The Typical Age Of Boat For Loans

Many lenders will not lend money for boats older than 15 years, according to the Mortgage Report. Some will lend for boats manufactured as long ago as the 1980s. Just as with cars, a buyer is more likely to find financing for an older high-quality boat than a mid-range or lower-end older boat, according to AllAtSea.com.

Regardless, interest rates will be higher for older boats. A premium is charged for financing boats older than 20 years. Lenders typically also will want the boat to be appraised and some may even require that list of comparable boats be presented to help them assess value, according to Boats.com. They also will require that the title be researched to be sure no other liens exist on the boat.

Navy Federal Credit Union

Navy Federal Credit Union offers loans for new and used boats and personal watercraft, with terms of up to 180 months. Military members with direct deposit may qualify for a rate discount. Service members in all branches of the armed forces, along with their families and household members, are eligible for credit union membership.

Boat Loan Terms: How Long Can You Finance A Boat

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Buying a boat? Before you gather your gear and take to the high seas, youll likely need to figure out how to afford your purchase. One of your key questions may be: How long can you finance a boat? Boat loan terms, unlike car loan terms, can stretch up to 20 years, nearly as long as a home mortgage. Whether you should borrow for that amount of time depends on several factors, including the cost of the boat, which can range from a new jon boat under $5,000 to million-dollar yachts. In general, the lowest interest rates are for the shortest loans, but your monthly payments would be higher.

