How Can I Find The Best Price On Car Insurance

Its a good idea to shop for car insurance before you buy a car. Without car insurance in place, you may not be able to drive your new wheels off the dealers lot.

Once you decide how much car insurance you need, its time to start shopping for a policy. Prices often vary widely among companies, so its smart to compare car insurance quotes from multiple insurers.

You can find free quotes online or by working with an auto insurance agent. Independent insurance agents can provide quotes from multiple companies.

Insurance quotes are always free.

Best For Individualized Customer Service: United Marine Underwriters

United Marine Underwriters

- No. of Policy Types: 4

- Coverage Limit: $1 million

The provider offers personal attention to its customers, doesnt make them feel like a number, and each customer gets assigned a primary customer service agent.

-

Discounts for boat safety courses

-

Knowledgeable agents

-

Cant buy other types of insurance from them

-

Contact for pricing and policy details

As it emphasizes on its website, United Marine Underwriters is a specialty insurance company that writes insurance for just boats. It has been in business since 1990 and provides boat insurance in all U.S. states except New Mexico. Boat insurance navigation is also available to Canada, the Bahamas, and Mexico. Liability limits are available up to $1,000,000, with discounts available for completing one of several boating safety courses approved by the Coast Guard Auxiliary and Power Squadron and the National Association of State Boating Law Administrators, among others, according to its website.

One of the more unique things about United Marine Underwriters is its policy service. When you purchase a boat insurance policy through United Marine Underwriters, you are assigned a primary service person who takes care of all of your servicing needs. This company really cares about its customer service.

Save Money By Comparing Insurance Quotes

Compare Free Insurance Quotes Instantly

Secured with SHA-256 Encryption

The content on this site is offered only as a public service to the web community and does not constitute solicitation or provision of legal advice. This site should not be used as a substitute for obtaining legal advice from an insurance company or an attorney licensed or authorized to practice in your jurisdiction. You should always consult a suitably qualified attorney regarding any specific legal problem or matter. The comments and opinions expressed on this site are of the individual author and may not reflect the opinions of the insurance company or any individual attorney.

Recommended Reading: How Do I Register My Boat In Colorado

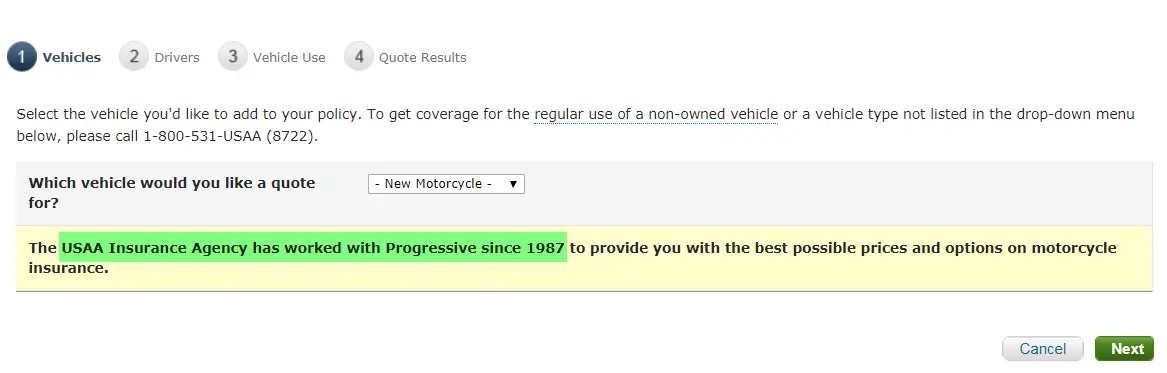

What Does Usaa Offer Besides Insurance

USAA offers not only insurance, but it also offers services of banking products, investments, shopping& discounts, advice, and other tools for its members.

Below are the types of benefits that USAA members can take advantage of:

- USAA banking: USAA offers its members direct deposit, which is beneficial for members who receive military pay. Additionally, USAA provides competitive credit card rates for its patrons. Lastly, there are roughly 60,000 USAA-preferred ATMS for its customers to use with no fees attached.

- USAA shopping discounts: discounts ranging from car rental insurance, travel deals, and car buying discounts.

- Financial planning and budgeting: Additionally, USAA understands the difficulty of budgeting and balancing military and work life. USAA offers advice to its members ranging from planning for retirement, budgetary advice for personal finances, as well as feedback and guidance on how to find a balance between military and personal life.

The shortened list of benefits are just a preview of what USAA offers to its patrons. To read the full list of benefits in each category, visit USAAs website.

Navy Federal Credit Union

Navy Federal Credit Union offers loans for new and used boats and personal watercraft, with terms of up to 180 months. Military members with direct deposit may qualify for a rate discount. Service members in all branches of the armed forces, along with their families and household members, are eligible for credit union membership.

