How Do You Become A Usaa Member

A USAA membership is free. Once you have an account, you are eligible for USAA’s insurance and other benefits. To become a member, you can visit USAAs website to begin the process.

The steps are to first determine your USAA eligibility. You will need the following information to verify eligibility:

- Personal information including your date of birth, contact information, and Social Security number

- Details about you or your family member’s military service

- A passport or permanent resident card if you are a non-US citizen

You cannot become a USAA member if your military family member is not a member of USAA. The only way to become a part of USAA is if your military-affiliated family member is first a member of USAA and is able to pass USAA eligibility on to you.

What Does Boat Insurance Typically Not Cover

What a boat insurance policy does not cover in relation to a boat is generally called an exclusion. These exclusions almost always include:

- Wear and tear of the boat

- Damage done by marine life such as sharks

- Faulty machinery such as an engine going out

- Infestations with bugs or rodents

- Accessories that break

Boat Insurance Coverage Information

Boat insurance coverage works equally to automotive insurance coverage by offering monetary safety towards damages to your vessel and others, in addition to paying medical bills to you or your passengers and overlaying different legal responsibility claims.

Nevertheless, in contrast to with automobiles, most states dont require that boats be insured though some marinas would possibly ask for insurance coverage to lease a dock. Lenders may additionally demand it to finance a vessel.

Even when these necessities dont apply to you, insuring your boat is likely to be a good suggestion particularly contemplating boating accidents elevated round 26% from 2019 to 2020.

Don’t Miss: Hydrofin Pontoon Cost

The Cost Of Boating Accidents

Take a look at some statistics from the Coast Guard for 2019 about boating accidents:

- 4,168 accidents involving recreational boats resulted in $55 million in property damage.

- 556 deaths and more than 2,559 injuries were due to boating accidents.

- 70% of boating deaths were drownings.

- 33% of deaths occurred when the driver had no boater safety instruction.

- Open motorboats were listed in 47% of all boating accidents.

- Alcohol was deemed the leading factor in fatal boating accidents.

What Is The Financial Strength Rating Of Usaa Boaters Insurance

The financial strength rating of an insurance company scores its ability to pay contracts and policies. Each agency has its own standards and rating scale and a company’s rating can change any day. It’s a good idea to check the financial rating of an insurance company before you purchase a policy. There are five main rating agencies. SuperMoney’s financial strength rating is based, among other factors, on the average score of available ratings.

USAA Boaters Insurance scores an A+, SuperMoney’s highest available rating.

SuperMoney DisclosureEditorial Disclaimer

Also Check: Freedom Boat Club Specials

What Is Boat Insurance

Boat insurance is a contract between you and an insurance carrier that protects you from financial loss in the event of a boating accident or natural disaster that damages your boat. Boat insurance for larger vessels typically has restrictions as to what it will cover and where in the world the coverage applies. Boat insurance is for vessels that have a motor and is not for canoes or small paddle boats.

Best For Additional Benefits: Boatus

BoatUS

- No. of Policy Types: 3

- Coverage Limit: Varies

BoatUS offers boat insurance as well as towing services and additional discounts on boat charters and services.

-

Coverage for fishing and watersports gear

-

Teamed up with Geico

-

Overload of boating services on site

BoatUS offers boat insurance through the Boat Owners Association of the United States and was acquired by GEICO in 2015. The company has been in business since 1966, resulting in a mix of online customer reviews. But a great majority are positive, especially in the area of claims service. BoatUS offers boat policies in all 50 states for many different types of personal watercraft and yachts.

While membership is not required to get a quote, added benefits for BoatUS members include discounts on popular boating and fishing businesses, fuel, slips, and charter cruises. The basic membership fee is relatively inexpensive at $25/year and goes up to an Unlimited Gold Towing membership for $179 that comes with perks like 100% payment dock-to-dock tows as well as $3,000 for tows outside of TowBoatUS service area. Other membership packages include Unlimited Freshwater Towing for $90/year and Unlimited Saltwater Towing for $165/year.

Recommended Reading: How To Get Mold Out Of Vinyl Boat Seats

Comparing Boat Insurance Providers

Owning a boat is a major expense and you should choose your boat insurance provider with care. Remember to research the company and check out its ratings and reviews. Some other things to keep in mind when comparing providers include:

- Coverage options: What type of coverage is offered? Make sure you understand the different plans and if things like running aground or hitting the dock are covered.