Also Check: What Kind Of Paint To Use On A Aluminum Boat

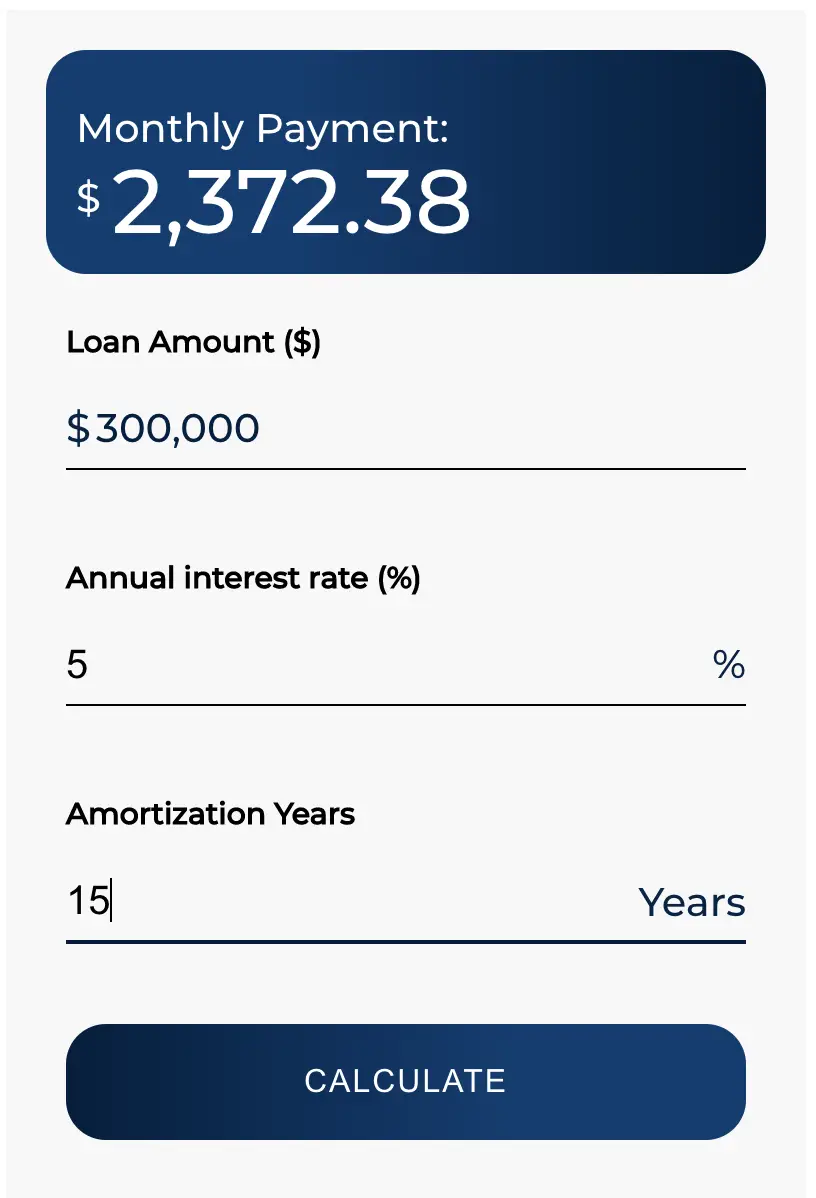

Use A Boat Loan Calculator

The LendingTree boat loan calculator helps you determine your monthly payment using the loan amount, interest rate and loan term. Additionally, the calculator breaks down monthly payments by year, helping you plan ahead. Should you find that your estimated payment is a bit tight for your budget, the tool allows you to adjust the loan amount and/or boat loan term to find what best fits your needs. When its time to buy, you may fill out a single LendingTree form and receive up to five possible boat loan offers from lenders based on your creditworthiness.

Understand The Costs Of Owning A Boat

Boat loan down payments typically range from 10% to 30%, so make sure you have enough money saved up to cover the cost of the down payment before you apply for a loan. Once you own a boat, youll also have to cover maintenance and related costs. Some of the expenses youll need to cover as a boat owner include:

- Trailer to transport and store your boat: If you dont plan on storing your boat near the water, youll need a trailer to transport it from your home.

- Boat insurance: Boat insurance can protect you in the case of an accident or if anything happens to your boat.

- If you dock your boat at a marina, youll typically have to pay monthly fees for the privilege.

- Registration: Just like a car, many states require boat owners to register their boat. Costs vary widely from state to state.

- Winter storage: If you live in an area where weather conditions arent suitable for boating year-round, youll need to store your boat in the winter.

- Maintenance: Routine maintenance costs include painting, cleaning, and replacing small parts.

- Gas: If your boat is powered by gas, youll need to fill it up regularly.

Don’t Miss: Suntex Boat Club Membership Cost

Guide To Boat Financing

Unless we are talking about a kayak, boat ownership is not exactly known for its affordability. If you dream of owning a superyacht, or even just a modest sailboat or pontoon boat, how much is it going to cost youand how expensive a boat can you afford?

You will probably need to get a boat loan unless you are planning on paying the full price of a boat out of pocket. Financing a boat is a process similar to getting any other type of loan, and can be broken down by answering a few simple questions.

The Bottom Line On Boat Loan Terms

If youre financing the purchase of a boat, keep in mind that your options vary along with your financial picture. As with any other loan, those who come bearing good credit and a decent chunk of disposable income will find more favorable boat loan terms than those with less-than-perfect credit and a tighter budget. In general, financing a luxury item like a boat may be subject to higher underwriting standards than a car or home.

A few things to be aware of:

- Simply getting approved for a loan and being able to make a down payment does not necessarily mean that you will be able to keep up with the obligation long term. Make sure you consult your budget and be realistic.

- When shopping for a loan, be sure to check your credit, pay down other debt and get prequalified so that you know the exact amount for which youll get approved.

- Dont get in over your head. Its tempting to buy a boat, but the better option is to make sure that you can afford the payments before giving into that temptation.

You May Like: How Do You Install A Seal Skin Boat Cover

Boat Loans: Best Ways To Finance A Boat

When looking to finance a boat purchase, it’s important to understand the ins and outs of boat loans and using a boat loan calculatorand how to get a loan through financial institutions likes Wells Fargo, USAA, and Chase.

Cheap fuel, low interest rates, tons of new boat models and lots of lenders add up to this being just about the perfect time to buy a boat. These days, borrowing is increasingly necessary too as boats have grown bigger and more expensive. The average new boat loan today is over $200,000, so theres been an uptick in larger loans. That said, smaller loans are also getting attention since national and local banks, financial services firms and credit unions have returned to marine lending after the recession. It may be time to dive in and get that dream boat.

Boat Down Payments And Ownership Costs

Obviously, if youre applying for a boat loan, you have to be able to show that you have the money to make the down payment, but also be able to pay for the expenses of owning a boat whether thats insurance, slip fees, fuel, all those things that go into boat ownership, said David Mann, membership program manager for Boat U.S., a boat owners association that connects lenders with buyers, among other services.

Boat down payments are usually between 10-20 percent, but can depend on the cost and value of the boat as well as your location and finances.