Don’t Miss: How To Clean Mildew Off Boat Seats

How Do You Cancel Usaa Auto Insurance

If you decide you want to cancel your insurance policy, there are three ways to proceed:

- Online: Log in to your account and request that your policy be cancelled. Youll definitely want to have another policy in place with your new insurer before doing this.

- 1800531USAA to request cancellation

- Write: USAA, 9800 Fredricksburg Rd, San Antonio, TX 78288

If you choose to cancel your USAA auto insurance policy in writing, consider having your insurance agent help you draft a form letter to send to USAA.

Failing that, you might try using USAAs own cancellation request for other insurers to cancel their coverage.

Usaa Ratings Reviews Customer Satisfaction And Complaints

| Rating organization |

| 905/1,000 |

Although USAA receives high scores from J.D. Power, they are technically rank-ineligible due to limited availability.

In J.D. Powers insurance studies, USAA is consistently the highest-rated insurance company. However, USAA is excluded from the rankings because it has membership restrictions limited to military families. J.D. Powers auto and home insurance studies rank the best insurance providers based on overall satisfaction, using real reviews from customers.

You May Like: Colorado Boat Registration

More About Travelers Insurance

Travelers sells car insurance, and boat and yacht insurance . Optional auto insurance add-ons include roadside assistance coverage and rental reimbursement coverage.

For drivers who want to protect their vehicle when its financed or leased, Travelers offers loan/lease gap insurance. If your vehicle is totaled, this add-on coverage can help cover the difference between the actual cash value of the car and the remaining balance of your loan or lease.

What Does Boat Insurance Typically Not Cover

What a boat insurance policy does not cover in relation to a boat is generally called an exclusion. These exclusions almost always include:

- Wear and tear of the boat

- Damage done by marine life such as sharks

- Faulty machinery such as an engine going out

- Infestations with bugs or rodents

- Accessories that break

Recommended Reading: How To Get Mold Stains Out Of Boat Seats

What States Require Boat Insurance

As of right now, only two states have boat insurance lawsâArkansas and Utah. In Arkansas, all motorboats powered by engines of more than 50 horsepower, and all PWC, must be covered by a liability insurance policy. The policy must provide at least $50,000 of liability coverage, and it is illegal to operate the PWC without the required insurance.

In Utah, all motorboats and PWC are required to carry ownerâs or operatorâs liability insurance when operated on Utah waters. Motorboats equipped with engines less than 50 horsepower and airboats are exempt. It is illegal to operate a PWC on Utah waters without the required insurance.

Utahâs boat insurance policy requires the following minimum coverage limits per occurrence:

- $25,000 for bodily injury per person.

- $50,000 for total bodily injury if multiple people are hurt in the accident.

- $15,000 for property damage.

There are some instances of states requiring insurance for boats used in some state parks or kept in some state-operated marinasâcheck with your state marine board or alternative governing agency to see if you are impacted.

Fallen In Love With A Boat Compared With Auto Loans Financing A Boat Can Be A Much Heftier Investment

Boats can be more expensive than a car, which means loan amounts can be higher and terms can be much longer.

Just how much you pay to finance a boat depends on a number of factors, including the type of boat loan you choose, the loan terms, your down payment and your credit.

Lets take a look at the different types of boat loans, your financing options and how to apply for a boat loan.

Also Check: How Much Do Mechanics Make In Florida

Bank Of The West Boat Loans

Types of boats financed: Boats must be model year 2001 or newer to be eligible. Bank of the West specifically says that it finances standard or custom power or sailboats, multi-hull boats, pontoon boats, and electric boats. The lender also offers loans for high-performance boats, houseboats, and wood hull boats. However, it does not finance boats that can exceed 99 miles per hour.

4.29% to 9.99% for both new and used purchases, and 3.59% to 3.94% for live-aboard boats

Loan amounts available: $10,000 and up for new and used boats, $25,000 and up for live-aboard boats. Loans over $2 million are available.

Watch out for: Credit score requirements. Bank of the West states on its site that it lends only to people with credit scores of 700 or higher.

Boat loans through Bank of the West and its lending division, Essex Credit, are a good option for people planning to get a boat loan of $50,000 or above.

A $10,000 boat loan with Bank of the West would have a starting interest rate of 8.89%, a $15,000 boat loan would start at 8.39%, and a $50,000 loan starts at 4.29%. While their rates for loan amounts over $50,000 are competitive, anyone looking for a smaller loan may find a better rate with LightStream.

Itâs worth noting that this lender does have a loan processing fee that could add to your total cost of borrowing. A 10% down payment is also required for loans between $10,000 and $200,000, and percentages increase for higher loan amounts.

