Bass Boat And Fishing Boat Insurance

At American Family Insurance, we understand boats. Thats why we offer bass and fishing boat insurance coverage that give you peace of mind knowing your boat is protected on or off the water. Whether youre using your boat in warm or cold climates, our agents understand whats best for your bass and fishing boat. Take a look at your coverage options and then connect with an agent to start building a policy customized for you.

Do You Need Insurance On A Boat

Unlike motor vehicles, boat insurance is not generally required by law. However, there are a couple of instances where you may be obligated to be insured.

Be sure to research your states insurance laws before making a new boat purchase. Contact a local insurance agent and your local title and registration office for more information.

Some states require a minimum of liability insurance for high horsepower boats . In the event of a boating accident, injuries and property damage of others will be covered by liability insurance.

The majority of bass boat shoppers intend to finance their purchase with a bank loan. Insurance may not be mandated by your state but your bank will certainly require proof of comprehensive coverage. Fair enough, since your loss would be their loss and theyre footing the bill.

If neither of the above situations pertain to you, then it comes down to your financial risk tolerance. Bass boats are expensive to buy, fix and replace. Insurance can save you from a financial loss if damage is incurred.

It is up to you to do the math and see if the cost of annual premiums can be justified by the value of your investment. At the very least, any serious boater should consider liability insurance. Accidents happen and if you are found liable for a serious accident, you are on the hook for associated costs.

What Is A Deductible For Car Insurance

Category: Insurance 1. Car Insurance Deductibles Explained | Progressive An auto insurance deductible is what you pay out of pocket on a claim before your insurance covers the rest. Collision, comprehensive, uninsured motorist, and Apr 22, 2021 A car insurance deductible is the amount of money youll pay out

You May Like: Hydrofin Pontoon Cost

Do You Need Bass Boat Insurance

If you want to drive a motor vehicle, you need to pay for insurance according to the law. However, this is not true of boats. Whether or not you get insurance for your bass boat is generally up to you.

There are some occasions when you may need to get insurance see. For instance, if you will be chartering your boat or using it for financial gain. In some areas, boats with higher horsepower are required to get insurance.

You may also be required to get insurance if you are buying your bass boat with a loan from a bank. After all, the bank wants to be confident that their lone wont sink with your boat if something should happen.

However, in the vast majority of instances, you get to choose whether to insure your bass boat or not. Therefore, you may find yourself wondering whether paying for insurance is really important for you, especially if you are being charged among the higher premiums.

There are a few good reasons for you to consider paying for insurance for your bass boat which are worth considering as you make up your mind:

Boat Insurance Cost: Get Average Pricing

10 Great Boats Under $20,000 Ship Prefixes: Understanding SS and Other Common Uses Eye-Opening Facts About the Cost of Boat Gas The Reason That Bellows Are Vital Part for a Boat and How to Maintain Them Outboard Lower Unit Oil Changes: What You Need, How to Do It, How Often, and What It Costs How Much is a Used Jet Ski?

These ongoing expenses might include slip fees, winterizing, towing, land storage, fuel, boat insurance, repairs, maintenance, registration and taxes. Whether youll need a marine survey. When you apply for a secured boat loan, the boats value will be a factor in how much you can borrow.

Most boat purchase decisions are budget-based, but you should consider the entire cost of ownership rather than just the price of the boat when setting your budget. Insurance, registration, storage, fuel, and more contribute to the cost of owning a boat.

Don’t Miss: Gluten-free Sunscreen 2021

What Is Bass Boat Insurance

Bass boat insurance is basically a contract between you and the insurer. Be it long-term or short-term, it will protect you financially if you or someone else have an accident or your boat gets damaged .

So if you have the boat insurance, you wont have to pay for the repair and medical expenses. Thats not it, you also get some additional perks, depending on the type of boat insurance you get.

However, insurance is not applicable to small paddle boats, vessels, or canoes.

If youre looking for insurance policies and requirements for your bass boat, then you should get in touch with the independent agents of your state. They may have something good that can meet your desired budget and needs.

So that was a small introduction on bass boat insurance to give you a clear picture. Next, lets move on and see the types of insurances available.

What Factors Affect The Cost Of Boat Insurance

There is a lot that goes into determining the cost of boat insurance. Everything from your personal driving record, to the specific use of the boat, will impact the premiums you pay.

The most important factors that influence bass boat insurance rates are as follows:

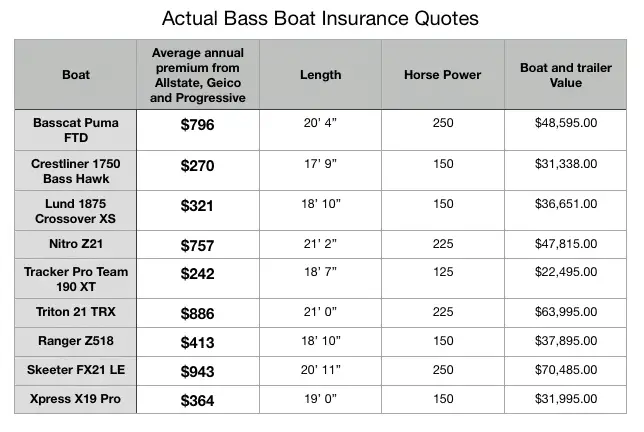

- Boat motor horsepower: Powerful motors make boats go fast and with speed comes increased risk. Bass boats that have larger motors will usually have higher insurance rates.