The boat loan rate for which you qualify is going to hinge on factors mentioned above, but it also could swing on the term of the loan how many years youll be paying on it or even the age of the boat youre buying. For example, you might be able to get a better interest rate on a boat thats as little as one year newer. In general, smaller loans for shorter terms usually have higher interest rates than larger loans for longer terms. Again, rates can vary with your credit history.

You May Like: Boat Mold Cleaner

How Houseboat Loans Are Structured

Houseboat loans may be quite large, so theyre often spread over more time. A houseboat loan is almost always a portfolio loan portfolio loans are kept on the books of the lender that made the loan and are not sold. That may mean more risk for the lender, so you could end up paying more for the loan as a result. Lenders also may have more stringent requirements, too. Heres what to expect when looking into this type of boat loan.

Other Costs Of Owning A Houseboat

Theres more to consider than just the upfront financing when youre looking to buy a houseboat. A houseboat is far from a one-time cost, and there are a few things youll want to consider when budgeting.

- Mooring costs: This will vary greatly by where your houseboat will be located. For example, slips in urban areas like Seattle can go for $500 or more per month for a 32-foot boat, while youll see them priced much lower in more rural freshwater lakes.

- Winter storage: Unless youre keeping your houseboat somewhere thats relatively warm year round, you may need to pay for winter storage.

- Fuel costs: When youre moving something as large as a houseboat, fuel efficiency falls by the wayside. And in a captive situation like a marina, gas could be much more expensive per gallon than it would at a roadside gas station.

- Insurance: Youll need to insure your houseboat, which Bagley mentioned can be a big cost. pay higher insurance rates, anywhere from double to triple to what youd pay for a house, he said.

- Maintenance: Keep in mind that youve got an engine on board, so youll have to pay to keep that up. Oil changes and tune ups are regular expenses, and youll see labor rates upwards of $30 per hour.

- Taxes: When it comes to taxes, laws vary by state. As Bagley noted, Seattle levies annual property tax on houseboats where it once charged a onetime 10.1% sales tax as a vessel. Make sure to check your local tax laws to find out more about how youll be taxed on your houseboat.

Recommended Reading: Boat Upholstery Cleaner Mildew

Fallen In Love With A Boat Compared With Auto Loans Financing A Boat Can Be A Much Heftier Investment

Boats can be more expensive than a car, which means loan amounts can be higher and terms can be much longer.

Just how much you pay to finance a boat depends on a number of factors, including the type of boat loan you choose, the loan terms, your down payment and your credit.

Lets take a look at the different types of boat loans, your financing options and how to apply for a boat loan.

How Long Does It Take To Get Approved For A Boat Loan

New Boat loans can be processed and closed in a week, which is much faster and easier than real estate loans. Financing for pre-owned vessels takes longer. However, Boat Loan Specialists, working with Lenders who know the marine industry, can process paperwork faster, provide guidelines of all the things that are needed for a Boat purchase, and refer needed resources. They are, more knowledgeable, faster and easier to work with than a personal banker.

Also Check: Marine Mold Removal

Financing Options For Boat Buyers

Like other major discretionary buys, funding a boat purchase often requires financial resources beyond cash on hand. Banks, credit unions and other traditional lenders furnish payment options for boat buyers, who rely on various forms of financing to get the job done. People with cash savings may choose to put the boat on a credit card to secure points. Buyers with a strong credit score might consider a personal loan. Homeowners with significant equity might consider a home equity loan. Boat buyers also turn to dedicated financing from maritime lenders, specializing in marine craft credit.

Buyers with good credit references tap collateral loans to pay for boats, in much the same way cars are funded. Once approved, funds are issued and the boat itself serves as collateral for the loan. Failure to make timely payments can result in repossession, allowing lenders to seize and sell boats to recoup their losses.

Another form of funding with versatile applications uses the equity in your home to guarantee repayment. Home equity loans and lines of credit can be used for various purchases, including recreational watercraft. In order to initiate equity credit, most lenders require a current appraisal. In addition, home equity lines carry closing costs similar to conventional mortgages. Because the loans are backed by real property, however, interest rates are lower than those associated with other forms of funding.

How To Finance A Houseboat

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

If youve ever daydreamed of living on the water and looked into a houseboat, you probably know that they can cost just as much as the average landlubbers house. For many, turning that dream into reality is where houseboat financing comes into play.

