How Much Does A Boat Cost

Boats vary depending on the type. You can expect to pay anything from $25,000 for a new motorboat to well over $1 million for a new yacht. Used models can go for even less.

Other expenses to consider

The boat itself is one of several costs that come with boat ownership. These include:

- Equipment. Consider the costs of decking out your boat. Electronics, water toys, accessories and safety equipment could set you back $1,500 or more.

- Operating costs. This cost will vary by the type of boat you choose and how you use it. However, the price of fuel should be a big part of your budget.

- Boat maintenance. All boats need regular maintenance to remain safe. Costs vary depending on your boats age, model and your mechanic.

- Storage. Mooring fees are calculated by the length of your boat and if you store it in an expensive area.

- Boat insurance. Depending on the type of boat you have and where you store it, boat insurance can cost you $100 or more every year.

How Do Boat Loans Work

Boat loans work by offering you funding for a new watercraft that uses your vessel as collateral. Its similar to a car loan: You can find a boat loan directly through a dealership or private lender.

If you finance through a lender, you can either have the funds sent to you or have the lender directly pay the dealership.

What gets me the lowest rates and longest terms?

To qualify for the most competitive deal, youll need to meet the following criteria:

- Strong credit. You generally need near-perfect credit and income well over the minimum requirements for the rates lenders advertise.

- Expensive boat. Higher loan amounts might come with lower rates and longer available terms, depending on the lender.

- New boat. Used boats tend to come with higher rates and more limited terms.

- Sign up for autopay. Often lenders offer a 0.25% discount for signing up for automatic repayments.

Ready To Secure Boat Financing

The bottom line? If youre buying a new boatwhich wed certainly encourage as opposed to buying used, since new boat-buyers report a much higher level of satisfactionand your credit score and debt-to-income ratio are up to snuff, you should have no problem financing a boat that meets a lenders minimum loan amounts for up to 20 years.

Use our Boat Buyers Guide to help work through all the other factors that should be taken into account when making a purchase of this nature, and youll have years of fun on the water to look forward to.

Recommended Reading: Is Banana Boat Sunscreen Gluten Free

What Is A Boat And Marine Loan

Although boat and marine loans can be borrowed from many select lenders across the country, particularly those located near bodies of water, Loans Canada can match you with the lender of your choosing, no matter where you live.

A marine or boat loan is a type of financing thats used to purchase almost any seafaring vessel. From sailboats to ski-dos to fishing boats. A boat loan from a specialty lender, private lender, or big bank allows you to make this large purchase, often by transferring the money directly to the dealer, although some lenders do offer direct deposit to the borrower. Once the funds are received, you would repay the loan through a series of equal installments.

Boat Loans: Questions To Ask Before You Apply

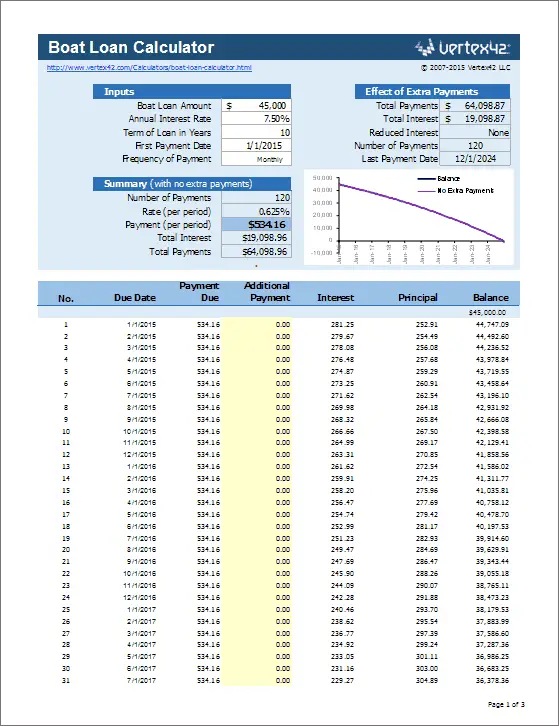

How does the loan fit into my budget? Monthly payments on a boat loan should fit comfortably within a budget that covers all of your needs, wants, debt payments and savings. Use our boat loan calculator to see estimated monthly payments, interest costs and total payments.

Payments toward the boat loan combined with other debt payments shouldnt exceed more than 20% of your income.

What is the true cost of boat ownership? Buying a boat isnt your only new expense. Additional costs include fuel, licenses, insurance, storage, maintenance and repairs. Boats also depreciate over time, just like a car.

Does my boat have resale value? Its smart to buy a boat that is both affordable and popular, as this can attract potential buyers if you decide to sell it and pay off your loan at any point in the future.

You May Like: What Is My Pontoon Boat Worth

Interest Rates Tend To Level Out

Unless youâre opting for a short loan term â five years or less â youâre going to get pretty much the same interest rate on your loan. When buyers find out an eight-year boat loan term is going to have the same interest rate as a 10- or 12-year loan term, they usually opt for the longer term.

