What Is A Boat And Marine Loan

Although boat and marine loans can be borrowed from many select lenders across the country, particularly those located near bodies of water, Loans Canada can match you with the lender of your choosing, no matter where you live.

A marine or boat loan is a type of financing thats used to purchase almost any seafaring vessel. From sailboats to ski-dos to fishing boats. A boat loan from a specialty lender, private lender, or big bank allows you to make this large purchase, often by transferring the money directly to the dealer, although some lenders do offer direct deposit to the borrower. Once the funds are received, you would repay the loan through a series of equal installments.

Securing A 650 Credit Score Boat Loan May Prove To Be Difficult For Many Borrowers So What Options Are Available For Those With Fair/average Credit

A 650 credit score boat loan will undoubtedly find choppy waters with lenders.

A minimal credit score for boat loans is typically above the 680 range which is considered good credit.

Not only that, but youll be required to carry boat insurance if you take out a loan. Marinas may require insurance as well. Theyll want to ensure that if damage occurs on the boat, theyll receive payment as the lien holder.

So finding a boat loan with a 650 credit score may be difficult, yet, options are available. Lets dive in!

- to view a list of lenders that may assist with boat financing, or

- to view a list of lending-matching networks that may better connect you with a lender.

Bank Of The West Boat Loans

Types of boats financed: Boats must be model year 2001 or newer to be eligible. Bank of the West specifically says that it finances standard or custom power or sailboats, multi-hull boats, pontoon boats, and electric boats. The lender also offers loans for high-performance boats, houseboats, and wood hull boats. However, it does not finance boats that can exceed 99 miles per hour.

4.29% to 9.99% for both new and used purchases, and 3.59% to 3.94% for live-aboard boats

Loan amounts available: $10,000 and up for new and used boats, $25,000 and up for live-aboard boats. Loans over $2 million are available.

Watch out for: Credit score requirements. Bank of the West states on its site that it lends only to people with credit scores of 700 or higher.

Boat loans through Bank of the West and its lending division, Essex Credit, are a good option for people planning to get a boat loan of $50,000 or above.

A $10,000 boat loan with Bank of the West would have a starting interest rate of 8.89%, a $15,000 boat loan would start at 8.39%, and a $50,000 loan starts at 4.29%. While their rates for loan amounts over $50,000 are competitive, anyone looking for a smaller loan may find a better rate with LightStream.

It’s worth noting that this lender does have a loan processing fee that could add to your total cost of borrowing. A 10% down payment is also required for loans between $10,000 and $200,000, and percentages increase for higher loan amounts.

Recommended Reading: Choosing The Right Boat Propeller

What To Consider For Boat Payments And Affordability

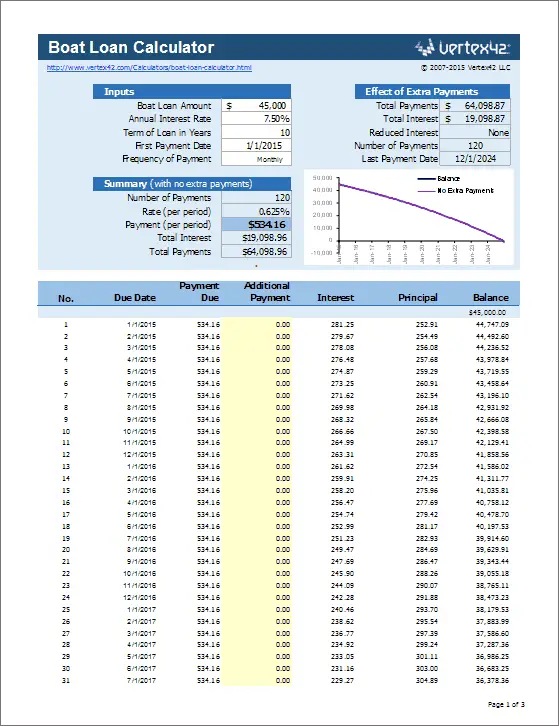

When you’re in the market for new or used boats, it can get rather daunting when you have no idea where to start. One of the keys to a successful boat purchase is knowing what you can afford. This boat payment calculator takes all the hard work out of making a sound financial decision. Simply enter in your desired monthly payment or vehicle price and it will return your results.

Other Lenders We Considered

- US Bank: This lender’s loan interest rates weren’t the most competitive, starting at 5.24% for a new boat. The bank states that rates may be higher for private party boat purchases, loans under $25,000, and used boats. Ultimately, lower rates may be available elsewhere.

- USAA: USAA is only available to people with military affiliations, limiting the number of people who can access these loans. However, even those eligible could get a better rate from one of our top picks interest rates start at 5.25% with USAA, about a percentage point higher than a LightStream loan.

- Navy Federal Credit Union: Like USAA, membership with this credit union is only available to certain people. However, a starting interest rate of 5.95% for new boats and 7.45% for used boat loans mean there are better deals to be found elsewhere.

- Boat US: This online boat loan marketplace didn’t beat interest rates offered by other lenders. A high minimum loan amount of $25,000 also may be more than many borrowers need.

