Liveaboard Insurance Cost Considerations

What contributes to the cost of liveaboard sailboat insurance? Purchasing insurance for a sailboat is a lot like buying car insurance, except it’s likely to be a lot less expensive when it’s all said and done.

Insurance companies take several things into account when issuing you a quote. The first thing they consider is the size and value of your sailboat. Obviously, a 40-foot priceless classic schooner will probably cost more to insure than a fiberglass 1971 Catalina 22.

However, that’s likely not the most important factor. Insurance companies also consider your deductible and how much coverage you need. In fact, these two factors are likely the most influential when it comes to determining your annual premiums,

Location is another factor considered by insurance companies. Some states have notoriously high insurance premiums. This is often due to a combination of state regulation and analysis of how often people wreck their coats in the area.

Some parts of the country are known for heavy boat traffic. Combine that with a proclivity for bad weather, and you’re likely to encounter steeper insurance premiums.

The final consideration is your personal history and how often you plan to use your sailboat. As we discussed earlier, having a history of accidents can negatively affect your ability to find an affordable sailboat insurance plan.

Kinds Of Boat Insurance Policies

- Boat

- Boat & PWC Rental – Although this is generally not required, rental insurance will help cover any damage the vessel, as well as the operator and passengers.

- Boat Clubs – covers all members of club while operating a boat.

- Professional – These policies are very customizable and can cover items like travel to a tournament, equipment and more.

What Factors Affect Average Boat Insurance Pricing

There are a lot of things that can make the cost of your boat insurance go up, but there are also plenty of ways you can get lower boat insurance prices, too.

Lets look at a few of the most common factors that affect boat insurance rates.

Safety Record

The more years you spend without having a boating accident or citation, the less youll pay for boat insurance. Its also a good idea to be a safe boater just for the merits of avoiding bodily injury and property damage, of course.

Homeowners Discount

If you own a home, chances are good that your boat insurance rates can be lowered based on that asset. This may come as part of a bundle your insurer will offer.

Even if you get homeowners insurance from one company and boat insurance from another, the latter may still consider your home ownership as a valid reason to offer lower boat insurance rates.

Payments

If you pay your boat insurance by the month or a few times a year, thats fineits standard, in fact. However, if you can pay for the entire years boat insurance in one lump sum, youll likely get a better rate.

Boat Age

As with cars, newer boats are usually more expensive to insure. Theres just one caveat.

Recommended Reading: How Do I Register My Boat In Colorado

Average Cost Of Boat Insurance

Current estimates have reckoned the national average is around $300 to $500 per yearly premium. In some cases, the annual percentage could increase up to $1,000. While anyone can take a good guess between these numbers, there is a precise way of determining the exact price to insure a boat.

According to boat insurance experts, a good ballpark figure for the annual premium is 1.5% of the vessels market value. Take, for instance, an entrepreneur owns a 30-foot long schooner that is worth $39,000:

39,000 x .015 = 585

Judging from this calculation, the estimated cost of the annual boat insurance premium for a $39,000 schooner is $585. Any insurance premium that costs a thousand bucks must have owned a luxury vessel that is worth a fortune. While this calculation is practically infallible, it is also important to consider other factors that can marginally increase the premium.

What Factors Affect The Cost Of Boat Insurance

There is a lot that goes into determining the cost of boat insurance. Everything from your personal driving record, to the specific use of the boat, will impact the premiums you pay.

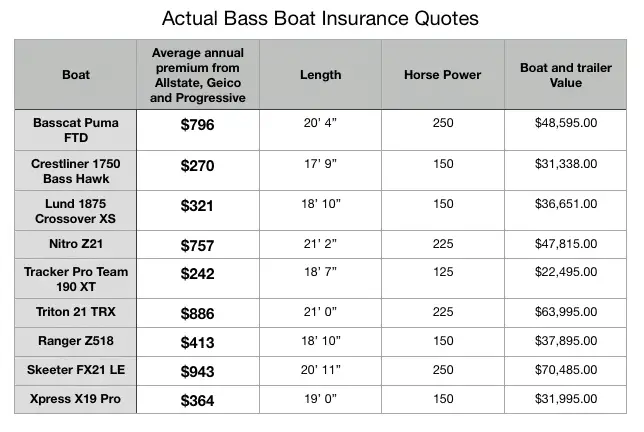

The most important factors that influence bass boat insurance rates are as follows:

- Boat motor horsepower: Powerful motors make boats go fast and with speed comes increased risk. Bass boats that have larger motors will usually have higher insurance rates.