Why? Because it gives buyers a lower monthly payment without adding to the total cost of their loan. This can make boat buying much more realistic for buyers with a tighter budget, and it provides buyers the opportunity to make additional payments toward their principle.

How A Boat Loan Works

Generally speaking, lenders will want a down payment between 10% and 20% of the boat purchase. However, for loans under $50,000, zero down loans are possible depending on the borrowers credit score and income. For larger loans on yacht purchases where more than $1 million is being borrowed, a 20% down payment is typically the minimum and some lenders may require even more.

If youre trading in a boat as part of the purchase, your equity in the trade-in boat can be used toward the down payment amount . Also, by putting more money down, you can sometimes improve the interest rate on the loan.

The term of a secured boat loan is typically somewhere between 10 and 20 years. Smaller loan amounts of, say, under $25,000 will usually be on the shorter end of the term range, and larger boat loans will often be around the 20 year term length. Of course, the longer the term of the loan, the more total interest the borrower will pay over time. However, since most loans are simple interest loans, the borrower only pays interest on the outstanding balance of the loan. The borrower can make additional payments to reduce the overall expense, but the payment amount will remain fixed for the duration of the loan.

As previously mentioned, the interest rate will mostly be dictated by your credit score, the size of the down payment, and the term and size of the loan.

Read Also: Best Mildew Remover For Boat Seats

Can I Finance My Fish Finder Chart Plotter Radar And Other Fishing Electronics

Financing is not only for the price of the Boat. Tangible assets can often be rolled into a Boat loan, including Marine electronics, trolling motor or Anchoring packages and Bottom paint. Note that labor to install the Electronics or perform commissioning tasks for new boats cannot be Financed.

-Tom Smith is President of Sterling Associates, a Financial Services Firm headquartered in Massachusetts that provides Financing, Insurance and Coast Guard Documentation services for all types of boats. Let Sterling get you, On The Water!!!

Best Commercial Loan: Coastal Financial

Coastal Financial

Why We Chose It: Coastal Financial is our top choice for the best commercial boat loan because the company specializes in charter boat financing and will also take care of setting up charter management and boat insurance for you.

-

Offers boat insurance and charter management

-

No upfront rates

-

No published loan fees

-

You have to contact the company for borrower requirements

Coastal Financial offers a quick application process and fast funding. It finances new and used boats, charter boats, refinances, and RV purchases. It offers boat loans from $5,000 $5 million and approvals take less than 24 hours. You can apply online or over the phone.

In addition to boat loans, Coastal Financial also offers U.S. Coast Guard documentation, boat insurance, and a boat charter management program. Coastal Financial offers commercial loans for yachts, fishing boats, catamarans, and sailboats. Youll need to contact the company for loan fees and specific loan requirements and terms as they are not available on the website.

Once the borrower and vessel are approved for a charter loan, you put the boat in your companys LLC and you can enter it into a charter program. You can choose how often you want the boat chartered, and when you want to use it, and the company will handle the rest.

Coastal Financial has mostly positive customer reviews with customers appreciating the marine industry knowledge, easy application process, and fast funding times.

Read Also: Is Banana Boat Sunscreen Gluten Free

How Much Can I Borrow

How much you can borrow generally depends on the price of your boat. Typically, you can fund 90% to 100% of the value of your boat. Minimum loan amounts can start anywhere from $2,000 to $15,000, depending on the lender.

Dont forget the down payment

Like car loans and mortgages, boat loans often require a down payment. Generally, youre required to cover at least 10% of the cost. But lenders tend to favor applicants that can front at least 20% of the boats cost. To avoid over-borrowing, we recommend saving up as much as you can for a down payment so you dont need to borrow as much. The less you borrow, the less interest youll pay.

Remember: Boats are more like cars than houses. Once you make a purchase, your vessel will begin to depreciate. If you borrow a large amount with a lengthy term, you may end up paying more in the long run than its really worth.

Other Lenders We Considered

- US Bank: This lender’s loan interest rates weren’t the most competitive, starting at 5.24% for a new boat. The bank states that rates may be higher for private party boat purchases, loans under $25,000, and used boats. Ultimately, lower rates may be available elsewhere.

- USAA: USAA is only available to people with military affiliations, limiting the number of people who can access these loans. However, even those eligible could get a better rate from one of our top picks interest rates start at 5.25% with USAA, about a percentage point higher than a LightStream loan.

- Navy Federal Credit Union: Like USAA, membership with this credit union is only available to certain people. However, a starting interest rate of 5.95% for new boats and 7.45% for used boat loans mean there are better deals to be found elsewhere.

- Boat US: This online boat loan marketplace didn’t beat interest rates offered by other lenders. A high minimum loan amount of $25,000 also may be more than many borrowers need.

You May Like: How To Patch Canvas Boat Cover

What Should I Know About Boat Financing

Financing a boat may be one of the most confusing parts of boat ownership for a new boat owner. There are literally dozens of options that could be chosen, some of which are designed to fit certain situations. In fact, boat financing may offer more options and more terms than any car loan.

Part of the reason for the myriad of options in boat financing is due to the large range of prices in the boats. It is possible to get a motorboat for $1,000 US Dollars . On the other hand, even a modest yacht can run $100,000 USD or more. Given the wide range of prices, there is little surprise that so many alternatives exist.

While a typical car loan may be for five years or, at the most, six years, boat loans can last anywhere from a few years to more than 20 years. As one may expect, as the cost increase, normally so too does the length of the loan. In boat financing, it is common for a loan to last at least ten years. A ten-year car loan is virtually unheard of.

Also, if a boat motor needs to be replaced, this can be done relatively easy without affecting the rest of the boat too much. Used boat motors usually can be bought relatively cheaply. All these things are taken into account when looking at boat financing.

How Long Does It Take To Get Approved For A Boat Loan

New Boat loans can be processed and closed in a week, which is much faster and easier than real estate loans. Financing for pre-owned vessels takes longer. However, Boat Loan Specialists, working with Lenders who know the marine industry, can process paperwork faster, provide guidelines of all the things that are needed for a Boat purchase, and refer needed resources. They are, more knowledgeable, faster and easier to work with than a personal banker.

You May Like: Freedom Boat Club Specials

What Types Of Watercraft Are Available To Finance

Whether youre looking to start a fishing business or you simply want to do some water-skiing and tubing, rest assured that there is a way to finance the craft of your choosing. That said, the amount of financing youre approved for must also factor into the size, make, and model that you want.

If you qualify the right boat and marine loan, youll have the ability to finance almost any vehicle, including but not limited to:

- Motorboats

- Wake board & Water ski models

How To Apply For A Boat Loan

Applying for a boat loan is similar to applying for a personal loan or auto loan. Youll need to find a lender first. In some cases, you can apply online. Otherwise you may be able to apply in person at a bank or credit union.

Next, youll typically need to provide information such as the loan amount, purchase price of the boat, type of boat and age of the boat along with employment information and other personal info about your assets and debts. As with personal loans and auto loans, this could result in a hard credit inquiry to check your credit profile .

Then youll wait for approval, which could be available as soon as the next business day, or may take a few business days, depending on the lender youre working with.

You May Like: How To Register My Boat In Florida

How Much Boat Can I Afford

Its important to carefully consider your budget to determine how much boat you can afford. Also keep in mind that on top of the boat itself, you might need to pay for insurance and accessories as well as provide a down payment.

Tip:

The table below shows how different interest rates, loan terms, and loan amounts could affect the total repayment cost of a loan. Keep in mind that the interest rates shown are solely for illustrative purposes and are hypothetical.

| Loan amount |

|---|

| $379,735 |

Other Boat Costs To Keep In Mind

Beyond the cost of purchasing a boat, here are several other expenses to keep in mind:

As you consider how much boat you can afford, be sure to think about how much a boat loan will cost you over time, too. This way, you can prepare for any added expenses. You can estimate how much youll pay for a loan using our personal loan calculator below.

Enter your loan information to calculate how much you could pay

Check Out: Average Personal Loan Interest Rates

You May Like: How To Get Mildew Off Boat Seats

Can I Get A Loan For A Used Boat

You can get a loan for a used boat but there are some limitations. The boat lender usually requires that the boat be no older than a certain age. Most lenders wont finance a boat that was built before 1999 or 2000. However, some lenders will finance boats of any age and price range, but you may end up paying a higher rate and putting down a larger down payment.

Different lenders have varying requirements when it comes to financing used boats. Some lenders will require an inspection and an appraisal and others will only finance up to 85% LTV and will expect a down payment.

Financing a used boat is usually more affordable than financing a new boat, but its important to know the condition of the boat so you dont end up with unexpected repair costs.

Online Boat Sales Team

Do you have additional questions? Maybe you are even ready to apply? Let us introduce the White River Online Boat Sales Team. As part of White River Financial Services, the Online Boat Sales Team can help MAKO Boats customers to easily apply for great finance options, and even shop for a MAKO boat at dealerships nearby. Theyre here to help at any stage of your shopping process!

Also Check: Is Boat Insurance Required In Washington State

Fallen In Love With A Boat Compared With Auto Loans Financing A Boat Can Be A Much Heftier Investment

Boats can be more expensive than a car, which means loan amounts can be higher and terms can be much longer.

Just how much you pay to finance a boat depends on a number of factors, including the type of boat loan you choose, the loan terms, your down payment and your credit.

Lets take a look at the different types of boat loans, your financing options and how to apply for a boat loan.

How Much Do You Have To Put Down On A Boat Loan

Standard down payment is 15% but depending on your boat age, loan amount, and loan term the required down payment can be between 10% 30%. This is the total amount you have already paid toward your down payment. The total amount that you are given for any vessel that you trade-in as part of this purchase.

Don’t Miss: How To Keep Birds Off Your Boat