You May Like: How Do I Register My Boat In Colorado

Some Of The Common Car Loan Interest Rate Related Questions Are Answered Below

Your loan amount you may be able to borrow is best determined based on your employment and credit history, among other factors. A car loan pre-approval would also be great to know how much you could be approved for. Savvy can help you possibly get a loan amount from $5,000 to $100,000 or even up to $100% of the cars purchase value. Get in touch with us to know more.

Its the percentage that a lender charges you on top of the loan amount, usually expressed per annum.

A type of loan where the car you purchased is used as collateral. You and the lender agree that if the loan remains unpaid, the car will be repossessed to reclaim losses for non-repayment.

Its a free enquiry on what possible loan amount you could apply for. The amount is not final nor legally binding for you or the lender.

Theres a possibility and its worth a try. Savvy is connected with more than 25 lenders that could find the one that matches you.

Online calculators give you a general overview of what your monthly repayments could be, based on the numbers you key in. They are not the final numbers since there are other factors that affect your monthly repayments such as application or ongoing fees. Speaking to a finance expert would be better to get you a more accurate reading on your financial standing and possible repayments.

Can I Deduct Boat Loan Interest

You can only deduct boat loan interest if you claim your boat as a residence. To be considered a qualified residence by law, your boat needs to have a sleeping space, a toilet and cooking facilities. You can only deduct interest on a loan on two residences per person. For additional information, go here.

Also Check: What Is My Pontoon Boat Worth

Lower Rates On Boat Loans

Looking to purchase that dream boat? After competitive marine finance rates that will beat your banks? If yes, you have come to the right place. Savvy has access to the most competitive boat financing options in the market.

Savvy has a long history and is very experienced in financing all types of assets including recreational vehicles. We pride ourselves on not just knowing how to deliver a cheap boat loan rate and repayment but also being able to talk your language as we have good knowledge on the type of assets you will be purchasing.

Boat Loans: Questions To Ask Before You Apply

How does the loan fit into my budget? Monthly payments on a boat loan should fit comfortably within a budget that covers all of your needs, wants, debt payments and savings. Use our boat loan calculator to see estimated monthly payments, interest costs and total payments.

Payments toward the boat loan combined with other debt payments shouldnt exceed more than 20% of your income.

What is the true cost of boat ownership? Buying a boat isnt your only new expense. Additional costs include fuel, licenses, insurance, storage, maintenance and repairs. Boats also depreciate over time, just like a car.

Does my boat have resale value? Its smart to buy a boat that is both affordable and popular, as this can attract potential buyers if you decide to sell it and pay off your loan at any point in the future.

You May Like: How Much Do Boat Mechanics Make

Understand The Costs Of Owning A Boat

Boat loan down payments typically range from 10% to 30%, so make sure you have enough money saved up to cover the cost of the down payment before you apply for a loan. Once you own a boat, youll also have to cover maintenance and related costs. Some of the expenses youll need to cover as a boat owner include:

- Trailer to transport and store your boat: If you dont plan on storing your boat near the water, youll need a trailer to transport it from your home.

- Boat insurance: Boat insurance can protect you in the case of an accident or if anything happens to your boat.

- If you dock your boat at a marina, youll typically have to pay monthly fees for the privilege.

- Registration: Just like a car, many states require boat owners to register their boat. Costs vary widely from state to state.

- Winter storage: If you live in an area where weather conditions arent suitable for boating year-round, youll need to store your boat in the winter.

- Maintenance: Routine maintenance costs include painting, cleaning, and replacing small parts.

- Gas: If your boat is powered by gas, youll need to fill it up regularly.

What Types Of Watercraft Are Available To Finance

Whether youre looking to start a fishing business or you simply want to do some water-skiing and tubing, rest assured that there is a way to finance the craft of your choosing. That said, the amount of financing youre approved for must also factor into the size, make, and model that you want.

If you qualify the right boat and marine loan, youll have the ability to finance almost any vehicle, including but not limited to:

- Motorboats

- Wake board & Water ski models

Read Also: Do You Need Boat Insurance In Mn

Factors That Effect Boat Financing Terms

You need to be aware, however, that how long you finance a boat can also impact those other variables we mentioned earlier. If you double the term of a loan, for example, a lender is likely to want a slightly higher interest rate, or perhaps a down payment thats a higher percentage of the boats value. There are also some other factors a lender may take into consideration when determining just how long a loan term theyll be willing to consider. These commonly include:

- The size of the loan

- The type of boat

- The age of the boat, if its used

Boat Loan Size

Loan size has an important impact on how long a lender will be willing to stretch the loan. As a general rule of thumb, the larger the loan is the longer it can be financed. Many lenders will have minimum loan amounts for different specific term periods.

Type of Boat

Most modern powerboats can be lumped together, but there are some outliers that financers will treat differently.

- Boats with wood hulls, for example, or high performance boats, may be treated differently.

- Some lenders differentiate between sailboats and powerboats in general, and some consider multi-hull boats or pontoon boats differently.