Also Check: Who Has The Best Boat Loans

Best For Policy Bundling: Nationwide

Nationwide

- No. of Policy Types: 4

- Coverage Limit: Varies

Nationwide is a well-known insurance provider that offers several packages to choose from and offers bundling discounts.

-

Multiple packages to choose from

-

Towing coverage

-

Need to enter zip code for policy details

-

Contact for pricing

-

Website could be more detailed

If you are already a Nationwide policyholder, then you may be eligible for the multi-policy discount offered through Nationwide Insurance, which gives you a discount for combining your home, boat, vehicle or life insurance policies. A few perks of this policy include optional towing and rental reimbursement coverage, as well as roadside assistance when you insure your boat trailer.

Several options are available for boat insurance with a variety of package options. You can get coverage for fishing equipment from $1,000 to $10,000, personal effects from $3,000 to $5,000 and towing coverage from $500 to $2,500. Other discounts include multi-boat, boater safety course, diesel fuel, paid-in-full discount, and a claims-free renewal discount that goes into effect for the policy renewal period if you have remained claims-free for the entire policy period. Nationwide also has a rewards program through a partnership with Plenti, which allows customers to earn points that can be applied as discounts at certain stores.

You May Like: How Do I Register My Boat In Colorado

Whether Youll Need A Marine Survey

When you apply for a secured boat loan, the boats value will be a factor in how much you can borrow.

If youre not getting a new boat, you should get a marine survey. During a marine survey, an inspector will examine the vessel, engine and trailer, detail the boats condition, note any repairs needed and determine whether its safe to take on the water.

Is Flood Insurance Worth Buying

Flood insurance offers financial protection for your property in the event that a flood damages your home or personal belongings. However, even if you arent in a flood-prone area or you fully own your home without a mortgage, purchasing a flood insurance policy can still end up being well worth it.13 jan. 2020

You May Like: How To Get Mold Stains Out Of Boat Seats

Where Does Usaa Do Business

USAA is an insurance carrier based in San Antonio, TX. The company was founded in 1922 and offers watercraft insurance in 50 states .

Highest possible financial rating. USAA scores the highest available financial rating, which is just what you want from the company responsible for paying for your insurance claims.

If you are looking for a personal watercraft insurance policy and you’re wondering whether USAA Personal Watercraft Insurance is a good choice, read on.

What Is The Financial Strength Rating Of Usaa Umbrella Insurance

The financial strength rating of an insurance company scores its ability to pay contracts and umbrella insurance policies. Each agency has its own standards and rating scale and a company’s rating can change any day. It’s a good idea to check the financial rating of an insurance company before you purchase a policy. There are five main rating agencies. SuperMoney’s financial strength rating is based, among other factors, on the average score from available ratings.

USAA umbrella insurance scores an A+ financial strength rating, SuperMoney’s highest available rating.

You May Like: How To Clean Mildew Off Boat Seats

Foremost: Best Variety Of Coverage

-

Variety of packages and coverage options

-

Several great discounts

-

Limitations on who can receive coverage

-

No mobile app

When it comes to coverage, Foremost offers many standard coverage options, including:

- Watercraft physical damage

- Personal property

Additionally, Foremost offers numerous packages that let boaters customize the coverage they receive. These include:

- Saver Package The most affordable package includes cash value settlements in case of a total loss

- Plus Package Includes all of the basic coverage plus agreed value/total loss replacement cost settlement, watersports liability, diminishing deductible, depreciation deferral, and hurricane haul-out

- Elite Package Offers the most coverage possible, with perks such as boat lift/hoist/cradle coverage, fishing tournament fee reimbursement, pet insurance, trip interruption coverage, enhanced towing services, Bahamas and Mexico navigation coverage, extended total loss replacement, and depreciation deferral

- Pontoon and Pontoon Elite Packages For the specific needs of pontoon boats

- Classic and Classic Elite Packages For boats more than 25 years old

- Performance and Performance Elite Packages For speedboats that reach speeds of 77 mph or greater

- Personal Watercraft Insurance With features specifically tailored for personal watercraft

Discounts

Limitations

Additional Perks

Applying For A Boat Loan

There are a few steps youll need to take in order to apply for a boat loan. These include:

- Whether youre interested in a sailboat, motor boat, or houseboat, what boat you want to purchase will influence what type of loan you need from a lender.

- Compare rates: When shopping for a loan, you should compare rates from multiple different lenders. This can help to ensure that you get the best deal possible.

- Review your credit score: Some lenders have minimum credit score requirements, while others reserve the most competitive rates for borrowers with excellent credit. Make sure your score is in a good place before applying.

- Make sure you have enough for a down payment: Typical down payments range from 10% to 30% of the total loan amount.

- Complete a loan application: To apply for a loan, youll need to provide information about yourself and the boat you want to buy, including your name, address, social security number.