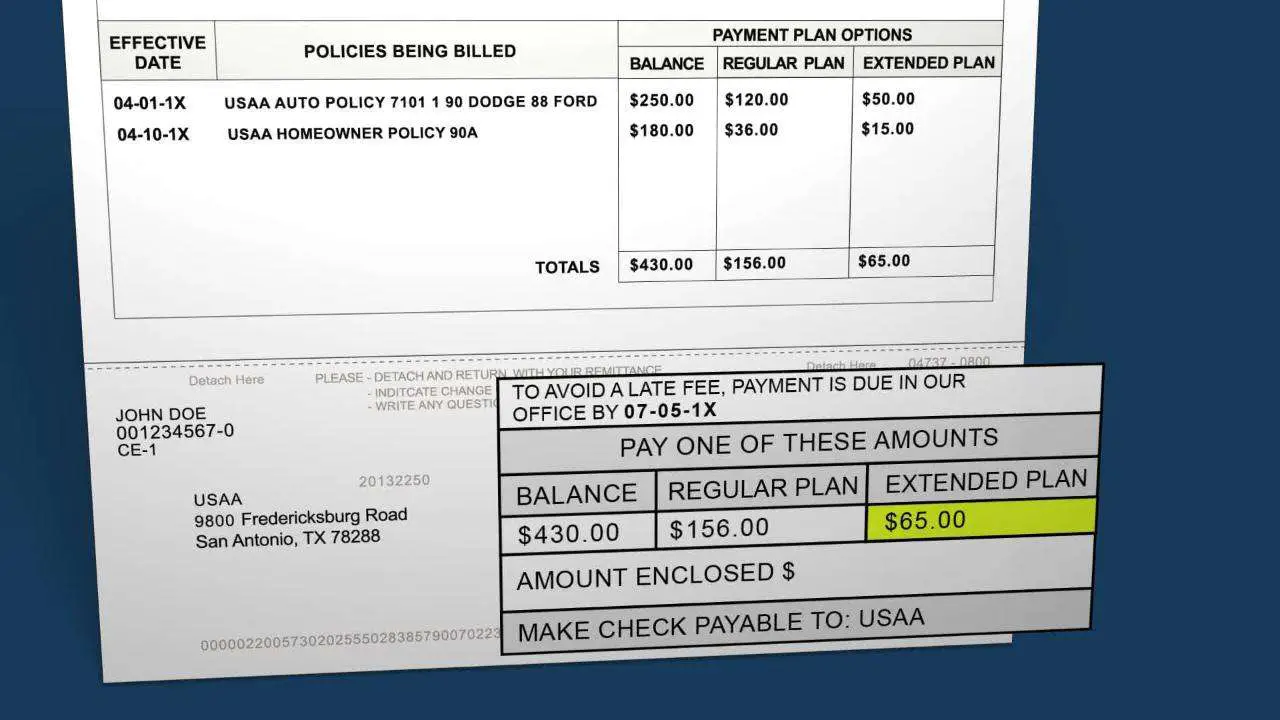

- Pricing: Know how much youre paying for coverage and what that includes. Also, keep due dates in mind and if a downpayment is required.

- Discounts: What discounts does the provider offer? Some things to ask about are bundling discounts, safe boater discounts, age-based discounts, and discounts for experienced boatmen

- Specializations: Know if the provider specializes in marine coverage and make sure the agents are knowledgeable because it is much different than auto insurance. Some companies specialize in recreational boating and others specialize in commercial boating and yachts.

- Coverage Exclusions: Research ahead of time what is not covered so you know before you choose a policy. Some providers wont insure boats that go above a certain amount of knots and others wont insure boats with aftermarket parts.

Usaa Ratings Reviews Customer Satisfaction And Complaints

| Rating organization |

| 905/1,000 |

Although USAA receives high scores from J.D. Power, they are technically rank-ineligible due to limited availability.

In J.D. Powers insurance studies, USAA is consistently the highest-rated insurance company. However, USAA is excluded from the rankings because it has membership restrictions limited to military families. J.D. Powers auto and home insurance studies rank the best insurance providers based on overall satisfaction, using real reviews from customers.

You May Like: Oxidation On Boat

Usaas Grade From Collision Repair Professionals: C+

In a survey of collision repair professionals by CRASH Network, USAA earned a C+ grade.

The opinions of auto body professionals are insightful because they see how insurers compare in the use of lower-quality repair parts, whether insurers encourage the use of repair procedures recommended by car makers, and whether insurers have claims processes that lead to quick and satisfactory claims for customers.

Frequent Causes For Boat Insurance Coverage Claims To Be Denied

Boat insurance coverage solely covers occasions which are explicitly said on the coverage declaration. Nevertheless, a declare would possibly get denied even when your coverage supplies protection for it. Listed below are some frequent causes that could be the case:

- You had been working a ship inebriated or medication

- Not offering correct upkeep to your watercraft

- Damages or accidents that exceed coverage limits

- Making errors in submitting a declare

- Failing to safeguard your boat earlier than a storm

- Utilizing your boat for business functions

Boat insurance coverage will help cowl the price of restore and accidents to you and others as a consequence of a collision with a dock, buoy or different boat. Theft, vandalism, hearth, storms and different surprising occasions might also be coated.