- Boat and trailer value: A luxury bass boat can run you in excess of $70,000. With high price tags comes high premiums. Expensive boats cost more to fix when something gets damaged. Motor and hull damage account for the majority of pricey repairs.

- Year, make and model: As boats depreciate, so do the insurance costs. Some brands hold value longer and therefore, require higher rates.

- Driving record and boating experience: If you are a good driver on the road, it stands to reason that you will be good on the water too. If you have years of boating experience and you can prove that you have boating safety training, your cost should be lower.

- Primary use: You bought a bass boat so it is safe to say your primary use is fishing and not pulling water skiers or wake boarders.

- Gender and age: Young males are just going to pay more because we like going fast. As you get older with a good record, rates should go down.

Recommended Reading: Cost Of Freedom Boat Club Membership

How Much Does A Boat Insurance Cost

In the United States, private ownership of boats is obviously not as crucial and ubiquitous as owning cars. However, the interest of Americans in recreational boating is also difficult to ignore, considering that over 87 million adults participate in any of its related leisurely activities . Recent statistics have counted up to 13.28 million American households owning boats.

While 2.65 million American families are planning to buy a boat, it is also important for prospective owners to be aware of its potential dangers. The US Coast Guard submitted a report concerning the fate of unfortunate boat owners in 2016 counting a total of 4,463 accidents that incurred up to $49 million worth of property damage. The need for boat insurance is predicated by these frequencies, especially given the fact that open motor boats account for 47% of these accidents.

Will My Driving Record Affect My Premiums

Many people wonder if their driving records will impact their sailboat insurance premiums. In most cases, the answer is a resounding “yes.” If you have a stellar driving record and lots of years on the road, you can expect to pay less than your younger or less experienced counterparts.

If you have a history of accidents, a DUI/DWI, or other issues, you’ll likely pay more . The longer you stay safe and responsible, the lower your rate will be.

On a similar note, your age can have a significant impact on the price of liveaboard sailboat insurance. Younger people, specifically in their late teens and early 20s, usually have to pay higher premiums. This is because people in that age range are far more likely to cause an accident.

The best way to avoid paying more because of your driving record is to keep it clean, avoid alcohol, and take driver’s or boater’s safety courses whenever possible. A ticket can have a ripple effect across all of your insurance plans, so it’s best to get them expunged with courses whenever possible.

Read Also: Mold Remover For Boat Seats

How Much Does Inland Marine Insurance Cost

The cost of an Inland Marine Insurance policy varies from company to company. This depends on the size of your business, how much protection you want, and if your state has requirements or limits that must be met.

Some policies cost under $500, while others easily surpass $10,000. This depends on your business, what you ship, and other variables. However, the average cost of Inland Marine Insurance is $2,500 per year.

The best way to estimate the cost of Inland Marine Insurance is to get a quote. Review the quote carefully and make sure every aspect of your business is covered.

Boat Insurance Can Actually Prove To Be Beneficial For You In Multiple Cases Keep On Reading And Find Out All You Need To Know Including What It Does And Does Not Cover Which States Require It And What It Might Cost You

In the event that having a good time on the water appeals to you, you may end up in the market to purchase a boat. You could purchase a boat for fishing, speed boating or sailing, or a pontoon to drift around casually. Just as you insure your car and your house, it is also a smart idea to get enough insurance coverage for your boat.