Purchasing a houseboat isnt like buying a boat or a home. Thats because the term houseboat may mean different things in a lenders eyes. But no matter what type of houseboat you choose, financing one will probably involve a significant down payment and higher interest rates than a traditional home on land. If you know that a houseboat is right for you, the money is out there heres how to get it.

Don’t Miss: Hsmv 82050 Instructions

Can I Finance My Fish Finder Chart Plotter Radar And Other Fishing Electronics

Financing is not only for the price of the Boat. Tangible assets can often be rolled into a Boat loan, including Marine electronics, trolling motor or Anchoring packages and Bottom paint. Note that labor to install the Electronics or perform commissioning tasks for new boats cannot be Financed.

-Tom Smith is President of Sterling Associates, a Financial Services Firm headquartered in Massachusetts that provides Financing, Insurance and Coast Guard Documentation services for all types of boats. Let Sterling get you, On The Water!!!

What Is The Typical Down Payment For A Boat

The size of the down payment required will depend on the age, price, and type of vessel as well as on your credit profile. Expect to pay 15 to 20 percent down payment on most Center Console or Sportfishing Boats. A Boat loan specialist can help you with programs available through various manufacturers that could allow you to qualify for a lower down payment. They can also help you find lenders that offer lower interest rates for higher down payments.

Recommended Reading: Is Banana Boat Sunscreen Gluten Free

Can You Get A Boat Loan On An Old Boat

Getting approved for a boat loan on an older watercraft can be tricky, but it is certainly possible. Some lenders will offer used and refi loans on boats as old as 19 years. If the boat is of high value, you may even find lenders willing to finance a watercraft as old as 25 or 30 years.

Expect that interest rates for old boat loans may be higher than those for newer boats, and you may even encounter higher down payment requirements.

If youre unable to find a lender willing to finance your old boat purchase, consider taking out a personal loan instead.

Consumer Boat Buying Guide

Homes and cars represent some of the most expensive single-item purchases individuals make during their lifetimes, but spending doesn’t always cease at the shoreline. Boats add to the cost of living for water sports enthusiasts, who eagerly take-on the cost of ownership. And though boat buying is born of passion for the open water, a prudent approach makes the most of recreational budgets and ensures affordability.

As you prepare to take the plunge, due diligence guarantees a smooth transition to boat ownership. From choosing the best boat for your needs to securing reasonable financing, weigh your options carefully before making commitments.

Also Check: Aaa Boat Towing

Which Houseboat Financing Option Is Right For You

According to Raney, the first step in buying a houseboat is truly understanding your purchase.

The first thing buyers need to be aware of is what exactly they are buying, he said, from the type of materials the boat is made out of to its condition under the water, and even whether youll own the space where it will be docked. From a financing perspective, he also mentioned that the biggest question is What exactly is it, and how does the municipality view it?

Here are some other things to consider:

- Not the usual lending requirements: Getting approved for a houseboat loan is about more than a credit score. Lenders are going to pay more attention to liquidity and your history with other assets. I dont think there will ever be a first-time homebuyer option for a houseboat loan, said Raney. Im looking for income, and a secondary asset as a source of repayment. For houseboat loans, its more about your overall financial picture.

- Buy a slip with the houseboat: Including some real estate in your loan will sweeten the deal for lenders. In Seattles Lake Washington, expect to pay between $50,000 and $150,000 to own a slip, plus additional homeowners association fees. To a lender, that provides a little more assurance that is buying a home, Raney said. Otherwise, youll need to pay rent for a slip each month.

How Old Of A Boat Can You Finance

- Post category:Loans

Buying a boat can be exciting. For many, buying a used boat is more affordable than buying a used one. Yet financing a used boat brings with it challenges beyond those of financing new boats. The age of the boat that can be financed depends upon the value of the boat, the source of financing and type of loan.

Loans for boats can be obtained through several sources:

- the boat dealer

- banks

Most of these loans work similarly to car loans. The lender holds an interest in the boat as collateral. If you make all your payments, the boat is yours free and clear at the end of the loan term. If you default on the loan, the lender can repossess the boat and sell it to cover your loan. For that reason, lenders want to be sure that your boat will be worth at least as much as you owe on it throughout the life of the loan. This need on the part of lenders is a key factor in how old of a boat they will finance.

Don’t Miss: Best Boat Cover Material