How a lot is boat insurance coverage?

You must count on to pay between $200 and $500 a 12 months for boat insurance coverage, as a rule. Insurers calculate your precise premium primarily based on the kind of boat you personal, any previous accidents, whether or not youve got taken security or different boating programs and whether or not you employ your boat primarily inland or in coastal areas. Further protection choices you select, comparable to wreck removing, fuel-spill cleanup, will enhance the price of your premium.

What does boat insurance coverage cowl?

Do I want boat insurance coverage?

How a lot boat insurance coverage do I want?

Also Check: How To Look Up Boat Hull Numbers

Usaa Membership And Eligibility

The United States Automobile Association started when a group of military officer friends decided to provide each other with automobile insurance, and has grown in members and products ever since, adding loan options, banking services, and other benefits.

A USAA membership is free, and if youre eligible you can sign up and start shopping products immediately. Members can use any and all of the products, services, and benefits offered by USAA. To be considered a full USAA member and to qualify for family membership benefits as well, you must meet membership eligibility requirements and hold one of the insurance policies from the organization.

Non-members can purchase select products, too. Investment services, life insurance, and some discount benefits are all available to non-members, but only members qualify for banking products, auto, property, and other insurance options.

Who Is Eligible For Usaa Auto Insurance

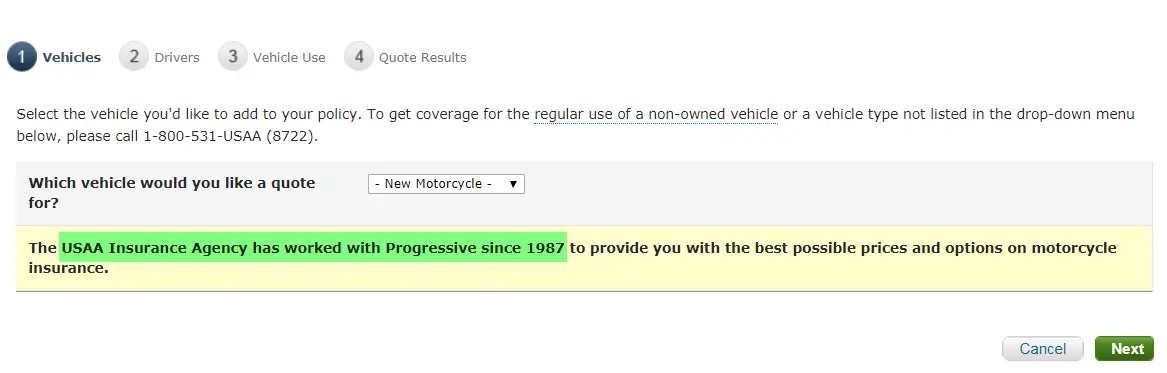

USAA is a diversified financial services company with offerings that include banking, investing and insurance.

But heres the key thing to know about USAA: The services it offers are only available to those in the military or who are affiliated with the military through direct family ties.

Membership is open to:

- Currently serving Those who are currently serving in the U.S. Air Force, Army, Coast Guard, Marines, Navy, National Guard and Reserves.

- Former Military Honorably discharged former members of the U.S. military who have retired or separated from the service.

- Family Widows, widowers and un-remarried former spouses of USAA members who had USAA auto or property insurance while married, along with individuals whose parents have or had USAA auto or property insurance.

- Cadets or midshipmen Those at U.S. service academies, in advance ROTC or on ROTC scholarship, plus officer candidates within 24 months of commissioning.

So, that may eliminate USAA from consideration for a lot of people. If thats the case for you, be sure to check out our list of the Best and Worst Auto Insurers for many good non-military options.

Recommended Reading: How To Clean Mildew Off Boat Seats

Who Can Use Usaa Auto Insurance

Auto insurance from USAA is only available to policyholders who are affiliated with the military. You must be an active, retired, or honorably separated member of the United States Armed Forces to qualify for a policy. This extends to veterans and candidates in commissioning programs.

In addition, spouses, former spouses, and children of USAA members are also eligible to obtain policies.

What Is The Boater Safety Course

The very 1st thing you need to take care of before applying for insurance is to complete a boater safety course, such as boat-ed. Taking your course from this website guarantees that youre inside the regulations of water education, according to the U.S. Coast Guard. More than 82% of our nation has state requirements for this course before you can legally drive a boat on any water in your state. Even if youre in ownership of the 7 states that dont require this course, a certificate will lower your insurance rate in every state.