- One big issue that arises from time to time is with liveaboards. Because of the laws regarding residences, home ownership, and home ownership escrow accounts, loans for liveaboards are treated very differently than common boat loans and some lenders wont make them at all.

Used Boat Age

How To Apply For Boat Loans

You can apply for boat loans by comparing with finder.com.au. All you have to do is check out the comparison table on this page and look at your options. Once you have selected an option that is right for you, click “Go to Site” to start your application.

To apply for a boat loan you will most likely have to be 18 years or older. You may also need a good credit rating and be able to provide details about your current financial position, using bank statements or employment details, to get approved. The application is generally quick and easy to complete.

Read Also: Freedom Boat Club Fees

What Are The Differences Between Fixed And Variable Interest Rates

Here is a working example of two car loans: one with a car loan broker like Savvy and with dealer finance. The dealer is offering a car for $30,000. The dealer offers you a base interest rate of 4%p.a. and a balloon payment of 30% over five years. Your broker has found a loan with a comparison rate of 4.5% over the same period.

Is Fair Credit For A Boat Loan Workable

A 650 credit score is considered fair or near-prime. With boats being a luxury item, lenders would prefer good credit before approving a loan.

With this being the case, you might want a credit score of at least 700 to increase the chances of approval.

Also, some lenders perform hard credit checks when deciding to accept your application. Unlike a soft check, this can damage your score temporarily. A hard inquiry will stay on your credit report for two years.

You May Like: Resale Value Of Pontoon Boats

How Did We Choose The Best Boat Loans

Personal Finance Insider’s goal is to help smart people make the best decisions with their money. We combed through the fine print of many boat loans and lenders so that you don’t have to. We considered the factors that are the most important to boaters, including:

- The type of boats financed: We searched for lenders that offered loans for the most shapes and sizes of boats, from houseboats to sport boats.

- Interest rates: We compared the starting points of interest rates from many banks, and compared ranges where available.

- Few or no fees: We looked for lenders that offered boat loans with the fewest amount of fees on each loan.

- Loan amounts: We chose lenders with the widest variety of loan amounts available to help everyone find a loan for their boat-buying budget.

- Widespread availability: Lenders we considered have loans available in almost all 50 states, if not all.

Where To Find A Boat Loan

How long you can finance a boat may also depend on where you find financing. Here are some of the main venues where youll be able to find boat loans:

Dealer financing. About 80% of new boat financing deals take place through dealerships, according to Jim Coburn, a principal at Coburn Consulting Company and member of the Michigan Boating Industries Association. Banks have relationships with dealerships and dealerships have the customers, he said. They refer the boat loan customers to the banks.

Banks, credit unions and online lenders. Much of the remaining 20% of U.S. boat loans takes place directly through the lenders themselves. In researching rates from top boat lenders, we found APRs as low as 4.29% at online lender LightStream, a division of SunTrust Bank, and 4.29% at Essex Credit, a division of Bank of the West, as of publication. You also may be able to find competitive rates at credit unions or your own bank that may offer discounts to existing customers.

Shop around. If you do decide to buy a used boat, its important to make sure youre paying what the boat is worth. Consult an industry resource, such as NADAGuides to research values and prices in your area. Used or new, as youre determining which financing path works best for you, its crucial that you comparison-shop to compare rates and boat loan terms from a variety of lenders.

Don’t Miss: What Is The Cost Of Freedom Boat Club

How Do I Apply For A Boat Loan

While every lender will have its own unique application process, in most cases, youll need to provide the same information when applying for a boat loan.

Once you have financing, you can start to shop for a boat that suits your needs just dont let a salesperson talk you into buying more than you can afford.

Will I need to know what boat I want before I apply?

It depends on the lender. Some might ask for a model and make, while others might allow you to apply for a ballpark amount, based on your budget. If youre unsure, ask your lender whats required ahead of time.

What Are Typical Boat Loan Terms

Most often, you can expect boat loan terms to include a repayment period of 15 to 20 years. Down payments may range from 10% to 30%, depending on the amount borrowed, and typically the boat is considered collateral for the loan. Boat loans often start out as low as $5,000 with some lenders offering financing up to $4 million.

Keep in mind that the terms involved with the average boat loan will vary based on a number of factors. These include whether the boat is new, used, or being refinanced how old the boat is how much you plan to borrow and whether the boat is for full- or part-time use.

You May Like: How To Clean Mildew Off Boat Seats

Boat Loans: Calculate How Much Boat Financing Could Cost You

Boat loans are available from a variety of lenders, including banks, credit unions, and online lenders.

Kat TretinaUpdated March 8, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Whether you love sailing, offshore fishing, or other water activities, you might consider buying a boat. However, boats can be expensive: Smaller vessels start at $10,000, while offshore fishing boats might cost $400,000 or more.

If you need to cover the cost of a boat or would like to refinance a boat you already own, a boat loan might be a good choice. Just keep in mind that youll likely need good credit and verifiable income to qualify.

Heres what you should know about boat loans: