Boat A Bad Idea

As a general rule of thumb, you should ensure that any purchase you finance will be paid down faster than it depreciates. If the purchases value decreases at a faster rate than your loan balance, you run the risk of going “upside down” on the loan, or dealing with negative equity.

While this is most often talked about in terms of new cars, its also a concern with watercraft, especially since boats are quickly depreciating assets.

Negative equity can be a serious concern with a high-value investment such as a boat. If the boat were to be stolen, totaled, etc., you would be on the hook for the difference between the remaining loan balance and the insurance companys valuation/payout. Negative equity can also come back to bite you if you ever want to trade in the boat or sell it, as youll wind up owing your lender out-of-pocket in order to finalize the transaction.

Lastly, its important to recognize that financing a purchase will cost you more than the sticker price, no matter how competitive the interest rate you obtain. Between loan processing fees and finance charges, the added expense can be significant.

While financing a boat is not a bad idea in and of itself, its important to strike a balance between your purchase price, down payment amount, and loan repayment terms. This will help maintain a healthy loan-to-value ratio and ensure that you dont pay significantly more for your purchase over time than if youd paid in cash.

What Is The Typical Down Payment For A Boat

The size of the down payment required will depend on the age, price, and type of vessel as well as on your credit profile. Expect to pay 15 to 20 percent down payment on most Center Console or Sportfishing Boats. A Boat loan specialist can help you with programs available through various manufacturers that could allow you to qualify for a lower down payment. They can also help you find lenders that offer lower interest rates for higher down payments.

Don’t Miss: Freedom Boat Club Membership Fees

What Should I Know About Boat Financing

Financing a boat may be one of the most confusing parts of boat ownership for a new boat owner. There are literally dozens of options that could be chosen, some of which are designed to fit certain situations. In fact, boat financing may offer more options and more terms than any car loan.

Part of the reason for the myriad of options in boat financing is due to the large range of prices in the boats. It is possible to get a motorboat for $1,000 US Dollars . On the other hand, even a modest yacht can run $100,000 USD or more. Given the wide range of prices, there is little surprise that so many alternatives exist.

While a typical car loan may be for five years or, at the most, six years, boat loans can last anywhere from a few years to more than 20 years. As one may expect, as the cost increase, normally so too does the length of the loan. In boat financing, it is common for a loan to last at least ten years. A ten-year car loan is virtually unheard of.

Also, if a boat motor needs to be replaced, this can be done relatively easy without affecting the rest of the boat too much. Used boat motors usually can be bought relatively cheaply. All these things are taken into account when looking at boat financing.

Consumer Boat Buying Guide

Homes and cars represent some of the most expensive single-item purchases individuals make during their lifetimes, but spending doesn’t always cease at the shoreline. Boats add to the cost of living for water sports enthusiasts, who eagerly take-on the cost of ownership. And though boat buying is born of passion for the open water, a prudent approach makes the most of recreational budgets and ensures affordability.

As you prepare to take the plunge, due diligence guarantees a smooth transition to boat ownership. From choosing the best boat for your needs to securing reasonable financing, weigh your options carefully before making commitments.

Also Check: 321 Boat Club Reviews

Other Items To Consider

Lenders will require you to have insurance on the boat in order to get approved for financing. Also if looking into extended and enhanced warranties to cover various operational breakdowns, lenders will often permit you to roll the cost of such a warranty into the loan. The reason is simple: the bank loves that youre protecting and taking care of the asset involved in the loan.

When financing a larger boat, note that your experience can indeed come into play in the lending approval. If youve never operated a boat near the size of boat in which youre purchasing, a lender may be concerned about whether or not you can properly manage and captain such a vessel.

Lastly, lenders may want to know where you plan to store the boat.

How To Finance A Boat Purchase

With warmer weather comes more time outdoors, and for those who have access to waterways, the desire to own a boat increases. But when it comes to buying a boat, what do you need to know? In this post, well explore all the aspects of boat loans and what it takes to sail home on your very own watercraft.

Recommended Reading: Best Anchor For 23 Foot Boat

How To Find Your Best Boat Loan Rates

When it comes to finding a quality boat loan rate, it pays to shop around. The terms for boat loans can be quite different between lenders. The only true way to know who can give you your best rate for your specific type of boat is to compare multiple offers. If youre looking for a fast and easy way to compare boat loan offers, you could fill out a single online form at LendingTree and receive offers from up to five different lenders, depending on your creditworthiness.

To guide your research, you should determine your top priority for the boat loan. Are you looking for the lowest possible interest rate? A longer loan term? A loan with a smaller down payment? This could influence the type of lender you choose.

If you plan on using the boat for a few years, you might care more about a quick application process than the interest rate. But if you want to keep your boat for 20 years, controlling borrowing costs may be more important. If you arent sure what you want, this calculator lets you experiment with different boat loan terms to see how your payment would change.

Whats Considered A Good Credit Score For A Boat Loan

As noted, there are many different types of boat loans and different types of lenders that offer them. As a general rule of thumb, the higher your credit score, the lower your interest rate. This means that you will end up paying less over the term of the loan than someone with a lower credit score.

Typically, 700 is considered a good credit score for a boat loan. However, some lenders dont require a minimum credit score or will consider your debt to income ratio, work history, and the cost of the boat alongside your credit score.

Don’t Miss: Best Deck Boat For Family

Why Should I Finance My Boat Purchase

Financing can make Boating more accessible, which is why most boat buyers seek a Boat loan. A loan allows you to keep cash in your pocket and, in some cases, deduct interest expense on the Boat loan. Boat financing can make your life easy if you work with someone who understands the Boat loan process and can guide you through every step.

Boat Loan Terms: How Long Can You Finance A Boat

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Buying a boat? Before you gather your gear and take to the high seas, youll likely need to figure out how to afford your purchase. One of your key questions may be: How long can you finance a boat? Boat loan terms, unlike car loan terms, can stretch up to 20 years, nearly as long as a home mortgage. Whether you should borrow for that amount of time depends on several factors, including the cost of the boat, which can range from a new jon boat under $5,000 to million-dollar yachts. In general, the lowest interest rates are for the shortest loans, but your monthly payments would be higher.

You May Like: How To Remove Mold From Boat Carpet

Where To Find Boat Loans

There are a few different types of lenders, each with varying strengths and weaknesses.

Large national banks and credit unions: Large national banks and some credit unions are more likely to have a specialty division that deals with marine lending. If so, they will understand how to compare different types of boats, and this will be part of their underwriting process. This has pros and cons. On one hand, their experts will spend more time on your application as they review the type of boat youre looking to buy. Expect tougher lending standards and a longer process. On the other hand, they will be more knowledgeable about boats and could tell the difference between various manufacturers to finetune your loan offer. This specialized knowledge can come in handy, especially if youre buying a larger or more expensive boat.

In addition, when you qualify for a boat loan from a specialty watercraft division, chances are youll receive a lower interest rate and a better selection of terms.

Some of the main large boat loan lenders include Essex, part of Bank of the West, online lender Lightstream, part of brick-and-mortar bank SunTrust, and U.S. Bank.

With online lenders, you also will not be able to speak with a representative in person because they dont have physical branches. Consider whether you can get by without this additional customer service.