*To Find out how to take a course in your location. Click on the state below you wish to have a license in.

Don’t Miss: How To Clean Mildew Off Boat Seats

Best For Emergency Services Coverage: State Farm

State Farm

- No. of Policy Types: 1

- Coverage Limit: Varies

State Farm is a well-known insurance provider that offers additional coverages including emergency services reimbursement.

-

Coverage for houseboats and jet-skis

-

No online quotes for boat insurance

-

Website needs more detailed information

-

Need to contact agent for policy details

In business since 1922, State Farm is one of the best-known names in insurance in the United States. They offer boat liability and property damage insurance for common risks like storms, collision, theft, and more, with add-on coverage options available . Their property damage coverage extends protection not only to equipment permanently attached to your boat but also to accessories such as detachable canopies, life preservers, and seat cushions. State Farm has resources available for boat owners including articles on boat trailer safety tips, boat safety, and water safety. Boat insurance is available for a multitude of watercraft: runabout/sport boats, cruisers/yachts, sailboats, bass boats, jet skis, houseboats, and kayak/canoes.

Does Flood Insurance Cover Docks

Typically, flood insurance will not help to protect a dock from damage or loss, so your dock would not be covered by flood insurance. There may be some circumstances under which a dock is covered for flood damage, but you will need to check with your insurance agent to confirm your coverage details.

Dock insurance is an important thing to have if you own a dock or boat launch, so connect with your American Family Insurance agent today to make sure youre covered. If you dont already have it, consider boat insurance, as well, to help protect the financial value of your boat from things like physical damage and protect your financial well-being with personal liability coverage in case someone is injured on board.

Also Check: What Must Be Displayed On Each Side Of The Forward Half Of A Registered Vessel

How We Selected The Finest Boat Insurance Coverage

Here is what we appeared for when selecting one of the best boat insurance coverage firms:

Protection choices and reductionsWe appeared for firms that supplied a complete number of insurance coverage packages, protection add-ons and coverage reductions.

Buyer satisfactionAs we researched firms, we targeted on those who obtain principally constructive suggestions on on-line evaluation websites such because the Higher Enterprise Bureau and buyer satisfaction research by J.D. Energy.

Monetary energyWe thought of the monetary energy of every firm by trying up their ranking from A.M. Finest, a credit standing company that focuses on assessing the creditworthiness of insurance coverage firms. All our picks scored between A and A++.

Grievance indexWe evaluated each insurers criticism development report from the Nationwide Affiliation of Insurance coverage Commissioners .

What Boat Insurance Will Pay For

You can typically buy liability insurance which pays for damage your boat does to others in amounts from $15,000 to $300,000, according to the Insurance Information Institute. Heres what else you can expect from a policy:

| What boat insurance typically covers | What it doesnt cover |

|---|---|

|

|

|

Check, too, about additional coverage for trailers and accessories, for towing and for damage caused by an uninsured boater.

You can buy two types of damage coverage for a boat:

- Actual cash value. This pays the value of your boat at the time of the damage. If your boat is destroyed, your insurance company determines its market value.

Some important things to know about boating and your policy:

Recommended Reading: Boat Mechanic Salary Florida

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Boat Insurance Covers

Policies vary between insurers but coverage typically includes:

- Property damage coverage: also known as physical damage coverage, it insures against damages or loss of your vessel caused by collisions with other boats or objects , theft, sinking, fire, storms and other risks. The property covered may include the hull, motor, fittings, furnishings and other equipment.

- Liability coverage: helps pay legal expenses and settlements if you’re found at fault for someones injuries during a crash, for example. It also covers damages to others property, such as a boat or dock you collide with.

Optional boat insurance coverage

Boat insurance companies may offer extra coverage options for:

- Medical payments for injuries to you or passengers

- Roadside assistance if the vehicle used to tow your boat breaks down

- Wreckage removal in the event your boat sinks

- Watersport injuries or damages from tubing wake surfing, or other similar activities

- Fuel spill cleanups for accidents or a leaking gas tank

- Personal property such as fishing equipment, scuba gear, clothing, smartphones and more

- Uninsured/Underinsured boater damages your boat

- On-water towing if your boat leaves you stranded

- Mechanical breakdowns

- Ice and freezing damage

- Hurricane haul-out in case you have to move the boat to safety due to a storm

- Extending your navigation to Alaska, Bahamas, Mexico and the Caribbean

Types of boats covered

The types of watercraft covered vary across insurance companies but may include:

Recommended Reading: How To Get Mold Stains Out Of Boat Seats