With regard to insuring your boat, it is frequently best to separate your boat insurance from your homeowners policy. Numerous homeowners policies limit or do not cover marine-specific risks, such as salvage work, wreck removal, pollution or environmental harm however, there are exceptions. Numerous homeowners policies incorporate entirely great coverage for smaller boats and motors, usually with a horsepower limit of from 25-to 100-horsepower. While homeowners riders are typically satisfactory for these boats, be careful to ask the same questions you would ask some other insurer about damages to your vessel and how they will be paid.

As you research your options for boat insurance, you may have some questions about boat insurance cost, what sort of coverage you should purchase, and what insurance organization carries the best policies for your dollar. An autonomous insurance specialist can help answer your insurance questions and get you in good shape for saving on your boat policy. Let us keep on reading in order to get ourselves better acquainted with boat insurance.

Don’t Miss: How To Clean Mildew Off Boat Seats

Liveaboard Vs Standard Sailboat Insurance

Is there a difference between standard sailboat insurance and liveaboard sailboat insurance? Generally speaking, no, but some insurance companies might have additional coverage requirements for people who use the coat as their primary residence.

This is primarily because liveaboards spend way more time ‘using’ their boats. When choosing a plan, be sure to talk to an agent to determine the insurance company’s precise definition of ‘use.’ Doing so can help save time and money, as you may only be required to disclose how often you plan to actually sail the vessel.

Some indemnity companies don’t require you to specify how often you use the vessel. In these cases, there should be no difference in the cost or coverage amounts.

How Are Yachts Categorized Concerning Insurance

A boat is any vessel that is 26 and smaller. These will have basic coverages and feel more like auto insurance policies.

However, a yacht is classified as 27 and larger, which will have broader, more specialized coverage. This is because yachts are more complicated, faster, bigger, and hold more stuff.

Also Check: Gluten Free Sunscreen

Find What You Should Be Paying For Coverage

Our independent agents shop around to find you the best coverage.

If having fun on the water appeals to you, then you might find yourself in the market to buy a boat. You could purchase a boat for fishing, speed boating or sailing, or a pontoon to float around casually. Just as you insure your car and your home, it’s a good idea to get adequate insurance coverage for your boat.

As you research your options for boat insurance, you might have some questions about the cost, what kind of coverage you should purchase, and what insurance company carries the best policies for your dollar.

An independent insurance agent can help answer your insurance questions and get you on the right track for saving on your boat policy. Contact an independent agent today to get started.

Save on Boat Insurance

Our independent agents shop around to find you the best coverage.

The Cost Of Boating Accidents

Take a look at some statistics from the Coast Guard for 2019 about boating accidents:

- 4,168 accidents involving recreational boats resulted in $55 million in property damage.

- 556 deaths and more than 2,559 injuries were due to boating accidents.

- 70% of boating deaths were drownings.

- 33% of deaths occurred when the driver had no boater safety instruction.

- Open motorboats were listed in 47% of all boating accidents.

- Alcohol was deemed the leading factor in fatal boating accidents.

Don’t Miss: How Much To Join Freedom Boat Club

Why Are Northern States Typically Less Expensive Than Southern States

Boat insurance rates are generally more affordable if you live in a state with no coastline, and many coastal states are in the southern part of the United States. Along the coast, you’ll usually find bigger and more expensive boats used in the oceans and on the Gulf of Mexico. The Great Lakes states tend to fall in the low-cost category because boat lengths tend to be smaller, with many boaters taking advantage of inland lakes and rivers. The length of the boating season also has a big impact on the cost of boat insurance. Many northern states have shorter boating seasons and lower policy costs than southern states where the boating season is generally much longer.

Regardless Of What You Think Injuries Can Happen

Just because youre a cautious boater who obeys all of the safety regulations doesnt mean that you wont cause an accident. We can take all the steps in the world to avoid collisions, it still doesnt make us impervious to the random freak accident.

Boating accidents are serious, much more so than a fender bender on the road. Making one mistake, like towing a tuber too fast or hitting a jet skier, can seriously injure or even kill someone. For this reason, you want to have a good insurance policy that protects you and your boat.