Donât Miss: How Much Is The Boat Ride To Mackinac Island

You May Like: Marine Mechanic Salary Florida

Usaa Umbrella Insurance Review

Umbrella insurance is another name for liability insurance. It is designed to protect your assets when you are hit with a lawsuit judgment. Another name for it is “excess liability coverage.” Umbrella insurance policies protect you when the liability coverage of your auto insurance, home insurance, or boat insurance is insufficient.

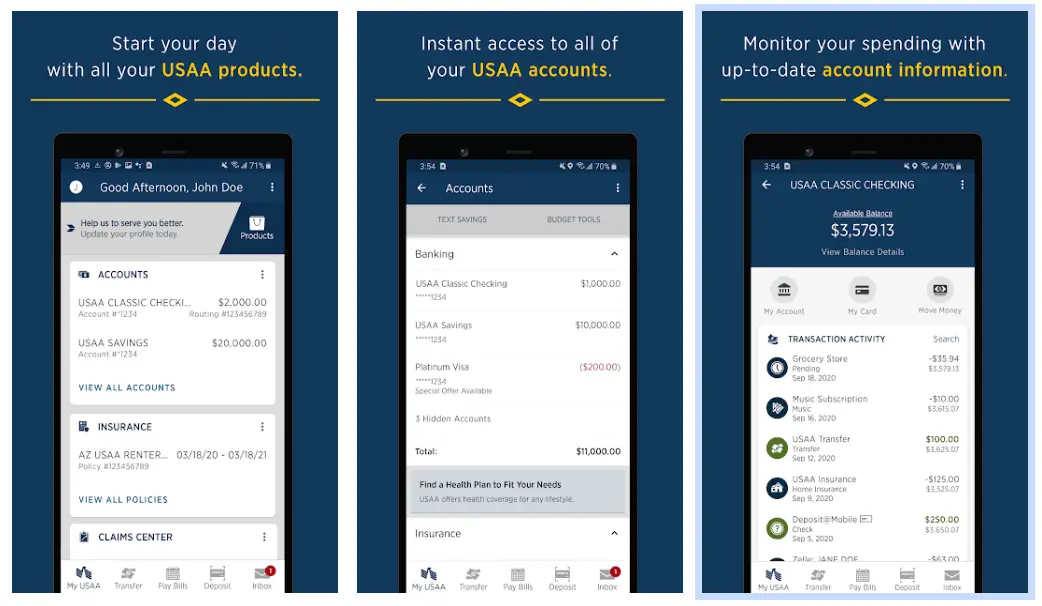

If I Need To File An Insurance Claim What Is The Process And What Can I Expect

You can report your claim via the website, over the phone, or through the USAA mobile app. You can schedule repair service, reserve a rental car and communicate with a claims adjuster, all virtually.

For property claims, you can upload photos, videos and other documents of damages in order to expedite claim handling. Further instructions will be provided once you report your claim. If youre displaced from your home due to a property claim, you can maintain contact with your claims adjuster throughout the claims process. Of course, you can still reach a live person by calling 1-800-531-USAA .

Recommended Reading: Lightstream Boat Loans

Monitoring Actual Driving People Are Divided

Usage-based auto insurance, which utilizes actual driving data in rates, could reduce reliance on non-driving price factors such as education. Using telematics, these insurance programs monitor and score actual driving such as speeding, braking and cornering.

About half of survey respondents said theyd be very comfortable or somewhat comfortable with having their driving closely monitored if it could lead to lower car insurance rates. A smaller portion had reluctance, expressing discomfort with such oversight.

So while auto insurance companies seek more precise ways to price individual risk, drivers may find fewer and fewer options that dont use highly personalized measurements.

Usaa Small Business Insurance Ratings

USAA Small Business Insurance Reviews 2021 . USAA, or the United Services Automobile Association, is a diversified financial services company. The insurance and insurance exchange subsidiaries of USAA are dedicated to offering insurance products to people who are either actively serving in the United States military and their family members. While USAA was originally set up to help members procure mutual automotive self-insurance, the company now offers a wide range of insurance and financial services including small business insurance coverage.

If you are a small business owner looking to buy liability insurance, read USAA small business insurance reviews to learn about USAA’s products.

Check out USAA reviews, ratings, complaints & coverage for USAA business insurance general liability, workers compensation and other small business insurance commercial policies.

Following are some of the answers to commonly asked USAA small business insurance questions:

The average cost of USAA’s commercial insurance policies ranges from $22 to over $129 per month, and is mainly based on your business’s: Industry, Location, Gross Sales, Employees and/or Payroll, Policy Limits, Endorsements, Deductibles, Experience & Claims History.

Who is Eligible for USAA Small Business Insurance?

They offer very limited services to non-members. The only sort of financial or insurance services you can get from them without being a member is life insurance and financial/investment consultancy service.

You May Like: Is Banana Boat Sunscreen Gluten Free