- Boat and trailer value: A luxury bass boat can run you in excess of $70,000. With high price tags comes high premiums. Expensive boats cost more to fix when something gets damaged. Motor and hull damage account for the majority of pricey repairs.

- Year, make and model: As boats depreciate, so do the insurance costs. Some brands hold value longer and therefore, require higher rates.

- Driving record and boating experience: If you are a good driver on the road, it stands to reason that you will be good on the water too. If you have years of boating experience and you can prove that you have boating safety training, your cost should be lower.

- Primary use: You bought a bass boat so it is safe to say your primary use is fishing and not pulling water skiers or wake boarders.

- Gender and age: Young males are just going to pay more because we like going fast. As you get older with a good record, rates should go down.

Don’t Miss: Who Makes The Best Jon Boat

Which Comes First: The Boat Or The Boat Insurance

If you are in the market for a boat, it’s a good idea to consider shopping for insurance first before signing your boat purchase paperwork. Insurance rates can vary, so you may want to factor in the cost of your coverage as you determine which boat you can reasonably afford.

Try narrowing your purchase choices down to two or three boats, and then take information about their specifications to a local independent agent.

Your agent will get quotes from several insurance companies for you on your potential purchases. You can then determine for yourself which boat will ultimately be better for your needs and budget.

An independent agent in your area can help you evaluate boat insurance rates and options so you can enjoy the water and have peace of mind. If youre thinking about getting a boat, contact a local agent today and get the vital information you need for your best protection.

TrustedChoice.com Article | Reviewed byJeffrey Green

Is Boat Insurance Expensive

As is the case with almost anything you purchase, the more research and price comparison you doâthe higher likelihood that you will find the boat insurance quote that is right for you. Here are some tips to ensure that you are getting your moneyâs worth and keeping your costs down:

- Only buy what you need: There are lots of options out there for marine insurance and many of these policies are custom-written. Ensure that you know what you need so you can avoid paying for features that you donât require.

- Agreed value vs. Cash value: In an agreed value policy, you are paid a pre-determined value for the vessel in the event of a total covered loss. With agreed value, the insured and insurer agree on the value of the boat upfront. Most agents would recommend this option for a new or late-model boat. As the boat continues to age, look to potentially switch to a cash value option to save on premiums.

- Take a boater safety course: Almost all insurers offer a discount for boaters that have recently completed an approved boater safety course. Take an in-person class or get your boat safety certification online. Check with your insurance agent to see if a discount is offered for your specific policy.

- Spend on safety gear: Insurance companies may cut you an additional discount for having extra safety features onboard your vessel. Check with your insurance agent to see if you qualify for any additional savings.

Also Check: Are You Required To Have Boat Insurance In Texas

What Kind Of Boat Insurance Do I Need

Like many other insurance policies, boat insurance can typically be separated into a few types: liability, uninsured motorist, and collision/comprehensive coverages.

Liability insurance is the minimum standard required by most states, banks, and marinas. The boat insurance professionals at trustedchoice.com recommend buying at least $1,000,000 in liability insurance. The recommended amount of liability coverage can be even higher if you have a fast, powerful boat that is both riskier and can cause more damage.

With uninsured/underinsured motorist coverage, the standard minimum is $10,000. Ensure that you take into account any potential injuries and damages you may need to cover if you or one of your passengers is injured or your vessel is badly damaged.

The last type of boat insurance we will cover is collision coverage and comprehensive coverage. These types of coverages should be based specifically on the value of your boat. Check with your lender or your marina to see if there are insurance policies in place.

Best For Professional Fishermen: Markel

- No. of Policy Types: One custom policy

- Coverage Limit: Contact for details

- Price: $100+/year

-

Policies tailored to your boating needs

-

Free online quotes

-

Need to contact company for policy details

-

Website could be updated

-

Not as well-known as other providers

The Markel Corporation is a specialty insurance company that offers specialized coverage for boats. They have an A rating from A.M. Best and an A+ rating from the Better Business Bureau. The company has been in business since 1930 and offers comprehensive boat insurance policies for boats and personal watercraft . The Markel policy has an option to add coverage if youre a professional fisherman which provides replacement cost coverage for a preset agreed upon value of fishing equipment. Several discounts are available including an accident-free discount, operator over age 40 discount, and an experienced boater discount for boaters who have five years or more of boating experience. If you happen to qualify for all of the discounts available through Markel, you could save up to 35% on your boat insurance premium. Extra features also come standard without having to pay an additional premium.