A comprehensive policy will cover your pontoon as well as injuries to yourself and others. If this isnt something youre interested in, you should get a liability plan at the very least. This way, youre protected in the event that you cause an accident that hurts someone else. You dont want to be stuck with hospital bills and expensive legal fees because you were uninsured and injured someone.

Recommended Reading: How Much Does Freedom Boat Club Cost Per Month

What Kind Of Boat Insurance Do I Need

Like many other insurance policies, boat insurance can typically be separated into a few types: liability, uninsured motorist, and collision/comprehensive coverages.

Liability insurance is the minimum standard required by most states, banks, and marinas. The boat insurance professionals at trustedchoice.com recommend buying at least $1,000,000 in liability insurance. The recommended amount of liability coverage can be even higher if you have a fast, powerful boat that is both riskier and can cause more damage.

With uninsured/underinsured motorist coverage, the standard minimum is $10,000. Ensure that you take into account any potential injuries and damages you may need to cover if you or one of your passengers is injured or your vessel is badly damaged.

The last type of boat insurance we will cover is collision coverage and comprehensive coverage. These types of coverages should be based specifically on the value of your boat. Check with your lender or your marina to see if there are insurance policies in place.

What Will Insurance Cover On The Boat

Insurance coverage is not perfect and not everything is covered with a standard policy. Before purchasing a policy, consider the most common situations you will likely face where you intend to fish. Often, extended coverage is necessary to protect against more unusual or extreme events.

Here is what insurance covers:

- Collision: Accidents that result in the damage of your boat will be covered. This would include running aground on rocks that would cause motor or hull damage.

- Property damage : The expenses associated with a crash involving someone elses personal property would be covered. This would include damage to other boats or docks.

- Bodily injury : In the unfortunate situation where someone else is injured, liability insurance covers hospital expenses, lost wages and other legal suits against you.

- Comprehensive coverage: Non-collision related loss is covered by the comprehensive portion of the policy. Things like theft, vandalism and non-collision damage are included in the protection.

To get the most out of your insurance, consider the following:

- Your homeowners insurance does not cover boating accidents.

- Motor damage from normal wear and tear is not covered. Only damage that is related to a collision, theft or vandalism is qualified for repair or replacement.

- Fishing tackle and equipment damage require extended coverage.

Extend coverage is available for most situations and is advised for those who have valuable equipment on board.

Recommended Reading: Freedom Boat Club Specials

Getting A Boat Insurance Quote

The best way to figure out how much boat insurance will cost is to get a quote.

For a free boat insurance quote from Nationwide, call or visit our boat insurance page of our and enter your zip code to begin the process.

Nationwide provides insurance for many types of watercraft, including bass boats, ski boats, sailboats, cabin cruisers and pontoon boats, as well as insurance for personal watercraft, such as Jet Skis, WaveRunners and Sea-Doos.

Types Of Boat Insurance And The Coverage

Depending on the category of the boat, you can choose from these boat insurance options. They are:

- PWC insurance : It is for houseboats, pontoon, sailboats or any other category under PWC. Hence, it covers for losses due to accidents, liability, as well as vandalism

- Yacht Insurance: The coverages for yacht insurance are bodily injury claims or third-party property damage. In addition, it provides personal property damage as well

- Sailboat insurance: The coverages are collision and comprehensive. Along with, vessel replacement, repairs, wreckage removal, fuel spills and many more

- Boat club: It provides coverage for operation of boat clubs such as Boat Setter, Sail time, or Carefree Boat Club. Also, you should get insurance for inland buildings, docks and marinas.

Therefore, boat insurance is crucial for boat owners and operators. It protects you financially from unwanted circumstances. Also, if you want to know what is insurance broker then this blog can help you figure out.

If you are an insurance agent then you may want tips on insurance leads. This blog can help you a lot. If you want to know more information on What Kind of Insurance Do I Need if I Dont Own a Car then head on to this blog.

Don’t Miss: How Long Are Boat Loans Usually