Setting A Value For The Boat Based On Usage

Once youve identified the associated costs, the next stepis to determine how much boat to buy. This can vary based on how often youreplanning on using the boat and what level of enthusiast you are. If youre aperson that uses the boat often or a huge boating enthusiast, it may make senseto spend a bit more. Another consideration is your threshold for maintenance.If youre considering a used boat, it may make sense to buy something a fewyears newer as the service and repair can be less time and resource consuming.

Conversely, if you live in a climate that limits boat usageor if your intended use is otherwise limited, a lower priced boat might makemore sense. The most important part of this decision is to be honest withyourself about your boating plans and select a boat accordingly.

Compare Boat Loans With Savvy And Save

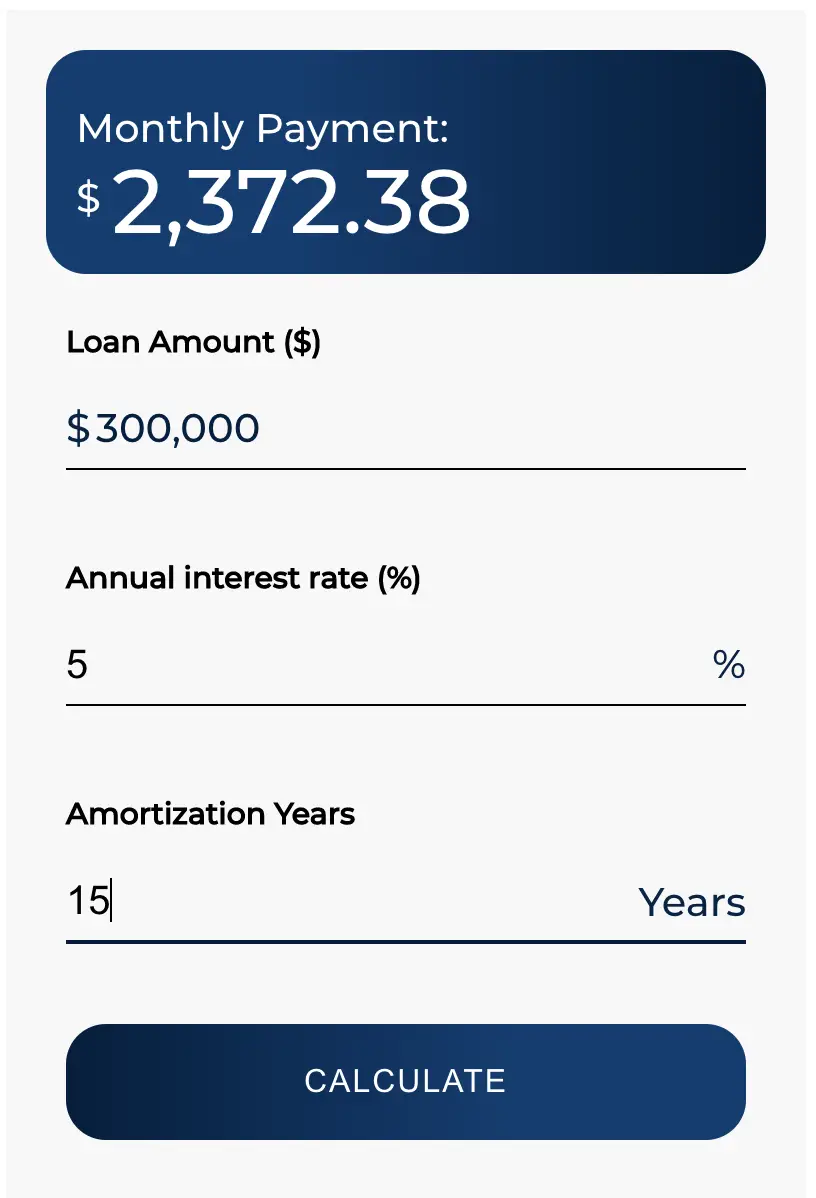

When youre applying for financing for your next boat purchase, its important to enter this process with an idea of what its likely to cost you. Thats why Savvy has put together an advanced calculator that crunches the numbers for you to determine what the cost of your proposed loan will be.

Were partnered with a range of lenders to give you more access to the best deals when it comes to rates, fees and repayment options. You can calculate different loan deals based on their loan amounts and terms, interest rates, repayment schedule and whether you make a deposit. Its a great tool to make use of before getting a quote with Savvy.

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

Read Also: What Is The Best Fishing Boat For Saltwater

Why Use A Boat Loan / Finance Payment Calculator In Canada

If you are in the market searching dealerships and online classifieds for boats, you know there is a huge variance in pricing. Learning what your Boat Loan payment will be will help you figure out if a new boat, ATV, or snowmobile fits into your budget.