Don’t Miss: How Much Do Boat Mechanics Make

How Does Boat Insurance Work

Boat insurance works similarly to car insurance, but it covers the financial loss of large boats instead of automobiles. You generally pay a set monthly fee for coverage on your boat, and in exchange can place claims against financial loss or damage for things related to your boat. When the claim is received by the insurance provider, they will investigate to determine the fault of any accident, what the damage costs are, and how much should be covered. Once that is complete, the insurance carrier will send you a check for the amount of coverage you are entitled to for whatever claim you submitted.

Boat Insurance Guide: Costs Coverage & Policies

On the other hand, a slower pontoon boat will use much less gas. Many consume closer to five gallons per hour, thus have an annual fuel cost of closer to $3,000 for the same total hours out on the water. So boat fuel costs can be affordable, as long as you dont have the need for all that much speed. The Price of Boat Insurance

Bass Boats – A small, flat-bottom boat used primarily for bass fishing in inland waters. They are often equipped with swivel chairs for easy casting. . Cruisers – Allow for longer range cruising. Typically, 25 – 40 feet with multiple cabins. And other fishing boats too.

Boat Insurance. Insurance policies for watercraft are commonly referred to as Boatowners policies and Yacht policies. The coverages usually provided by boatowners and yacht insurance policies are physical damage, liability and medical payments. Boatowners policies are typically used to cover smaller watercraft usually less than 26 feet.

Boat Beam — “Most bassers categorize bass boats in terms of their length. They compare the various brands of 17-, 19- or 20-foot boats, but they may not consider the beam of these rigs. In a bass boat, ‘beamier’ is better. A wide rig is roomier inside, better balanced and more stable when running or fishing.

Here’s our annual review of the best boat insurance providers. Compare boat insurance cost and policy features for popular powerboat and sailboat insurance.

Don’t Miss: What Is My Pontoon Boat Worth

Finding A Boat With The Ideal Balance

As a boat manufacturer, at Formula Boats we know the balance of giving you the power and speed you want while making sure safety is a priority. If youre considering purchasing a boat, our online boat builder gives you the opportunity to fully customize several different boat models with a few different horsepower options. You can be sure horsepower options for each boat model we provide are within the limits we believe maximize your performance while maintaining safety.

Discover a boat you like through our boat builder? We have dealers located throughout the country ready to help you find your boat. Get started by searching for the dealer location closest to you on our website.

Even though we narrow down the options, it can still be tough to choose the amount of horsepower that will give you performance based on boat weight and use, but also fuel efficiency. If youre interested in one of our boat models, but are still wondering how much horsepower you need, were here to help please dont hesitate to contact us.

Boat Insurance Coverage Faqs

Small Boat Insurance

What is the best coverage for my boat?

It is best to have what is known as an “All Risk” policy, which will provide coverage for all types of losses except those specifically excluded in the policy. Typical exclusions may include wear and tear, gradual deterioration, marring, denting, scratching, animal damage, manufacturer’s defects, defects in design, and ice and freezing.

How much should I insure my boat for?

You should insure your boat for the amount it would cost you to replace it with like kind and quality. This is called “Agreed Value” or “Stated Value” coverage, and in the event of a total loss, will pay the full insured amount. Beware of policies providing “Actual Cash Value” coverage, which means the value of your boat will be replacement cost less depreciation.

What other coverages can I expect with my policy?

The following are standard coverages with standard deductibles and average limits:

- Medical payments, $5,000

- $1,000 limit Personal effects, $250 deductible

- Uninsured boaters liability, between $300,000 and $500,000

- $500 to $1000 limit Towing and assistance, no deductible

- $1,000 limit Fishing equipment, $250 deductible

Who is allowed to operate my boat?

I live in an area where I can’t use my boat in the winter, but my lender requires it be insured year-round. What can I do?

Large Boat Insurance

What are the differences between boat and yacht insurance?

What should I look for in a yacht policy?

What is a normal deductible?

Recommended Reading: When Does Banana Boat Sunscreen Expire

What Boat Insurance Covers

Policies vary between insurers but coverage typically includes:

- Property damage coverage: also known as physical damage coverage, it insures against damages or loss of your vessel caused by collisions with other boats or objects , theft, sinking, fire, storms and other risks. The property covered may include the hull, motor, fittings, furnishings and other equipment.

- Liability coverage: helps pay legal expenses and settlements if you’re found at fault for someones injuries during a crash, for example. It also covers damages to others property, such as a boat or dock you collide with.

Optional boat insurance coverage

Boat insurance companies may offer extra coverage options for:

- Medical payments for injuries to you or passengers

- Roadside assistance if the vehicle used to tow your boat breaks down

- Wreckage removal in the event your boat sinks

- Watersport injuries or damages from tubing wake surfing, or other similar activities

- Fuel spill cleanups for accidents or a leaking gas tank

- Personal property such as fishing equipment, scuba gear, clothing, smartphones and more

- Uninsured/Underinsured boater damages your boat

- On-water towing if your boat leaves you stranded

- Mechanical breakdowns

- Ice and freezing damage

- Hurricane haul-out in case you have to move the boat to safety due to a storm

- Extending your navigation to Alaska, Bahamas, Mexico and the Caribbean

Types of boats covered

The types of watercraft covered vary across insurance companies but may include: