Types Of Boat Insurance

There are two basic types of boat insuranceagreed value and actual cash value. How depreciation is handled is what sets them apart.

An “agreed value” policy covers the boat based on its value when the policy was written. While it can cost more up front, there is no depreciation for a total loss of the boat .

“Actual cash value” policies cost less up front, but factor in depreciation. In other word, the policy will only pay up to the actual cash value of the boat at the time it is declared a total or partial loss. Eventually, as your boat ages, your insurer will likely insist on an actual cash value policyand if often gives a substantial savings.

Boat Insurance Covers More Than Just The Boat

Boat insurance doesnt just cover the boat owner, their guest passengers and non-passengers in the event of bodily injury. It also covers the boat itself. The boat owner may elect to purchase coverage for their vessels actual cash value . Or an agreed amount value .

A mishap will not necessarily send your boat to the bottom of Lake Red Rock, but plenty of other misfortunes can cause serious damage to your summer toy. Boat insurance covers the cost of any repairs your boat and its permanently attached equipment might need after an accident. Unfortunately, your beautiful boat might arouse envy in amoral minds theft and vandalism are both crimes commonly committed against boat owners. And however securely you might store your boat, insects, mold, rodents and fire all threaten it with partial or total destruction. Somewhat ironically, even flooding can damage or destroy your boat!

Insurance can cover a boats trailer and removable accessories in the event of an accident, theft, vandalism or natural disaster. It can also cover the cost of towing following damage. Additionally, it can cover any damage the boat owner may accidentally inflict on another persons property. Even the most seasoned captain may lose control of their boat. It is best to prepare for that occasion!

Iowa Boating Laws And Regulations

Who needs a Boater Education ID Card in Iowa?

Iowa requires any operator between 12-17 years of age, who will operate a motorized boat over 10 horsepower, or who will operate a personal watercraft , to obtain a Boater Education Certificate, commonly called a boat license.

Those operators who are required to obtain a Boater Education Certificate must carry the certificate on board during boat operation, as well as ensure that the certificate is available for inspection by law enforcement

Operators under 12 years of age:

Are permitted to operate a boat with a motor of more than 10 horsepower, if they supervised by a person on board who is at least 18 years of age, and who is experienced in boat operation.

Operators between 12-17 years of age:

Are permitted to operate a boat with a motor of more than 10 horsepower, including personal watercraft , if:

- They have completed an Iowa Department of Natural Resources-approved Boater Education Course or

- They are being supervised by a person on board who is at least 18 years of age, who is experienced in boat operation

Get your Official North American Boating License

Get your Official North American Boating License

The Official NASBLA and State-Approved Canada Boating Course, Test & License.

Iowa Life jacket REquirements

A child age 12 and under in an enclosed cabin, below deck, or aboard a commercial vessel with a capacity of 25 persons or more is exempt.

Boat REgistration Requirements in Iowa

Exemptions:

Sailboats

Offenses

You May Like: How Much Is A Freedom Boat Club Membership

What Other Factors Affect Your Boat Insurance Cost

Besides where you live, several factors play into boat insurance rates, including:

- Type of watercraft: Fishing boats, pontoon boats, sailboats, and other personal watercraft all have unique features that may affect the cost of your policy.

- Safety measures:Completing a boating safety course may lower your rate.

- Boats horsepower: Boats with stronger engines, like powerboats, often have higher rates.

- Boat’s age: Newer boats are often more expensive to insure than older boats.

- Boating history: More experienced boaters may receive lower insurance rates than newer boaters with less experience on the water.

You may be able to lower the cost of boat insurance by qualifying for discounts, including multi-policy, multi-boat, and responsible driver. Learn more about boat insurance discounts at Progressive.

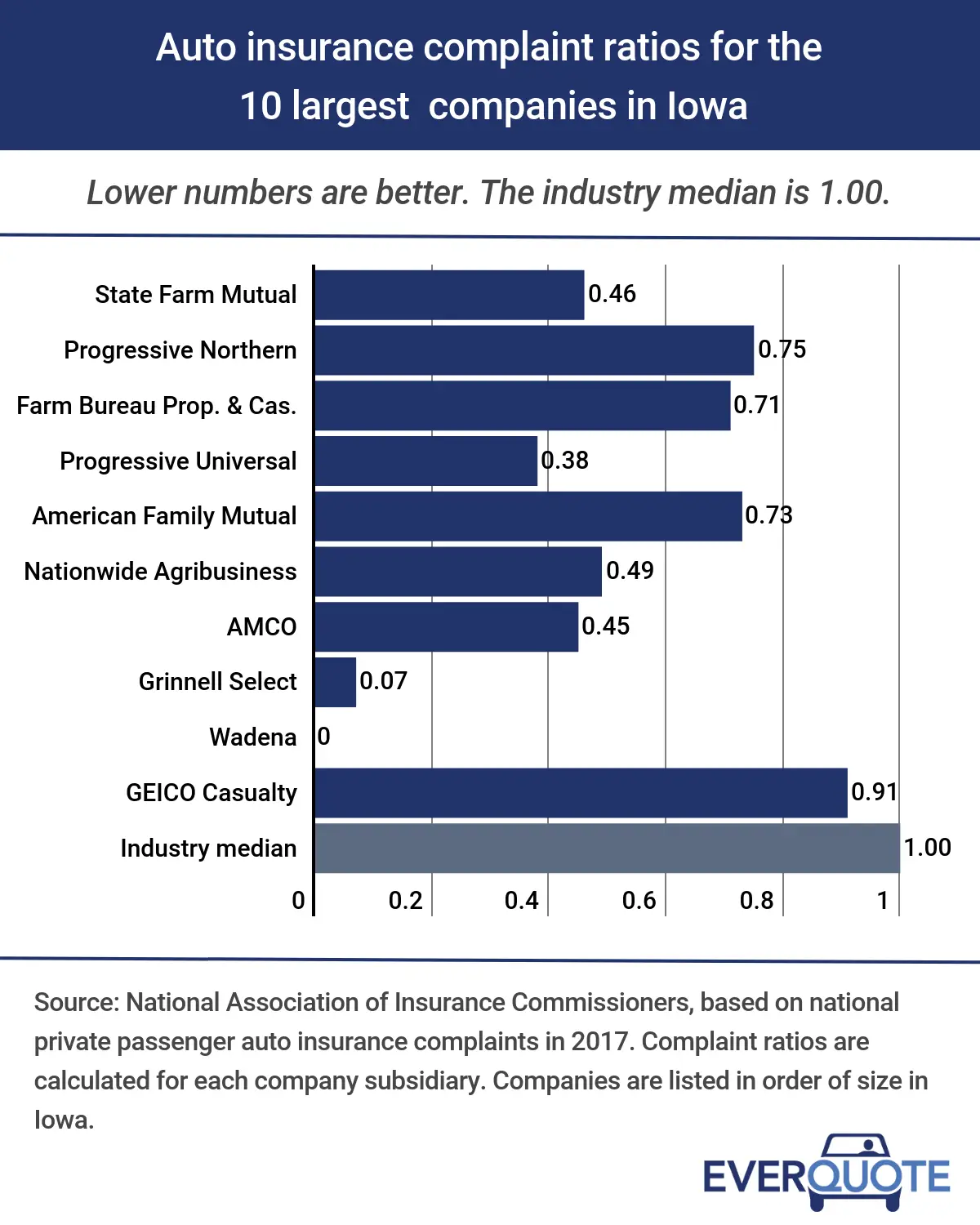

How To Get The Cheapest Iowa Car Insurance Policy

You may be able to lower the cost of your premiums in the following ways:

- Ask about available discounts for good driving habits, anti-theft devices, multiple cars on one policy, bundling your car insurance with your homeowners or renters policy, automatic or online payments and driving a hybrid or electric car

- Compare quotes from a variety of providers on this website

- Eliminate unnecessary coverage

- Check to see if you qualify for any low-cost auto insurance program your state may offer

You May Like: How To Remove Oxidation From Boat

Iowa Car Insurance Premiums

Vehicle insurance premiums are regulated by the Iowa Insurance Division. Insurance companies are allowed to charge premiums and award discounts based on a number of factors that can include:

- The type of car you are insuring

- Prior auto insurance coverage

- How long youve been driving

- Whether or not you use your car for business

Iowa also allows insurers to consider your credit history to determine your premium.

Renewing Your Iowa Boat Registration

Be aware that registrations are valid for three calendar years, and boat registration renewal in Iowa is always due on April 30th of the third year. Remember that you cannot renew boat registration online in Iowa, and you must bring your current registration card and fee payment to your county recorders office. There is no grace period for renewal and a $5 penalty is added when the registration expires.

You May Like: Boat History By Hull Number

When Boat Insurance Is Required

While most states do not require you to have boat insurance, you might find that there are certain situations that call for you to have your boat insured.

If you use your boat as collateral for a loan, your bank may require you to have insurance for the boat.

Also, you may be required to have boat insurance in order to dock your boat in certain marinas or harbors. Contact marina/harbor officials to learn more about their boat insurance requirements.

Boat Insurance Basics: What’s Covered

Learn about boat owners insurance and what the coverage means to you.

Did you know that boat insurance is one of the earliest known forms of insurance? Ancient sailors knew firsthand about the risks of a life at sea and sought to insure their boats against hurricanes and other unpredictable weather and waters. And it still applies today.

Boat insurance policies can vary widely in what they do and do not cover based on a number of considerations, including the type of boat, the waters it will traffic, and how many months of the year the boat will be used. Still, there are a few basic kinds of coverage you can expect to receive, as well as some potential discounts for safe boaters.

Don’t Miss: Are You Required To Have Boat Insurance In Texas

Contact The Hoffman Agency In Sioux City

Do you need help navigating the insurance seas? Then let the Hoffman Agency be your chief mate. Since our foundation in 1964, we have worked closely with thousands of Iowans to ensure all of their insurance needs are met. Contact us today and our team in Sioux City, IA will make certain you are completely covered before your next launch!

Find The Right Boat Insurance Policy For You

Our independent agents shop around to find you the best coverage.

Whether you like taking your bass boat out on beautiful Doe Run Lake, or you enjoy time on your speedboat out on the Ohio River, as a boat owner in Florence, you have plenty of options. It is little wonder that so many residents of this Cincinnati suburb choose to purchase a recreational water vessel.

Unfortunately, boating accidents sometimes happen. You can make sure that a family fun day on the river doesnt end up causing you large financial losses by investing in an affordable boat insurance policy. A local independent insurance agent can help you find a great policy at a competitive rate.

Don’t Miss: Applying Boat Registration Numbers

Is Boat Insurance Required In Alabama

Looking for is boat insurance required in alabama? Get direct access to is boat insurance required in alabama through official links provided below.

Follow these easy steps:

- Step 1. Go to is boat insurance required in alabama page via official link below.

- Step 2. Find the official insurance at the bottom of the website.

- Step 3. If you still cant access is boat insurance required in alabama please leave a message below .

The majority of states do not require you to carry boat insurance. You may assume that you need it in cities surrounded by water. However, only a few states require proof of insurance. The chart below lists each state and their boat insurance requirements. Yes, just Arkansas, Hawaii, and Utah require you to have a boat insurance policy.

Is boat insurance required in Il? Who is the govenor of Alabama? What license is required to sell boat insurance in nys? Who was needed due to its usefulness as a waterprfing agent? Are public adjusters required to be nfip certified? How do you become licensed in Pennsylvania to sell title insurance? How much majority required to form govt in

Illegal Operations That Can Make Boat Insurance Higher

These risky operating practices are illegal in Iowa, and if you have been caught and ticketed for these, it can make your insurance policy higher.

1. Careless or Neglectful Operation of a boat or the irresponsible operation of water skis, surfboard, or related scheme, functioning in a way that causes jeopardy to the life, limb, or belongings of any individual.

2. Incorrect Speed or Distance is not keeping a correct speed or distance while operating a boat.

It is particularly unlawful to operate a boat at:

- Over the slow, no wake speed* in any area with a sign displayed no wake zone.

- Over 5 mph in 100 ft of another boat that is moving at 5 mph or less.

- Over 5 mph in 50 ft of another boat that is moving beyond 5 mph.

- Over 10 mph except vision is clear for at least 200 ft ahead.

- Over 10 mph in 300 ft of coastline on any provincial lake or state impoundment.

- Over 25 mph between 1/2 hour after sunset and sunrise on any lake in Dickinson County.

- Over 10 mph between 1 hour after sunset and 1 hour before sunrise on Lake Delhi.

*** Slow, No Wake Speed means a speed at which the boat does not form a wake. A Wake means any flow of water produced by a boat that will harmfully affect the usual structures of the coastline.

4.Overriding is operating the boat over the limit of the suggested carrying horsepower presented in the capacity plate attached by the boat builder.

Don’t Miss: How To Look Up Boat Registration

Who Else May Require You To Carry Boat Insurance

If you intend to finance the purchase of a boat, your bank will require you to provide proof of insurance for the watercraft. Typically, the policy will need to cover the full value of the boat, and your bank may set minimum requirements for specific types of coverage. In addition, you will need to list the bank as a lienholder on the policy so that it will be included as a co-payee on any compensation in the event of a loss payment.

Most ports and marinas will require you to carry boat insurance in order to use their facilities.

For example, if you want to moor your boat at Port of Bellingham in Washington, you must carry a policy with at least $300,000 in general, legal and pollution liability with a policy term of no less than one year. As another example, the Hawaii Division of Boats and Ocean Recreation requires all vessels moored at its facilities to carry at least $500,000 in liability insurance.

Some marinas, such as the Hawaii Division of Boats and Ocean Recreation, may even require that the marina itself be listed as an “additional insured” or “additional interest” on the policy. You’ll normally need to provide proof of insurance before you can sign a contract for a slip or mooring.

Checklist Before Boating To Ensure Safety And Prevent Accidents

To stay safe on the water and ensure you dont get any accidents that can affect your insurance, it is helpful to have a checklist. It is always best to check the following before driving your boat to avoid any problem while youre having a good time boating on the Iowa waters.

Prevention is key to avoiding an accident or other issues. If you are at fault for an accident or damage, then that can lead to higher insurance premiums.

- Check the weather condition.

- Ensure that all the lights and steering controls are properly working.

- Make sure that there are no fuel or oil leaks and cracks on the boat. Check the lines, tanks, engine, and carburetor section.

- Make sure that the hose clamp, engine battery, bilge plug are replaced, charged, and secured.

- Remove the water on the engine section. Ensure that the ignition safety switch and the wrist lanyard are in the proper place as well.

- Life jackets should be in good shape, and you have enough for the number of people on board. Also, you have to ensure that they have a proper fit.

Read Also: How To Clean Mildew Off Boat Seats

Boat Insurance Cost Factors

Many factors are used to set the cost of a policy, and they vary among insurers. Here are some items to consider:

- Cruising Area: Where you boat.

- Boating Safety Education: If you have been formally trained or certified.

- Good Driving Records: Both boating and driving.

- Liability Limits: The higher the limit the higher the cost.

- Deductible: The higher the deductible the lower the premium.

- Towing insurance requirements for offshore fishing .

New Jersey Boat Insurance

Sandwiched between the Delaware River and the Atlantic Ocean, the relatively tiny state of New Jersey packs a lot of boating between and around its boundaries. A boat insurance policy can help you enjoy the waters without worry. It can protect your vessel from many forms of damage. And, it can cover injuries you and your passengers sustain in an accident.

To make an informed decision about boat insurance in New Jersey, weve highlighted some important information you should know, including cost factors, requirements, and other considerations.

Read Also: How To Clean Mildew Off Boat Seats

Boat Insurance Discount Opportunities In Florence Ky

Independent insurance agents work for you, not for a specific insurance company, so they are dedicated to finding you the best rates for your boat insurance coverage. One way they do this by looking for discount opportunities for which you may qualify.

Some money-saving opportunities that you may be eligible for include discounts for bundling your boat insurance with other policies like home or car insurance discounts for taking and passing a boater safety course and discounts for having certain industry or professional affiliations.

Talk to your local insurance agent to learn more.

Auto Insurance Coverage In Iathe Basics

Whether you’re driving through Iowa on I-80 or I-35, your drive is likely to be accompanied by rows of corn on all sides. Natives, however, know that Iowa is more than the food capital of the world. From the vibrant college town of Iowa City to the diversity of Des Moines , the state is a leader in literature, biotechnology, and even insurance. Like any other state, it’s vital to protect yourself and your vehicle with the proper auto insurance. You can get an Iowa car insurance quote online with GEICO anytime.

Also Check: What Is My Pontoon Boat Worth

Who Can Operate A Boat

It is mandatory in Iowa that a person between 12 and 18 years old have an Iowa Watercraft Safety Certificate to operate a boat that is above 10hp on state waters. Therefore, an adult should not permit anyone in this age group to operate the boat if they do not have a legal watercraft safety certificate.

Does A Pwc Need A Fire Extinguisher

All vessels, including PWC, are required to have a Type B fire extinguisher on board if one or more of the following conditions exist: Closed compartments under seats where portable fuel tanks may be stored. Closed storage compartments in which flammable or combustible materials may be stored. Closed living spaces.

Read Also: How Much Does Freedom Boat Club Cost Per Month

Kinds Of Boat Insurance Policies

- Boat

- Boat & PWC Rental – Although this is generally not required, rental insurance will help cover any damage the vessel, as well as the operator and passengers.

- Boat Clubs – covers all members of club while operating a boat.

- Professional – These policies are very customizable and can cover items like travel to a tournament, equipment and more.

Types Of Boat Insurance In New Jersey

While boat insurance is highly customizable and subject to optional add-ons and endorsements, there are generally two categories of boat insurance coverage in New Jersey: liability coverage and physical damage coverage. Both insurance types together can be considered comprehensive boat insurance. Lets go over what they both mean.

Liability Coverage

Boater liability insurance covers the damages you may cause to others. If you cause an accident, your liability policy can cover the resulting medical expenses and property damage to the affected parties.

Liability insurance for boats often includes fuel spill coverage, too, which can pay to remedy damages that are caused by a fuel or oil spill after an accident. Liability coverage may also include wreckage removal, which can help cover the costs to raise or remove your boat if needed. Check with your provider on the specifics of these coverages in your policy.

Liability limits for boaters typically start around a couple hundred thousand dollars and may top out at $1 million. Be aware, though, that if you only have liability insurance, your insurance company wont recoup you for any damages your boat suffers in an accident. Liability insurance only covers injuries and property damage to others.

Comprehensive Coverage

New Jersey Boat Insurance Considerations

Recommended Reading: How To Remove Streptoverticillium Reticulum