Westshore Marine strives to help every person looking for recreation or offroad products the right information so they can make an informed decision. Keep in mind certain banks offer special rates, and if you would like to get an exact payment for your boat purchase, you can fill out a secure online application and have one of our finance specialists reach out with a 100% accurate payment.

| — |

Disclaimer:

New vehicle pricing includes all offers and incentives. Tax, Title and Tags not included in vehicle prices shown and must be paid by the purchaser. While great effort is made to ensure the accuracy of the information on this site, errors do occur so please verify information with a customer service rep. This is easily done by calling us at 855-534-7333 or by visiting us at the dealership.

**With approved credit. Terms may vary. Monthly payments are only estimates derived from the vehicle price with a month term, % interest and % downpayment.

How Much Can I Borrow For A Boat

It depends on your debt-to-income ratio, which you can find by dividing the total of all of your monthly debt payments by your monthly pre-tax income. For example, if you have a $250 monthly student loan payment and an $800 monthly mortgage payment, and you make $4,000 a month pre-tax, your debt-to-income ratio is 26.25%.

If your debt-to-income ratio is higher than 40%, then you probably wont qualify for a boat loan and should focus on paying down your current bills before trying to finance such a significant purchase.

Ideally, even with the boat, you should try and keep your debt-to-income ratio at or below 43%. In the above scenario, that means you could afford about $670 a month in boat loan payments.

Don’t Miss: What Channel Is The Love Boat On

How Do I Get The Best Deal On A Loan

It is a good idea to shop around a bit for the best interest rates and loan terms. Sometimes local credit unions will have the best deal for you. Other times a dealership can get the best loan, because they act as brokers for multiple lenders. Sometimes a bank offers the best rates. The key is to make a few calls and see what is available.

In order to get a low interest rate, lenders will look at your:

Some lenders will offer a discount if you set up automatic payments.

Boat Loan Affordability Calculator

Want a new boat? One of the best ways to finance your purchase is via a boat loan. Nevertheless, getting a boat loan is an important financial decision. To better prepare and easily calculate your eventual monthly payment or to further estimate the full boat loan amount you can afford based on a monthly payment per term can greatly help you shape your financial stability. To do so, you can use our boat affordability calculator.

What Does the Boat Affordability Calculator Do?

The boat affordability calculator lets you get an estimate about the monthly payment, based on your boat loan amount, the boat loan term, the down payment and the interest rate. Having an idea about the expected monthly payment you will need to make can help you better prepare your financial future stability in advance. Whats more, by using this calculator you can better estimate the loan amount you can afford and thus be able to know what type of boat and price tag will better suit your current financial situation.

How the Boat Affordability Calculator Work?

The boat affordability calculator gives you an estimate about the eventual monthly payment you will have to make each month, based on multiple factors. These factors include the full amount of your loan, the required down payment, the term of the loan itself and the expected interest rate of the boat loan itself.

Read Also: Where Do I Get My Boat Registered

Can I Get A Boat Loan With Bad Credit

Technically, there are lenders who will offer boat loans to individuals with bad credit ratings. Since a boat is a luxury purchase, you shold think through whether it is a good idea to be getting a loan on a boat with a low credit rating.

It is possible that you have repaired whatever underlying condition in your finances that caused you to have a bad credit rating, and it just takes time for your rating to improve.

The interest rate will be higher, and in many cases could be as much as 2-3 times higher than the interest rate offered to a highly qualified borrower. You will likely not be eligible for the 10-20 year boat loans that are offered to borrowers with better credit scores.

The Only Boat Loan Calculator You Will Need

Live your ultimate life with the help of a boat loan. From fishing tinnies to yachts, boat loans can be used to secure the watercraft of your dreams.

Taking out a loan to finance your boat makes it more affordable, and may mean you can buy a boat you may not be able to otherwise afford on your own. With a boat loan, you pay off the amount in periodic instalments, as well as interest, over an agreed loan period. A boat loan can be for a new or used boat.

Whether youre looking to purchase a boat for leisure or business purposes, boat financing is a good option to get out on the water as soon as possible.

Read Also: Is Boat Insurance Required In Virginia

What Are The Next Steps

Once you have done the hard yards and worked out a repayment option that suits your circumstances, you are ready to take the next steps. While the calculator gives you a great insight into what you can and canât afford, itâs important to contact a broker who can accurately assess your financial situation and borrowing power before taking out a loan.

Consulting with a financial expert will ensure you gain a thorough assessment of your financial situation, so you enter into a loan agreement with both eyes open. Our expert team of finance brokers can provide you with a deeper evaluation of the boat loan calculator results, focused on your individual circumstances. They will help determine what you are able to afford when it comes to taking out a boat loan, offering their expert advice and tips so you get the most out of your boat loan.

Give us a call today or submit an online enquiry so you can get out on the water even sooner.

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexible loan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use our VA home loan calculator to estimate how expensive of a house you can afford.

Don’t Miss: How To Rent My Boat

What To Consider For Boat Payments And Affordability

When you’re in the market for new or used boats, it can get rather daunting when you have no idea where to start. One of the keys to a successful boat purchase is knowing what you can afford. This boat payment calculator takes all the hard work out of making a sound financial decision. Simply enter in your desired monthly payment or vehicle price and it will return your results.

How To Use Our Boat Loan Calculator

To use our boat loan calculator, enter how much you want to borrow for how long and the interest rate you expect to pay. With these inputs, the calculator will compute your estimated monthly payment on your boat loan.

The loan amount should include any taxes, registration fees or add-ons youd like to finance, but it shouldnt include any down payment you plan to make.

The interest rate is how much youre paying the lender for the loan, expressed as a percentage. You could use the annual percentage rate instead, which includes the interest rate and any fees or additional costs. An APR would provide a more accurate estimate.

The loan term is how long you want to borrow the money for the boat. Its expressed in years in our boat payment calculator, but you may find lenders that express it in months.

See if the estimated monthly payment fits into your budget. Its also important to keep in mind that having a boat will cost more than just payments. Boat storage in the off-season, boat insurance, fuel and maintenance can add up, so we recommend having a boat payment that is financially comfortable.

Also Check: How To Sell My Boat

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Consumer Boat Buying Guide

Homes and cars represent some of the most expensive single-item purchases individuals make during their lifetimes, but spending doesn’t always cease at the shoreline. Boats add to the cost of living for water sports enthusiasts, who eagerly take-on the cost of ownership. And though boat buying is born of passion for the open water, a prudent approach makes the most of recreational budgets and ensures affordability.

As you prepare to take the plunge, due diligence guarantees a smooth transition to boat ownership. From choosing the best boat for your needs to securing reasonable financing, weigh your options carefully before making commitments.

Also Check: Do You Need Boat Insurance In Washington State

Calculate Payments With Our Boat Loans Calculator

Use our boat payment calculator to determine a monthly payment that you can afford when looking to finance a new or used boat.

Simply enter your desired amount, estimated interest rate, and the loan term over which you intend to pay back the loan. Once you’ve input the information, the calculator will generate your estimated monthly payment on your boat loan. Take this number and plug it into your current monthly budget.

Boat Loans: Options Interest Rates And Lenders

If it sounds simple, well, thats because it is. Most new boats are purchased with a loan, so well-established procedures are in place. As for who to take out the loan from, youll have three basic options to choose from:

Read Also: How Much Is Boat Transport

Common Myths About Owning A Boat

Maintenance and upkeep is too expensive.

Modern family powerboats and personal watercraft actually require very little annual maintenanceannual basic engine maintenance, usually an oil and filter change and a fuel filter change, a change of gearcase lubricant, and perhaps propeller inspection. If you live in a cold climate the boat will need to be winterized for off-season storage.

Check out the Maintenance pages for more information. You can reduce maintenance costs by learning to handle some of the basics yourself, by utilizing the services of a professional marine technician who will keep the boat in tip-top shape, and by following the maintenance schedules outlined in the boat and engine owners manuals.

I cant afford to store a boat.

There are many other boat-storage options, from a dry stack valet service to mooring in a marina. For ideas on storage, read Boat Storage: Which Method Is Best for You?

There is no body of water nearby.

Lakes, rivers and coastal areas offer many opportunities for boating, and those might be closer to home than you realize. Our interactive Find Places to Fish and Boat map is searchable by ZIP Code and shows navigable water, launch facilities and other information.

Boats use too much fuel which is expensive.

For more information on boat ownership costs and what it takes to buy a boat, read:

Determine The Ongoing Cost Of Ownership

The first thing to identify is the cost of boat ownership,not only the price of the boat itself. Youll want to identify how much it willcost to use the boat. The main items to consider would be:

- Storage/ Moorage Will there be a costto store the boat in or out of the water?

- Fuel How much will it cost to operatethe boat?

- Insurance How much is the annual ormonthly rate for the insurance?

- Maintenance What is the expectation forservice and repair costs?

Fortunately, the ownership costs can be relatively low.However, taking the associated costs into consideration will ensure that you donot get caught off guard with additional bills and allow you to concentrate onthe good part- having fun on the water with friends and family.

Also Check: Do You Have To Have Boat Insurance In Alabama

Boat Loans: Calculate How Much Boat Financing Could Cost You

Boat loans are available from a variety of lenders, including banks, credit unions, and online lenders.

Kat TretinaUpdated March 8, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Whether you love sailing, offshore fishing, or other water activities, you might consider buying a boat. However, boats can be expensive: Smaller vessels start at $10,000, while offshore fishing boats might cost $400,000 or more.

If you need to cover the cost of a boat or would like to refinance a boat you already own, a boat loan might be a good choice. Just keep in mind that youll likely need good credit and verifiable income to qualify.

Heres what you should know about boat loans: